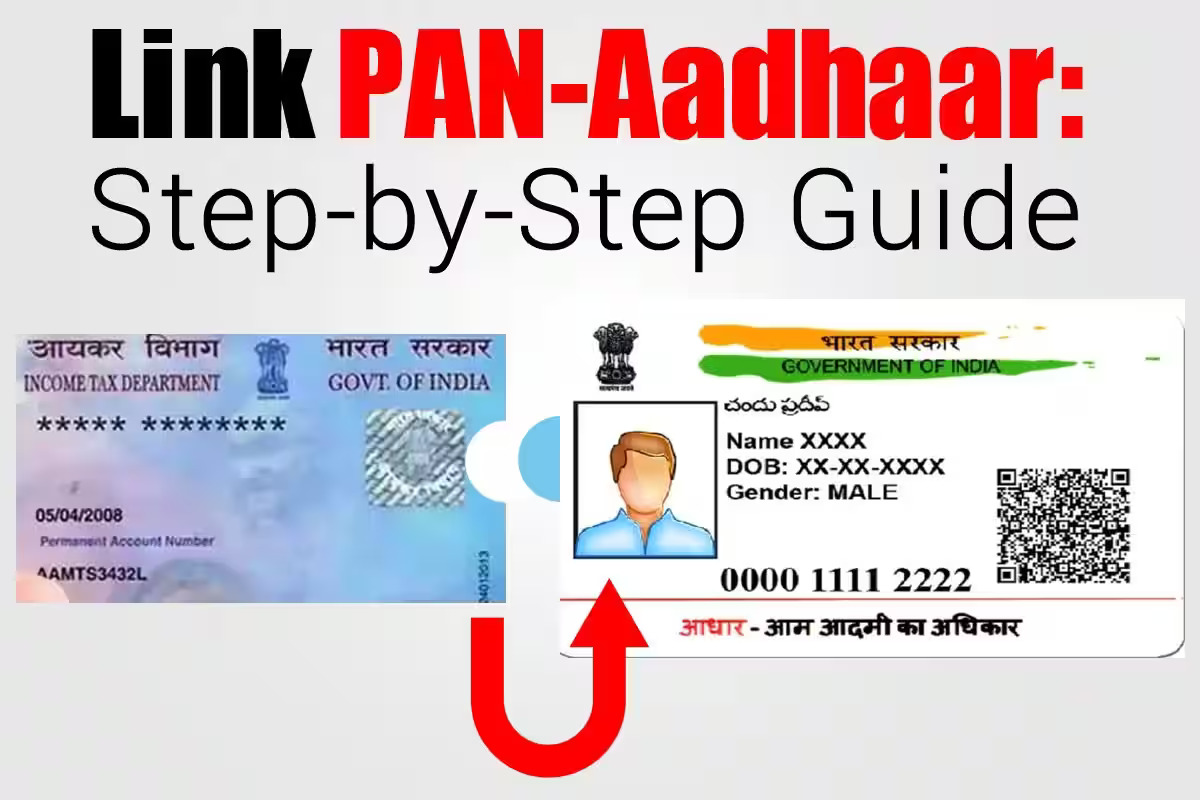

Pan & Aadhaar News

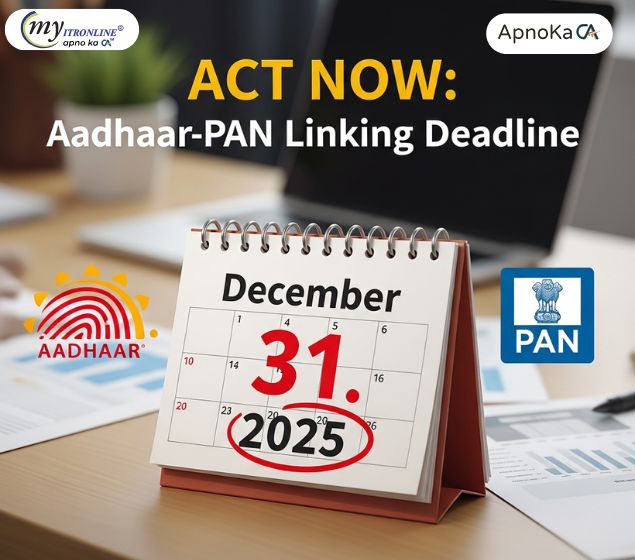

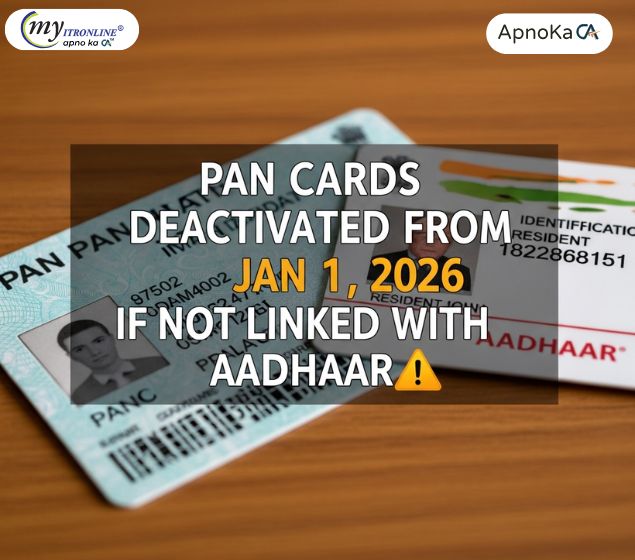

The recent news surrounding PAN (Permanent Account Number) and Aadhaar cards involves updates, regulations, or developments related to their linkage, authentication, or utilization in financial transactions and identity verification. These updates may include changes in deadlines, compliance requirements, or security measures concerning PAN and Aadhaar cards as mandated by government entities.

.jpg)