Bona Fide Purchasers and Input Tax Credit: What the Supreme Court’s Ruling Means for You

The Supreme Court has ruled that genuine buyers cannot be denied Input Tax Credit just because the seller failed to deposit tax or lost registration. This landmark decision under DVAT sets a strong precedent for GST cases too, ensuring fairness and protecting honest taxpayers.

Bona Fide Purchasers and Input Tax Credit: What the Supreme Court’s Ruling Means for You

The Issue

Can a genuine buyer lose Input Tax Credit (ITC) just because the seller didn’t pay tax to the government or had their registration cancelled later?

This was the key question in the case Commissioner of Trade and Tax, Delhi v. M/s Shanti Kiran India (P) Ltd. decided by the Supreme Court on 9 October 2025.

Background

Under Section 9(2)(g) of the Delhi Value Added Tax Act, 2004 (DVAT), ITC can be denied if the selling dealer hasn’t deposited the tax. Tax officers often used this to reject ITC even when the buyer had done everything right.

What the Court Found

- The sellers were registered when the sale happened.

- The invoices and purchases were genuine and properly recorded.

- There was no fraud or collusion between buyer and seller.

The Supreme Court said that ITC cannot be denied to a genuine buyer just because the seller defaulted later. The buyer followed the law and should not be punished for someone else’s mistake.

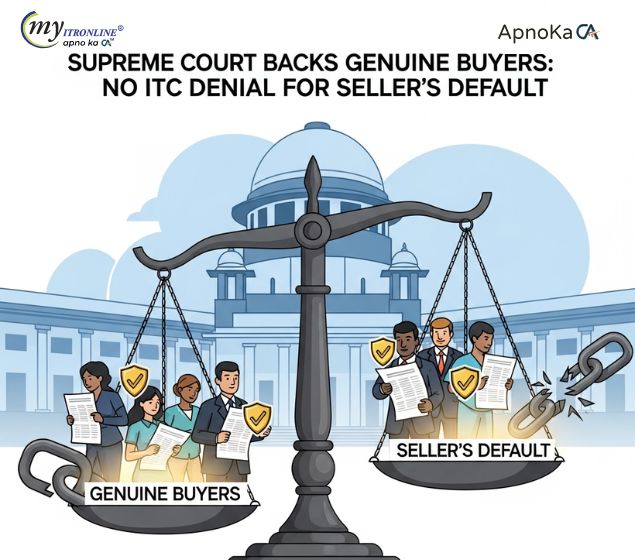

Why This Matters

This ruling protects honest businesses and supports fair taxation. It also upholds Article 14 of the Constitution, which guarantees equality before the law.

Impact on GST

Even though this case was under DVAT, the logic applies to GST too. Under GST, ITC is sometimes denied due to supplier-side issues like mismatches in GSTR-2A or GSTR-2B.

Key Takeaways for GST:

- ITC should not be denied without proof of fraud or collusion.

- Tax authorities must act fairly and proportionately.

- Buyers should not suffer for procedural lapses by sellers.

Conclusion

The Supreme Court’s decision in the Shanti Kiran case is a big win for taxpayers. It confirms that ITC is a right—not a privilege—and cannot be taken away from genuine buyers due to someone else’s fault.

This sets a strong example for GST cases and helps build trust in the tax system.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles