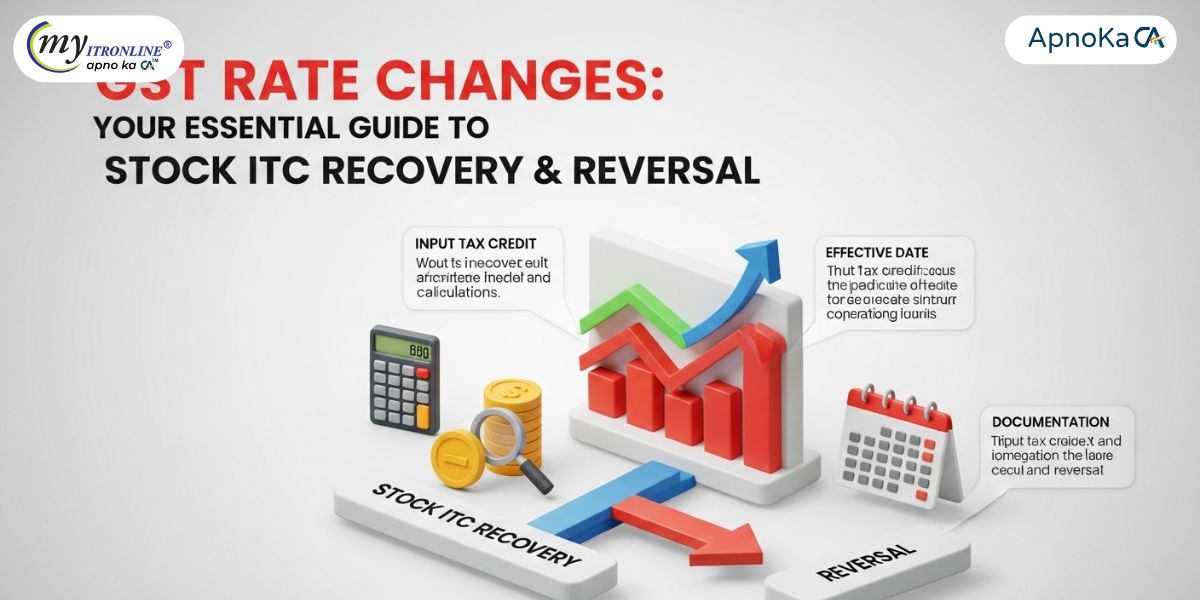

The September 22nd Deadline: Critical ITC Moves for Your Existing Stock

This blog post provides a comprehensive guide to the upcoming GST rate changes in India, effective 22 September 2025, focusing specifically on the implications for Input Tax Credit (ITC) on stock. It explains the new simplified tax slab structure (5%, 18%, 40% for luxury goods) and details how businesses should handle ITC for stock purchased before the changes, supplies made after the changes, and unsold old inventory. The post offers practical advice on identifying stock, claiming eligible ITC, reversing ITC where necessary, seeking manufacturer support, and maintaining audit-ready records to navigate this significant tax transition effectively.

Starting 22 September 2025, GST will change to a simpler structure. The 12% and 28% slabs will be replaced by just 5%, 18%, and a new 40% for luxury and sin goods. The aim is to simplify tax, lower costs, and increase consumption.

In practical terms:

- Essential goods like daily staples will move to 5%.

- High-demand items like TVs and ACs will stay at 18%.

- Luxury items will be taxed at 40%.

What About Stock ITC? How Are Businesses Impacted?

1. Stock Purchased Before 22 September

If you bought inventory before the new GST rates started and paid a higher rate (like 18% or 28%), you can still claim ITC on that. Just make sure it’s recorded in your e-credit ledger and meets GST conditions.

2. Stock Supplied After 22 September

Once the new GST rates go into effect:

- If your goods are exempt, you’ll need to reverse the ITC for these supplies.

- Even if reduced to 5%, some services like hotels or passenger transportation may not allow ITC, unless you choose the 18% rate.

3. Unsold Inventory Carried Across

Dealers with older stock billed under the old, higher GST rates (especially automobiles) are facing significant financial issues. With changes in cess structures and no clear refund or ITC reversal options, many are experiencing heavy losses.

Some companies are offering compensation for losses on unsold inventory or providing credit notes to help offset the mismatch.

What This Means for Businesses — At a Glance

| Scenario | ITC Treatment Post-22 Sept 2025 |

|---|---|

| Stock purchased before 22 Sept | ITC can be claimed as per regular rules (if recorded and valid) |

| Supplies after 22 Sept taxed 5% or exempt | ITC needs to be reversed for exempt supplies; some supplies at 5% may or may not allow ITC |

| Unsold old inventory | Dealers face financial strain due to inability to claim ITC or refund on cess; some relief via compensation or credit notes |

What Businesses Should Do Now

- Identify old vs new stock: Keep track of stock purchased under the old rates versus stock supplied or sold after 22 September.

- Claim eligible ITC: For purchases made before 22 September, ensure invoices and ledgers are organized to support ITC claims.

- Reverse ITC where required: If supplies are exempt under the new rules, follow reversal guidelines under GST law.

- Seek manufacturer support: Talk to your suppliers or OEMs. They may offer credit notes or cover some costs for mismatched old stock.

- Stay audit-ready: Keep clear records and reasons for your decisions. GST authorities will closely review these transitions.

Final Thoughts

The GST overhaul on 22 September simplifies tax slabs and gives the economy a boost, but it creates challenges for businesses holding old stock. The good news is that ITC for pre-reform purchases can still be claimed. The challenge lies in navigating new exemptions, non-ITC supplies, and potential costs.

Act now, stay informed, and manage your stock wisely. This isn’t just a policy change; it’s a shift that will impact your balance sheet.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles