GST E-Way Bill System: Major Flaws Fixed for Tighter Compliance

The government has upgraded the GST E-Way Bill system to close long-standing loopholes that allowed duplicate bills, non-filers, and cancelled GSTIN holders to move goods illegally. New system-driven checks such as unique invoice lock, filing restrictions, GSTIN validation, and a 180-day invoice limit now ensure stronger, automated compliance for all businesses and transporters.

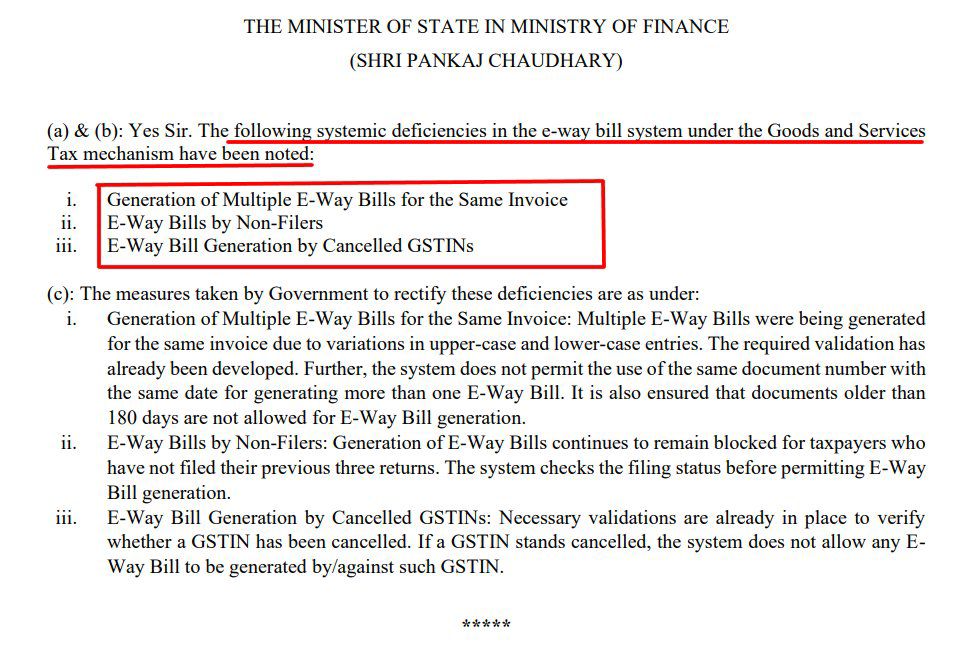

The government has upgraded the digital E-Way Bill system to shut down major loopholes previously used for tax evasion. Responding to issues highlighted by the Comptroller and Auditor General (CAG), several system-level checks are now hard-coded to ensure only compliant businesses can generate and use E-Way Bills.

Old Problems vs. New Fixes

| Old Problem (The Flaw) | New Rule (The Fix) | Who is Affected? |

|---|---|---|

| Duplicate E-Way Bills were generated for the same invoice. | Unique Invoice Lock: The system now blocks multiple E-Way Bills for the same invoice number and date. | All Businesses & Transporters |

| Non-filers of GST returns were still generating E-Way Bills. | Filing Check: E-Way Bill generation is blocked if the taxpayer has not filed the previous three GST returns. | Non-Compliant Businesses |

| Cancelled GSTIN holders could still generate bills. | Registration Check: The system now disallows generating bills by or against any cancelled or suspended GSTIN. | Cancelled/Suspended Businesses |

| Old invoices were used to generate fresh E-Way Bills. | 180-Day Limit: E-Way Bills cannot be generated for invoices older than 180 days. | Any Business Using Old Invoices |

Immediate Action for Businesses and Transporters

- Strict Deadlines: E-Way Bills can only be cancelled within 24 hours if goods were not moved.

- No Part A Edits: Invoice details cannot be changed once submitted. Only vehicle or transporter details in Part B can be updated.

- Carry Documents: Transporters must carry a valid invoice and the E-Way Bill copy or number during movement.

The Bottom Line

These system-driven corrections make the E-Way Bill mechanism stronger and more aligned with GST compliance standards. The message is simple: digital checks are now tight, and businesses must stay compliant with return filing, invoicing and reporting to avoid automatic blocks and penalties.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles