CBI Action Against CGST Officer Over Disproportionate Assets

The CBI has initiated an investigation against Assistant Commissioner Rati Ram Meena for allegedly possessing disproportionate assets of approximately ₹2.54 crore accumulated between August 2018 and August 2025. Searches in Jaipur, Ankleshwar, and Ahmedabad reportedly uncovered properties, high-end vehicles, jewellery worth ₹35 lakh, and documents indicating funds routed via family-linked entities.

Case Background

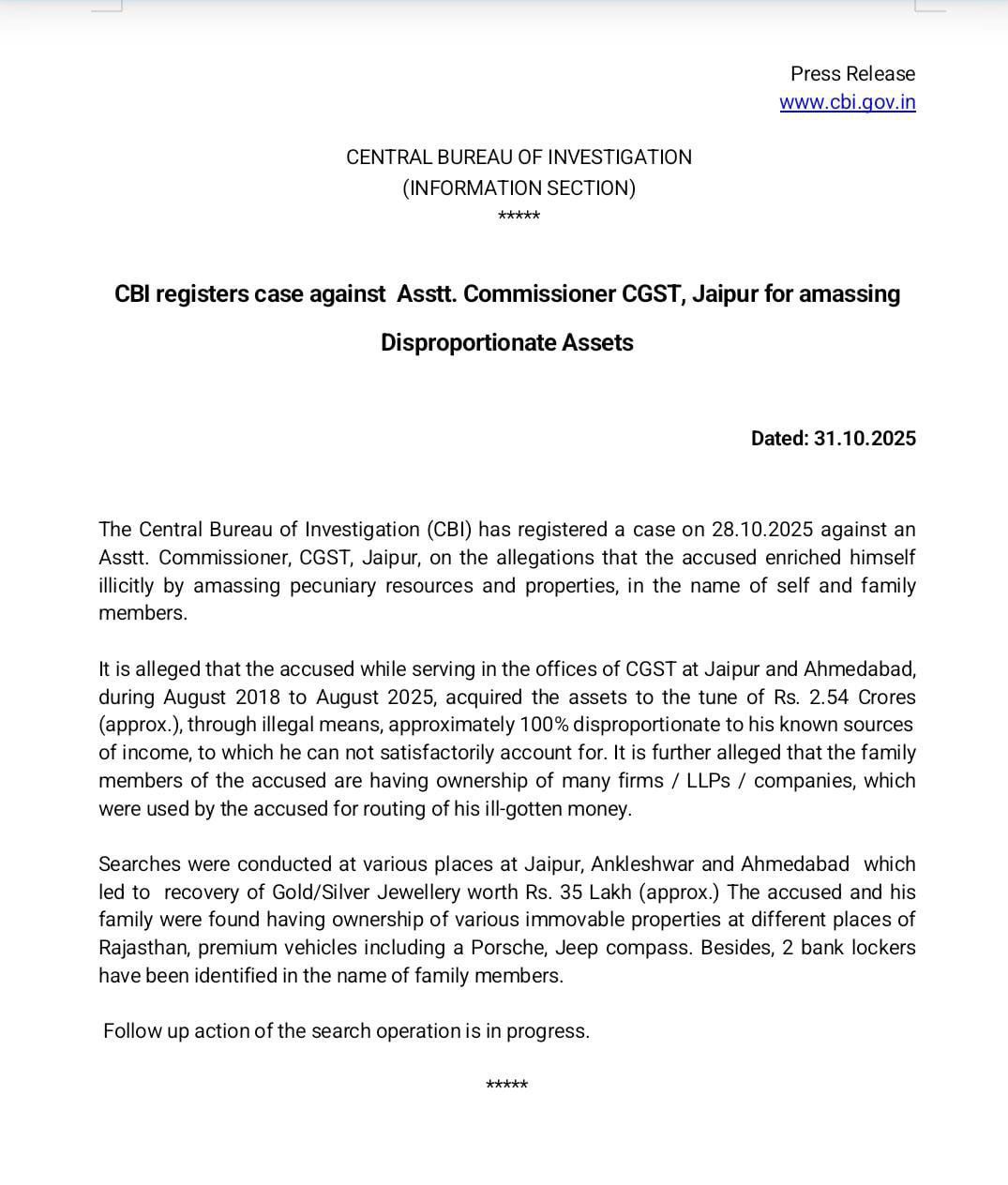

The Central Bureau of Investigation (CBI) has registered a case against an Assistant Commissioner of the Central Goods and Services Tax (CGST) department in Jaipur. The officer, identified as Rati Ram Meena, is accused of holding assets far beyond his known sources of income.

According to CBI officials, Meena allegedly built up wealth much higher than his legal earnings while working in CGST offices in Jaipur and Ahmedabad between August 2018 and August 2025.

Allegations and Findings

- The officer and his family members owned assets worth about ₹2.54 crore, nearly double his known income.

- The money was allegedly moved through firms, LLPs, and companies in the names of his family members to hide its source.

During searches in Jaipur, Ankleshwar, and Ahmedabad, investigators reportedly found:

- Properties in Rajasthan

- Luxury cars, including a Porsche and Jeep Compass

- Gold and silver jewellery worth about ₹35 lakh

- Documents for two bank lockers in the names of family members

The case has been filed under the Prevention of Corruption Act, 1988, which deals with public servants holding wealth they cannot explain.

CBI’s Next Steps

The CBI will now:

- Trace the money trail

- Examine the firms linked to the officer’s family

- Check if the assets were bought through corrupt means

If found guilty, the officer could face:

- Jail under the Prevention of Corruption Act

- Confiscation of illegal assets

- Departmental disciplinary action

Impact on Tax Administration

- Restoring trust: Honest taxpayers expect fairness, and action against corrupt officials helps rebuild confidence.

- Zero tolerance: No officer is above the law. Even family members who help hide illegal money can be investigated.

- Better compliance: Removing corruption ensures fair GST compliance and reduces harassment of genuine taxpayers.

Apnokaca’s View

At Apnokaca, we believe that a transparent tax system is key to building trust between taxpayers and authorities. Cases like this send a strong message that integrity in public service is non-negotiable.

Disclaimer: This report is based on information available from CBI sources and public news reports. Apnokaca does not independently verify the allegations and publishes this for informational purposes only.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles