Supreme Court ruling on ITC: protection for bona fide buyers

The Supreme Court of India has held that a genuine buyer cannot be denied ITC merely because the seller failed to deposit tax. In M/s Shanti Kiran India Pvt Ltd vs Commissioner, Trade & Tax, Delhi (October 9, 2025), the Court emphasized fairness: action should target the defaulting seller, not the compliant purchaser. While the case arose under the Delhi VAT Act, its reasoning strongly influences GST disputes under Section 16(2)(c). Businesses gain a constitutional shield against automatic ITC denials but must continue robust documentation, vendor checks, and genuine transactions. Example: if you paid ₹100 in tax against a valid invoice and acted in good faith, your ITC right stands.

Big relief for taxpayers

The Supreme Court of India has given a major relief to honest businesses. The Court ruled that a genuine buyer cannot be punished just because their seller did not deposit the tax with the government. This decision is a strong win for taxpayers who have faced difficulty with Input Tax Credit (ITC) claims.

What the Supreme Court said

In the case of M/s Shanti Kiran India Pvt Ltd vs Commissioner, Trade & Tax, Delhi (October 9, 2025), the Court made it clear:

- Genuine purchase matters: If you bought goods or services with a valid invoice and your seller was registered at the time, your ITC is secure.

- No penalty for seller’s fault: ITC cannot be denied just because the seller did not pay the tax to the government.

- Action against the defaulter: The tax department should recover dues from the seller, not from the buyer who has already paid.

In simple words

If you are a registered business and you paid your supplier, received a valid invoice, and acted in good faith, then your ITC claim is valid. Even if your supplier fails to deposit the tax, your right to ITC should not be taken away.

Impact on GST (Section 16(2)(c))

While the case arose under the Delhi VAT law, its logic applies strongly to GST. Section 16(2)(c) of the CGST Act says ITC is allowed only if the tax is actually paid to the government. This has caused disputes for many businesses. After this ruling, taxpayers have a stronger constitutional shield. Authorities should not deny ITC only because of a seller’s default, unless there is fraud or collusion.

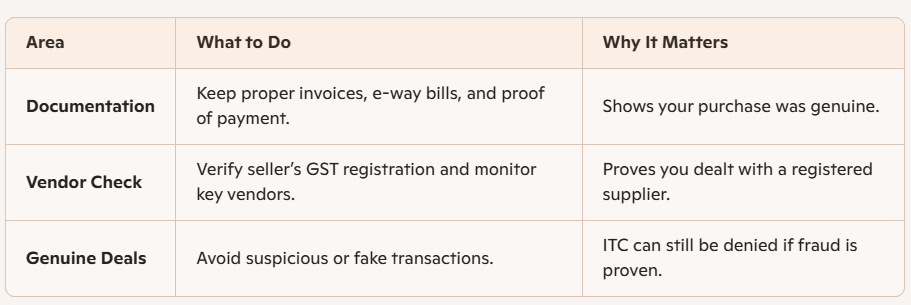

What businesses should do

This judgment brings relief, but businesses must continue to be careful and keep clean records. Follow these best practices:

Final word

This ruling is a milestone in India’s indirect tax law. It protects honest taxpayers from being punished for someone else’s mistake. The tax department should focus on defaulters, not compliant businesses. For businesses, this means greater confidence in claiming ITC—while keeping documentation strong and transactions genuine.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles