Which GST Officer Will Handle Your Case? CBIC Clarifies in New Circular

CBIC has issued Circular No. 254/11/2025-GST to clarify which officers will handle GST cases related to tax, ITC, and penalties under the CGST Act. This blog explains the officer levels, monetary limits, and key sections covered, making it easier for taxpayers to understand who will manage their case.

Download Official Circular (PDF): Click here to view or download

The CBIC (Central Board of Indirect Taxes and Customs) has issued a new circular to clarify which GST officers will handle cases related to tax, ITC (Input Tax Credit), and penalties under the CGST Act. This helps bring more clarity and consistency in GST proceedings.

What’s This Circular About?

The circular assigns specific officers to handle cases under the following sections:

- Section 74A: For deciding how much tax or ITC is due.

- Section 75(2): For rechecking tax if fraud or suppression is not proven.

- Section 122: For imposing penalties.

- Rule 142(1A): For sending notices before issuing a formal Show Cause Notice (SCN).

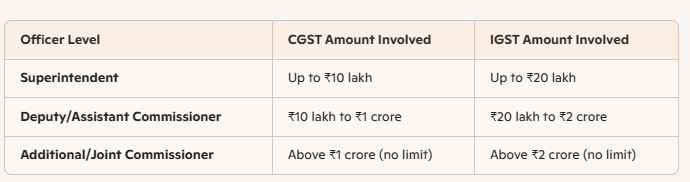

Who Will Handle What? (Based on Amount Involved)

This means that the higher the amount involved, the higher the officer rank who will handle the case.

What Happens If Fraud Is Not Proven?

If a case was earlier treated as fraud (under Section 74), but later it’s found that there was no fraud or suppression, then:

- The same officer will re-decide the case under Section 73(1) (normal tax determination).

Other Important Points

- Trade notices will be issued to inform taxpayers about these changes.

- If there are any issues in applying this circular, they should be reported to CBIC for clarification.

Why This Matters

- Avoids confusion about which officer will handle your case.

- Ensures faster and smoother GST proceedings.

- Makes the tax process more transparent and structured.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles