GSTN Revamps GSTR-9 Table 8A Logic for Better ITC Accuracy

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

New Delhi: Taxpayers, take note the Goods and Services Tax Network (GSTN) has made a big change to how Table 8A in your GSTR-9 annual return is filled. Starting with FY 2023-24 and continuing into FY 2024-25, the system will now include invoice data from both the current and next financial year. This aims to give a clearer picture of your Input Tax Credit (ITC).

What Was the Old Method?

Earlier, Table 8A only showed ITC based on invoices and debit notes from your GSTR-2B between April and March of the same financial year. If your supplier filed late, those invoices didn’t show up causing mismatches and confusion.

What’s New in FY 2024-25?

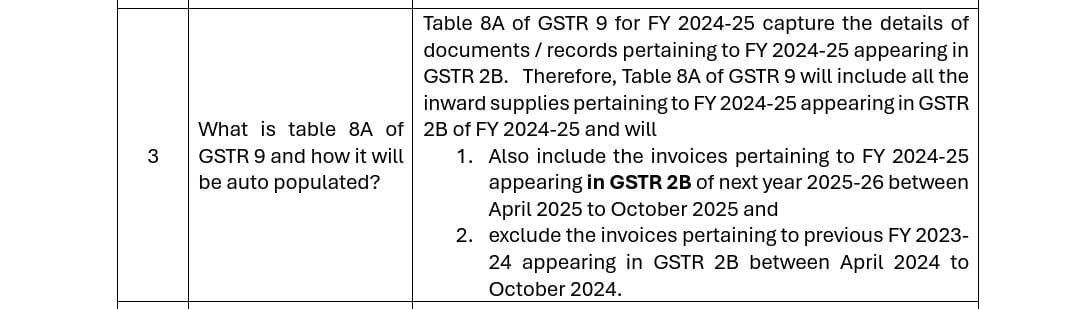

The new auto-fill logic for Table 8A will include:

- Current Year Invoices: All inward supply details from April 2024 to March 2025 that appear in GSTR-2B.

- Next Year’s GSTR-2B: Invoices for FY 2024-25 that show up in GSTR-2B from April to October 2025. This helps include ITC from suppliers who file late.

- Exclusion of Past Year Invoices: Invoices from FY 2023-24 that appear in GSTR-2B between April and October 2024 will be excluded to avoid double counting.

Why This Matters

- Better Accuracy: Your ITC data will reflect actual eligible credit, even if suppliers file late.

- Fewer Gaps: Reduces mismatch between your books and GSTR-9 auto-filled data.

- Smoother Filing: Makes the annual return process easier and less error-prone.

What Should Taxpayers Do?

Keep detailed records of all inward supplies and regularly match them with GSTR-2B not just during the year, but also up to October of the next year. This will help you stay compliant and avoid surprises during filing.

Disclaimer: This blog is for general awareness. Please consult a GST professional for specific advice.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles