B2C HSN Summary Now Required in GSTR-1: Everything You Need to Know

The recent Infosys GSTN update has made it mandatory to include a consolidated HSN (Harmonized System of Nomenclature) summary for all B2C (Business-to-Consumer) transactions in GSTR-1 filing. Earlier applicable mainly to B2B and high-value B2CS invoices, this significant change now requires businesses to classify and report even small B2C sales by HSN code. The update aims to improve transparency, data accuracy, and tax compliance. This blog details the key implications for businesses, steps for reporting the B2C HSN summary in Table 12 of GSTR-1, HSN digit requirements, and best practices to ensure seamless compliance under the new GST regime.

The recent Infosys GSTN update mandates the inclusion of a consolidated HSN (Harmonized System of Nomenclature) summary for all B2C (Business-to-Consumer) transactions in the GSTR-1 filing.

Previously, HSN summary reporting was primarily for B2B supplies and large B2CS invoices (inter-state, > ₹2.5 lakhs).

This significant change means businesses must now aggregate B2C sales by HSN code, irrespective of transaction value or state. The primary goal is to enhance data accuracy, provide detailed insights into consumption trends, aid policy development, improve revenue assessment, prevent fraud, and ensure compliance.

Key Implications for Businesses:

- Enhanced Data Necessity: Meticulous tracking of HSN codes for every B2C sale is now essential.

- System Modifications: Accounting and ERP systems will likely require reconfiguration to capture and consolidate B2C HSN details.

- Potential for Mistakes: Increased reporting detail raises the risk of errors in HSN assignment or aggregation.

- Impact on Small Enterprises: Smaller retailers may face challenges adapting their less detailed accounting methods.

- Greater Scrutiny: More comprehensive data will provide tax authorities with a clearer view of B2C supplies, potentially leading to increased scrutiny.

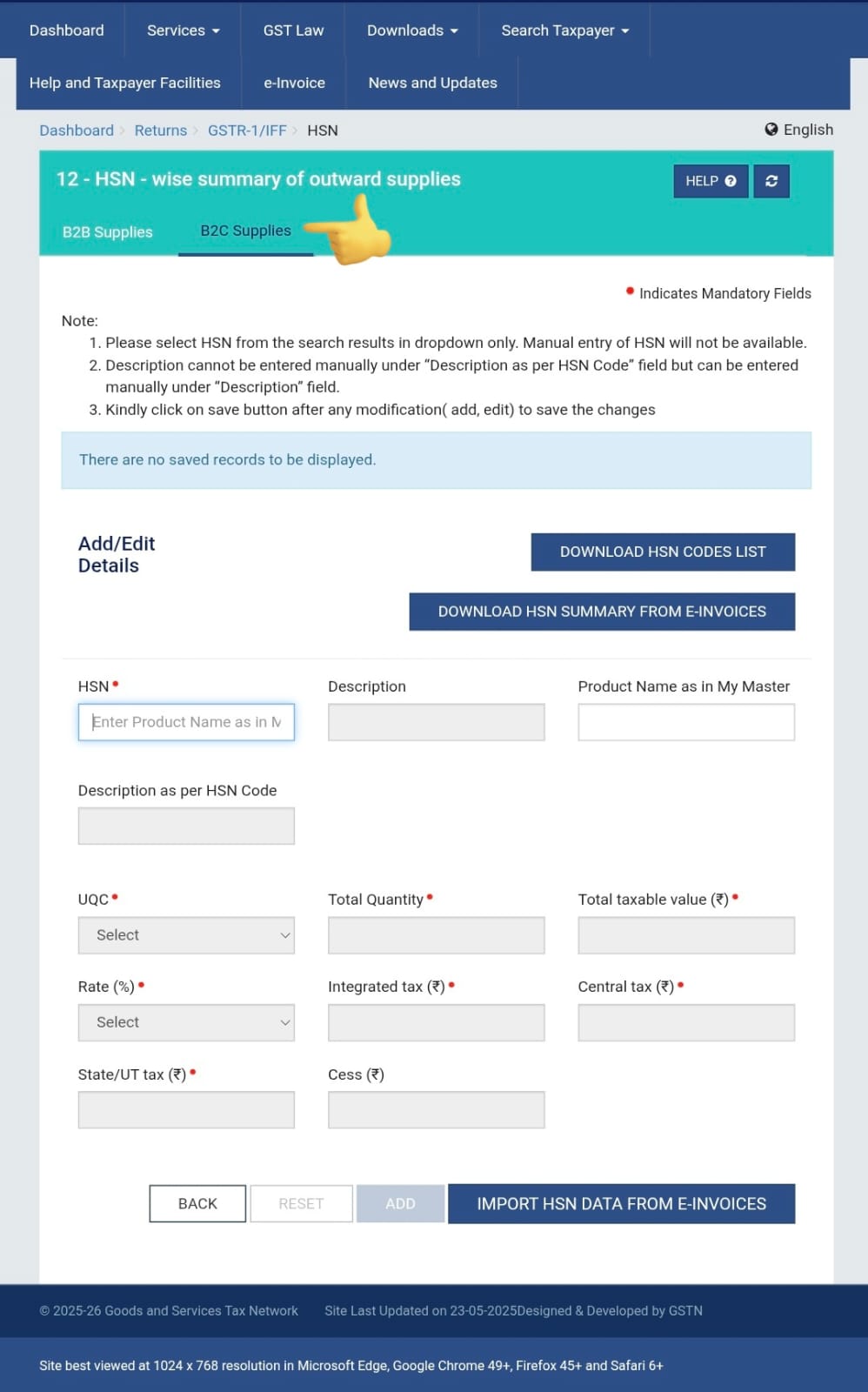

How to Report B2C HSN Summary in GSTR-1:

- Classify B2C Sales by HSN: Identify the appropriate HSN code for each product/service sold.

- Aggregate by HSN, Taxable Value, and Rate: Group sales by HSN code and total the taxable value, applicable GST (Central, State/UT, Integrated, Cess), and GST rate for each HSN.

- Enter into GSTR-1 Table 12: Input the aggregated data into Table 12 (HSN-wise summary of outward supplies). While quantity and UQC may be optional, HSN, taxable value, and tax amounts are mandatory.

- Ensure Uniformity: The total taxable value and tax in the B2C Summary (Table 7) must reconcile with the B2C HSN Summary (Table 12) to avoid validation errors.

HSN Digit Requirement:

The number of HSN digits depends on annual turnover: typically 4 digits for turnover under ₹5 Crore, and 6 or 8 digits for ₹5 Crore or more. Always refer to the latest GSTN advisories.

Best Practices for Compliance:

- Revise Accounting Systems: Configure systems to record HSN codes for all B2C transactions at the point of sale.

- Train Your Team: Educate billing and sales personnel on HSN code importance and accurate entry.

- Periodic Reconciliation: Regularly compare B2C sales data with the HSN summary.

- Stay Informed: Frequently check the GSTN portal for updates and advisories.

- Utilize GSP/ASP Services: Consider using GST Suvidha Providers (GSPs) or Application Service Providers (ASPs) for automated data management.

- Consult Professionals: Seek guidance from GST experts for complex business models or HSN classification uncertainties.

This update, while adding complexity, is crucial for enhanced transparency and data granularity in the GST framework. Proactive system upgrades, team training, and meticulous record-keeping are vital for accurate GSTR-1 submissions and minimizing potential scrutiny.

This update, while adding complexity, is crucial for enhanced transparency and data granularity in the GST framework. Proactive system upgrades, team training, and meticulous record-keeping are vital for accurate GSTR-1 submissions and minimizing potential scrutiny.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles