CBDT’s Notification No. 4/2025: Unlocking 100% Tax Deduction for R&D Contributions

The CBDT has issued Notification No. 4/2025 under Section 35(1)(iia) of the Income Tax Act, granting approval to a company for scientific research and development. Contributions made to the approved entity qualify for a 100% tax deduction, encouraging businesses to support innovation while reducing their tax burden. This move strengthens India’s R&D ecosystem and promotes industry-science collaboration.

The Central Board of Direct Taxes (CBDT) has issued Notification No. 4/2025, a move that may sound technical but carries huge significance for India’s innovation ecosystem. This order, issued under Section 35(1)(iia) of the Income Tax Act, 1961 read with Rule 5F of the Income Tax Rules, 1962, directly impacts Scientific Research and Development (R&D) and offers a powerful tax incentive for businesses that support innovation.

What Does the Notification Do?

In simple terms, the notification grants approval to a specific company or institution to carry out scientific research and development.

- Who gets approved? An Indian company whose primary objective is R&D.

- Who benefits? Any taxpayer whether an individual, firm, or company who contributes funds to the approved entity.

- Validity: Such approvals are typically valid for several assessment years. For example, similar notifications have covered five years (A.Y. 2026-27 to A.Y. 2030-31).

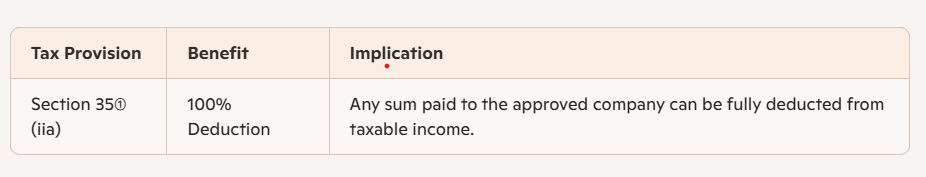

This approval essentially unlocks a 100% tax deduction for contributions made to the notified entity.

The 100% Tax Deduction Advantage

This provision is a cornerstone of the government’s strategy to encourage corporate funding of R&D. It allows businesses even those without in-house research facilities to invest in innovation and claim a full tax write-off.

Example: If your company contributes ₹10 lakhs to the approved entity, your taxable profit is reduced by the entire ₹10 lakhs.

The Legal Framework

- Section 35(1)(iia): The Income Tax Act provision that permits a 100% deduction for contributions to approved R&D companies.

- Rule 5F: The Income Tax Rule that sets out the conditions, record-keeping, and compliance requirements for R&D entities to qualify for approval.

By issuing Notification No. 4/2025, the CBDT confirms that the specified entity has met all requirements under Rule 5F. Contributions to it are now officially eligible for the 100% deduction.

Why This Matters

This notification is more than just a tax rule—it’s a signal of support for India’s R&D ecosystem. By approving new players in the research space, the government is encouraging businesses to collaborate, contribute, and strengthen the bridge between industry and scientific advancement.

For companies, it’s a win-win: support innovation and enjoy a full tax deduction. For India, it’s another step toward becoming a global hub for research and development.

Takeaway

The CBDT’s Notification No. 4/2025 under Section 35(1)(iia) is a game-changer for corporate-backed R&D. It provides businesses with a clear incentive to fund innovation while reducing their tax burden.

In essence, this is the government’s way of saying: invest in science, and we’ll invest in you.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles