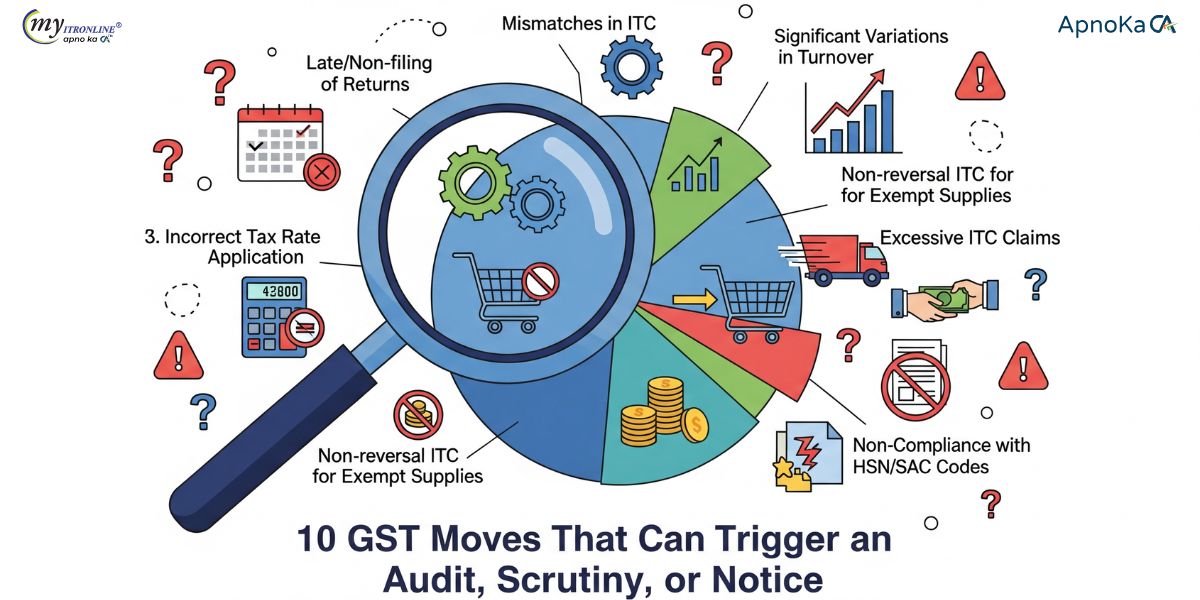

Stop the Fines: 10 GST Mistakes That Cost You Lakhs in Penalties and Audits

The GST system uses AI and data analytics to flag discrepancies. This guide details the 10 most common GST mistakes such as excess ITC and GSTR mismatches that instantly catch the department’s eye and lead to notices or audits.

The Goods and Services Tax (GST) system in India is not just about filing returns it’s powered by AI and advanced data analytics. Even a small mismatch or careless mistake can raise a red flag and land you in trouble with notices, scrutiny, or even a departmental audit.

To help you stay safe and stress-free, here are the 10 most common GST mistakes that instantly catch the department’s eye. Avoid these, and you’ll save yourself from unnecessary headaches.

The 10 Major GST Red Flags

1. Claiming Excess ITC Rule: Section 16(2) of the CGST Act allows ITC only when you have a valid invoice, received goods/services, and your supplier has filed returns. Trigger: Rule 36(4) restricts ITC to what’s shown in GSTR-2B. Claiming more than that? Straightaway scrutiny.

2. ITC Without a Valid Invoice Rule: Sections 31 & 16 make it clear no invoice, no ITC. Trigger: Claiming ITC without a proper tax invoice or debit note is a direct violation. Expect rejection and penalty.

3. Fake or Non-Compliant Suppliers Rule: Section 16(2)(aa) says ITC is valid only if the invoice appears in your GSTR-2B. Trigger: If your supplier is flagged for fake billing or non-compliance, your ITC can be blocked under Rule 86A.

4. Not Filing GSTR-3B Rule: Section 39(1) makes monthly filing mandatory. Trigger: Missed filings repeatedly? Your GST registration can be suspended under Rule 21A.

5. Mismatch Between GSTR-1 & GSTR-3B Rule: Outward supplies in GSTR-1 and GSTR-3B must match. Trigger: Big differences invite notices like DRC-01A for clarification.

6. Sudden Drop in Cash Sales Trigger: If your cash sales suddenly fall to zero, the system suspects underreporting or hidden transactions.

7. E-way Bill Mismatch Rule: Rule 138 requires correct details of value, quantity, and route. Trigger: Wrong entries or deviations can lead to goods being stopped and penalties imposed.

8. Large ITC Blocked by Department Trigger: If Rule 86A is used to block your ITC, it means the department doubts your supplier or your transactions. This often leads to a full audit.

9. High Refund Claims Rule: Section 54 puts refund claims under strict checks. Trigger: Large or repeated refund claims (especially for exports or accumulated ITC) are always scrutinised before approval.

10. Misusing GST Number for Relatives’ Business Rule: Section 25 & 122 prohibit misuse of GSTIN. Trigger: Issuing invoices without actual supply or using your GST number for someone else’s business is treated as fraud. Heavy penalties follow.

Compliance Tips You Must Follow

- AI is watching: Assume every transaction is tracked.

- Monthly reconciliation: Match purchases (GSTR-2A/2B) and sales (GSTR-1/3B) every month.

- Clean records: Keep invoices, bills, and documents ready to justify every claim.

Final Word

GST compliance is not just about filing returns it’s about being consistent, transparent, and careful. The more disciplined you are, the less likely you’ll face notices or audits.

Stay compliant, stay stress-free, and let your business grow without interruptions.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles