MVAT & PT Returns Deadline Extended for October 2025 Updated Filing Schedule

The Maharashtra government has extended the deadlines for filing MVAT and Professional Tax returns for October 2025. Payment due dates remain unchanged, and interest applies if taxes are paid late. Taxpayers now have additional time to file returns correctly and avoid late fees. This update helps businesses manage compliance efficiently and avoid penalties by following the revised dates.

The Maharashtra government has announced an extension for filing MVAT (Maharashtra Value Added Tax) and PT (Professional Tax) returns for October 2025. This update is important for all registered taxpayers because it provides additional time to ensure correct and timely filing of returns.

However, payment deadlines remain unchanged. If payment is made after the original due date, interest will apply even if the return filing date has been extended.

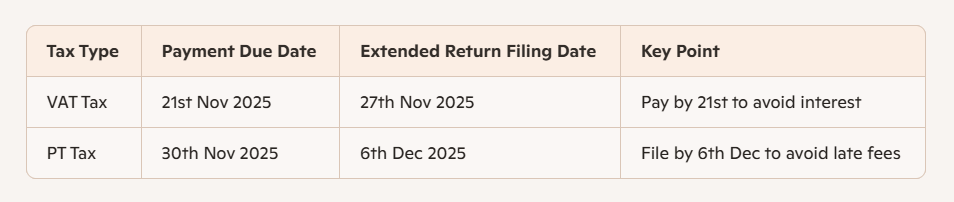

Updated Compliance Calendar October 2025

These extensions apply only for October 2025. For future filing periods, always check official notifications issued by the Maharashtra government.

How to Avoid Penalties

1. Pay on Time

Interest starts the day after the original payment due date. Ensure tax is paid before:

- VAT Payment: 21st November 2025

- PT Payment: 30th November 2025

2. File Within Extended Dates

Use the additional time for verification and reconciliation. File returns before:

- VAT Return Filing: 27th November 2025

- PT Return Filing: 6th December 2025

If You Pay on Time but File Late

Paying tax on or before the original due date prevents interest on delayed payment. However, filing after the extended deadline may still result in late fees. This extension helps taxpayers avoid filing penalties only if they follow the revised dates.

Final Word

The extension provides practical relief for businesses and professionals in Maharashtra. It should be used wisely to complete filings accurately, not as a reason to delay. Pay tax on time, use the extended days to ensure correctness, and remain fully compliant with state tax regulations.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles