GST Portal Update: GSTR-9 and GSTR-9C Enabled for FY 2024-25

The GST portal has enabled GSTR-9 and GSTR-9C forms for FY 2024-25 starting October 12, 2025. Taxpayers can now file their annual returns and reconciliation statements before the December 31 deadline. Learn who needs to file and how to prepare.

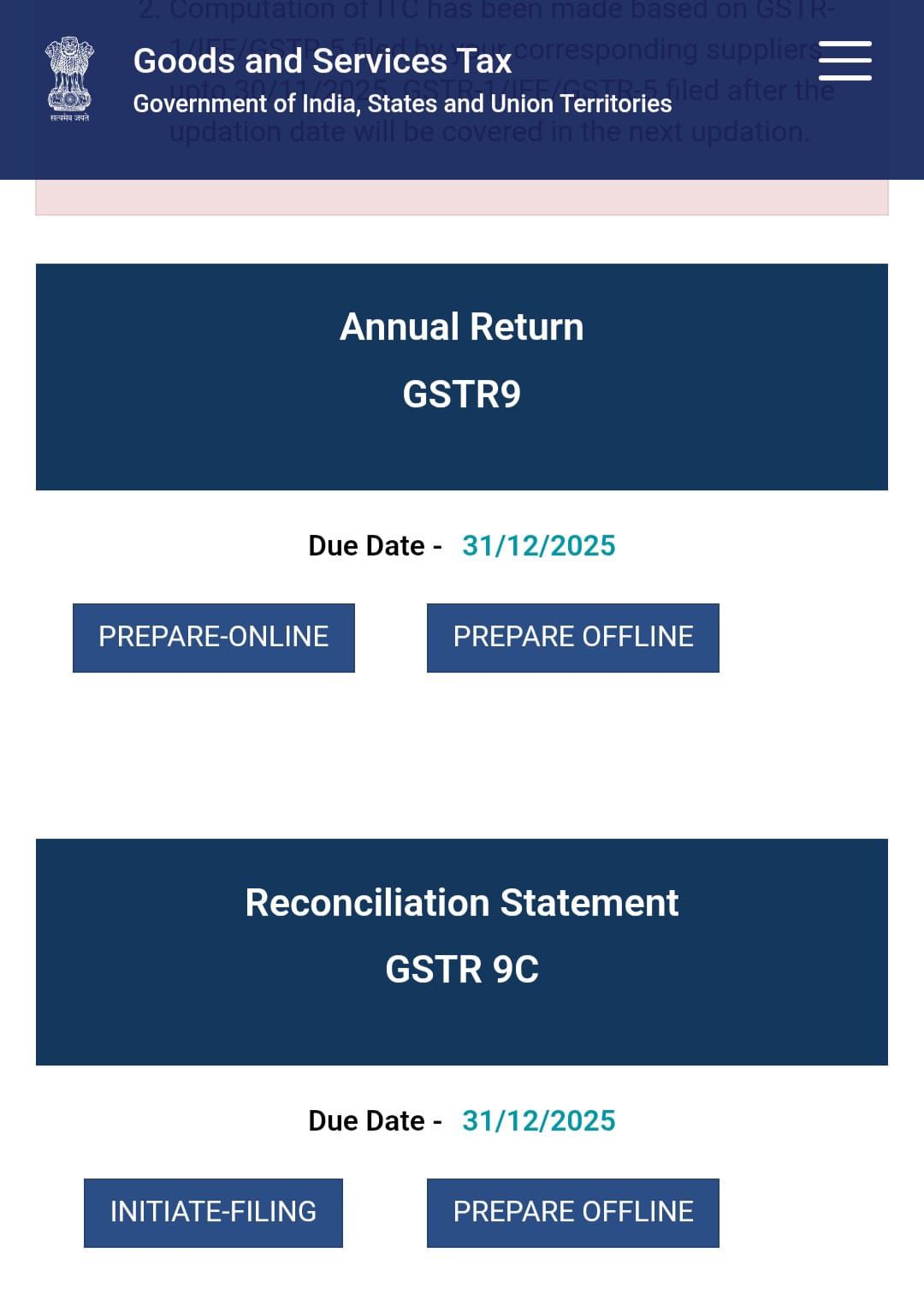

Good news for businesses! The GST portal has now activated the forms for GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for the financial year 2024-25, starting October 12, 2025. The last date to file both forms is December 31, 2025.

This early release gives you extra time to prepare and file your returns without rushing at the last minute.

What Are These Forms?

GSTR-9 – Annual Return: This form gives a summary of all your GST returns (GSTR-1 and GSTR-3B) filed during the year. It includes details of your sales, purchases, taxes paid, and ITC claimed.

Who needs to file? Mandatory for businesses with turnover above ₹2 crore. Optional for those below.

GSTR-9C – Reconciliation Statement: This form compares your GSTR-9 data with your audited financial statements. It helps confirm that your GST records match your books.

Who needs to file? Mandatory for businesses with turnover above ₹5 crore.

What Should You Do Now?

- Collect Your Data: Gather all GSTR-1 and GSTR-3B returns filed for FY 2024-25.

- Reconcile Carefully: Match your books with your GST returns. Focus on:

- Total revenue

- ITC claimed vs. ITC available in GSTR-2B

- Taxes paid (cash and credit)

- Fix Any Mismatches: If you spot differences, correct them in your books or future returns.

- Get Expert Help: If you're unsure, talk to your CA or tax advisor. It’s better to be safe than sorry.

Final Tip

Don’t wait till December. The GST portal can slow down near deadlines. Filing early means fewer errors, less stress, and better compliance.

Disclaimer: This blog is for general information only. Please consult a qualified professional for specific advice.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles