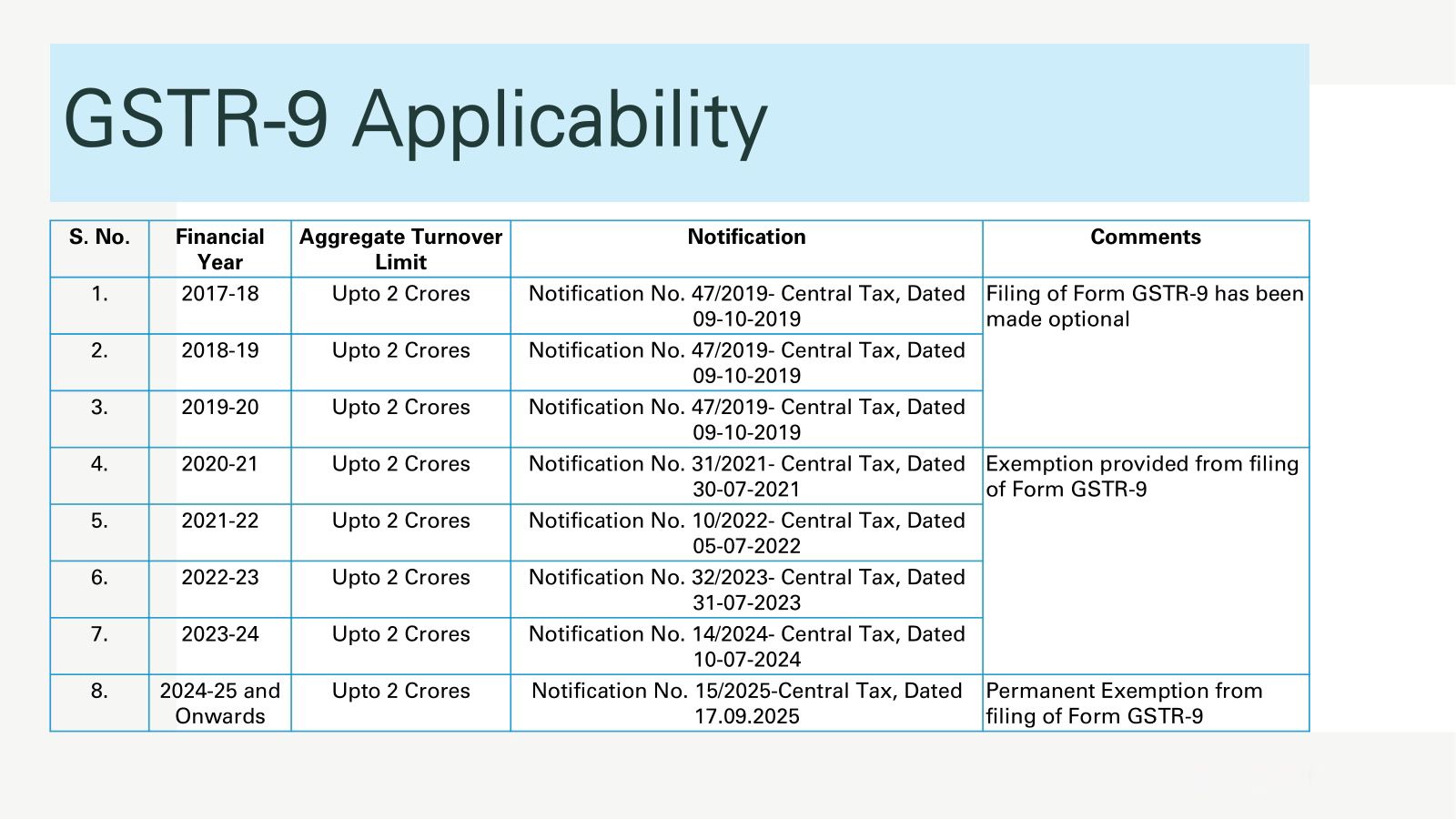

Understanding GSTR-9 Applicability for Small Businesses in India

The government has permanently exempted businesses with turnover up to 2 Crores from filing GSTR-9. The move aims to reduce compliance burden while ensuring monthly and quarterly GST filings continue.

GSTR-9 Applicability: A Simple Guide for Small Businesses

Filing GST annual returns can feel overwhelming, but the government has made life easier for small taxpayers. If your yearly turnover is up to ₹2 Crores, you don’t need to worry much about GSTR-9 anymore.

What This Means for You

- ₹2 Crore Limit: If your turnover is below this, GSTR-9 is not required.

- Optional vs. Exempted: Before 2020, filing was optional. From 2020 onwards, it became a full exemption.

- Permanent Relief: From FY 2024-25, small taxpayers are permanently exempt.

Why the Change?

To make business easier. Less paperwork means more time to focus on growth.

Important Notice

Even if exempt from GSTR-9, you must still file mandatory monthly or quarterly GST returns:

- GSTR-1

- GSTR-3B

Final Takeaway

If your business turnover is up to ₹2 Crores, you now have a permanent exemption from filing GSTR-9. This move helps simplify GST compliance and supports small business operations across India.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles