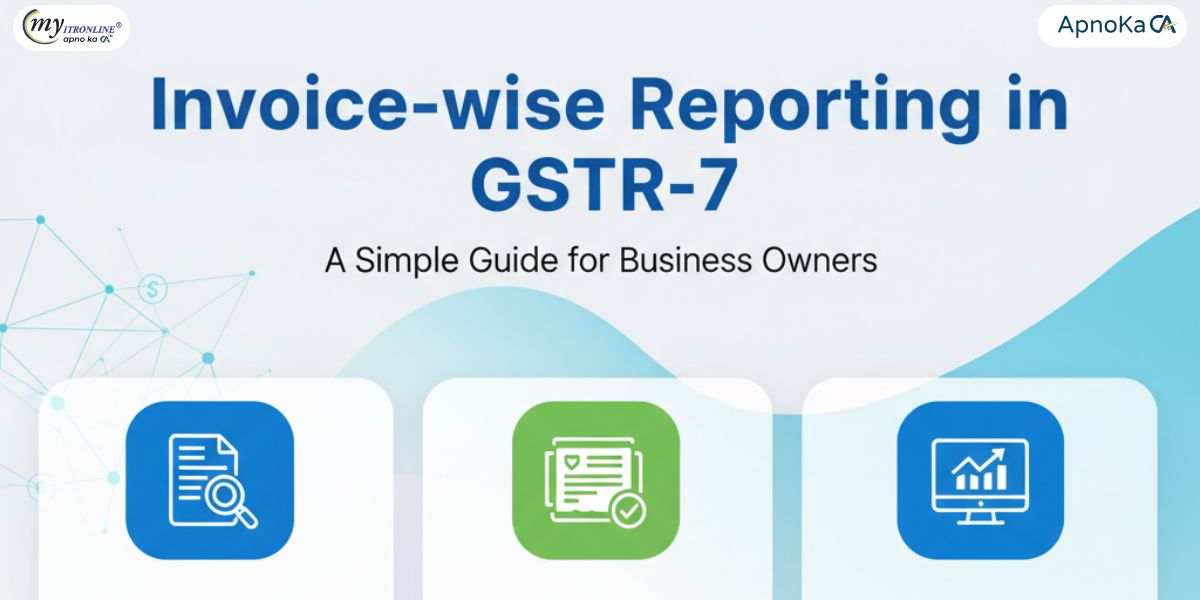

invoice-wise Reporting in GSTR-7 Made Easy for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

Introduction

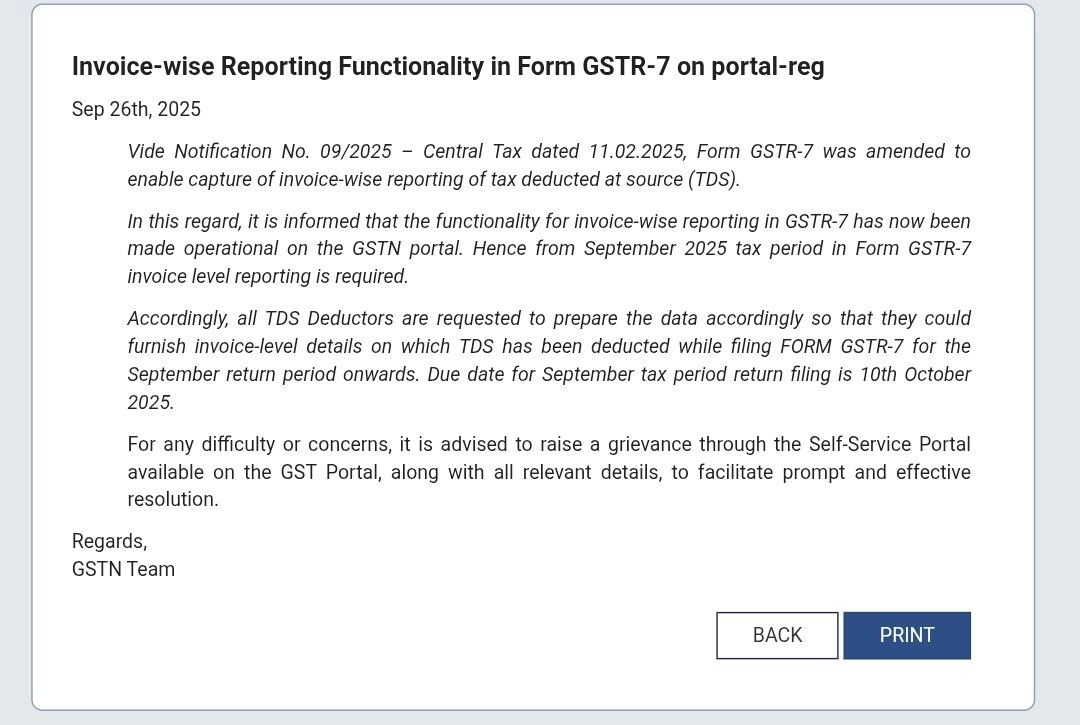

If you deduct TDS under GST, there’s an important update you need to know: Invoice-wise reporting in Form GSTR-7 is now mandatory.

Earlier, you could simply report the total TDS deducted per supplier. But now, every invoice where TDS is applied must be reported individually on the GST portal with full details like:

- Invoice number and date

- Supplier GSTIN

- Taxable value

- Tax breakup (CGST/SGST/IGST)

- Exact TDS amount

This shift from aggregate to invoice-level reporting is designed to make TDS credits more transparent, traceable, and easier to reconcile for both deductors and suppliers.

What’s Changed and Why It Matters

Old Method: Report total TDS per supplier

New Method: Report each invoice where TDS was deducted, with mandatory fields including:

- Invoice number and date

- Supplier GSTIN

- Taxable value before tax

- Tax breakup (CGST/SGST/IGST)

- TDS amount per tax head

Why this matters: Invoice-level entries create a direct link between your TDS deduction and the supplier’s input tax credit. This reduces mismatches, speeds up reconciliation, and builds a cleaner audit trail.

Filing Deadline You Can’t Miss

For the September 2025 tax period, the due date to file GSTR-7 is October 10, 2025.

This is the first full-cycle filing where invoice-wise reporting is compulsory. Make sure all entries are uploaded correctly before this date to avoid:

- Penalties

- Interest

- Supplier credit mismatches

Smart Tip: Finalize and validate your data by October 7 to avoid last-minute portal issues.

Impact on Deductors and Suppliers

For Deductors

- Maintain invoice-level records for every TDS deduction

- Ensure ERP/accounting systems support invoice-wise exports

- Expect a slight increase in filing effort due to detailed validations

For Suppliers

- TDS credit reflects faster and more accurately

- Fewer disputes or mismatches with your filings

- Clear audit trail for claiming credits

Practical Compliance Checklist

- Map TDS cases: Identify contracts and payments where Section 51 applies.

- Prepare export template: Ensure your system can generate required columns.

- Clean your data: Validate GSTINs, remove duplicates, confirm date formats, check taxable value rounding.

- Test uploads in batches: Start with a small sample, confirm acceptance, and note portal validation messages.

- Reconcile monthly: Match your GSTR-7 entries with supplier ledgers and log exceptions.

- Maintain evidence: Keep invoices, payment proofs, portal screenshots, and export files.

- Assign ownership: Appoint a single owner for GSTR-7 data and set timelines for corrections.

Common Portal Errors and How to Fix Them

- Duplicate invoice number: Ensure unique numbering per supplier

- Invalid GSTIN: Verify the 15-character format and confirm with suppliers

- Taxable value mismatch: Align rounding rules and recalculate if needed

- TDS allocation error: Check tax head splits and match with payment vouchers

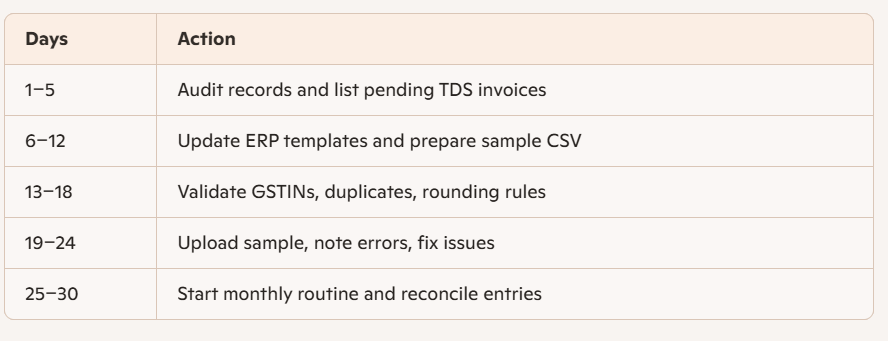

Your 30-Day Action Plan

Conclusion

Invoice-wise GSTR-7 reporting may require a bit more effort upfront, but it brings long-term clarity, fewer disputes, and stronger compliance.

Act now: Map your TDS invoices, update export templates, test uploads, and set a monthly reconciliation rhythm. And most importantly don’t miss the October 10, 2025 deadline.

Need Help Filing GSTR-7?

Our team at Myitronline is here to support you with:

- Invoice-wise uploads

- Data validation

- Portal filing assistance

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles