GST Annual Return Deadline: File Before December 31, 2025!

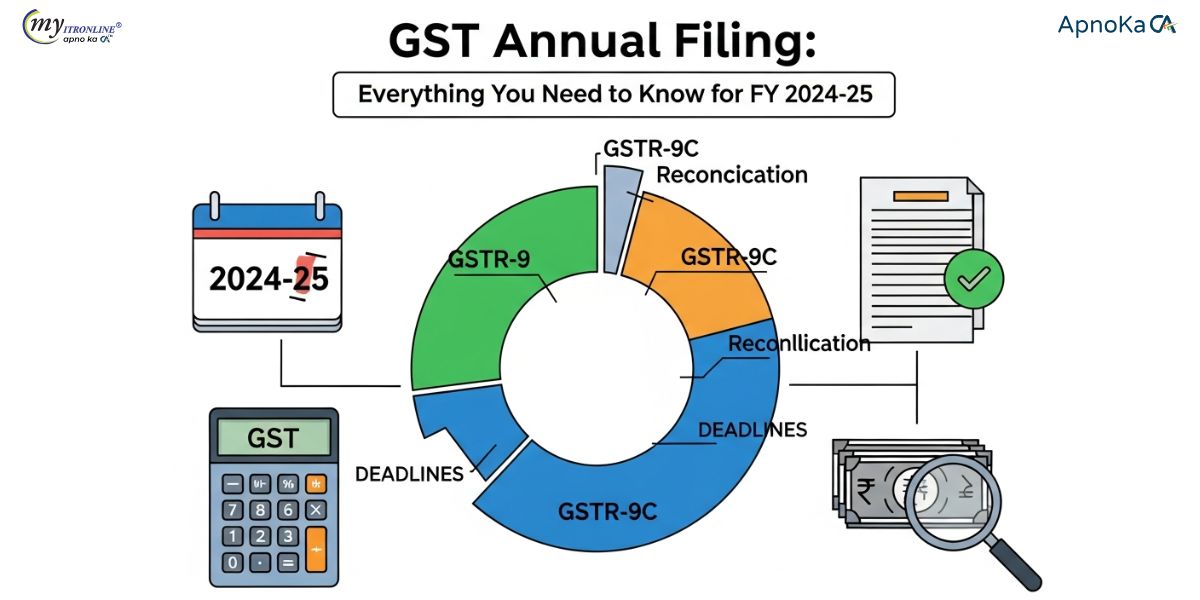

The annual Goods and Services Tax (GST) filing for the 2024-2025 financial year is quickly approaching. This post explains who needs to file the yearly return (GSTR-9) and the reconciliation statement (GSTR-9C), outlines the penalties for delays, and provides an essential checklist to ensure timely compliance.

The annual Goods and Services Tax (GST) filing for the 2024-2025 financial year is quickly approaching. This post explains who needs to file the yearly return (GSTR-9) and the reconciliation statement (GSTR-9C), outlines the penalties for delays, and provides an essential checklist to ensure timely compliance.

Important Deadline Alert!

The yearly GST return for the Financial Year (FY) 2024-25 is due on 31 December 2025.

Who Must File?

- For Yearly Return (GSTR-9): All registered businesses must submit this yearly statement.

- For Reconciliation Statement (GSTR-9C): Businesses whose total yearly sales (turnover) are more than ₹5 crore must also file this statement, which reconciles the details in the yearly return with the audited accounts.

Penalties for Missing the Deadline

- Late-Filing Penalty: If you miss the due date, a penalty of ₹200 per day (₹100 Central GST + ₹100 State GST) is charged. This daily penalty is capped at 0.04% of the business's total yearly sales for the state/UT.

- Interest on Unpaid Tax: If you owe any tax that hasn't been paid, you will be charged interest at 18% per year. This interest starts calculating from the original due date until the tax is finally paid.

Your Action Checklist Now

Here are the steps you should take right away to prepare for filing:

- Review your records to confirm if your total yearly sales (turnover) exceeded ₹5 crore.

- Gather and organize all your monthly/quarterly sales (GSTR-1) and summary payment (GSTR-3B) data for the entire financial year.

- Compare your input tax credit (ITC) records with the official data and prepare the Reconciliation Statement (GSTR-9C) if your turnover requires it.

- File the return online before 31 December 2025 to completely avoid the daily penalty.

Don’t let a missed filing cost you extra – get your yearly GST compliance done before the year ends!

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles