Step-by-Step Guide to Fix Income Tax Refund Issues

Many taxpayers face the issue where their Income Tax refund status shows "Refund Credited" but the money doesn’t appear in their bank account. This guide explains why it happens, how to check your bank and portal details, and what steps to take to resolve it quickly.

Refund Credited but Not Reflected in Bank – What to Do?

Step-by-Step Guide to Fix Income Tax Refund Issues

It’s a common and frustrating situation: your Income Tax refund status says “Refund Credited”, but there’s no money in your bank account.

Don’t worry this doesn’t always mean something is wrong. Sometimes it’s just a delay. Other times, it could be due to incorrect bank details. Let’s walk through what you should do.

1. Check the Bank Processing Time

- Bank Delay is Normal: Even after the Income Tax Department (ITD) sends the refund, your bank may take 3 to 7 working days to process and show the credit.

- Check the Credit Date: Log in to the Income Tax e-Filing portal, go to ‘My Account’ or ‘Services’, and check the exact date the refund was credited. Then compare it with your bank’s usual processing time.

2. Verify Your Bank Account Details

- Check Pre-Validation: Go to ‘My Profile’ > ‘My Bank Account’ on the e-Filing portal. Make sure the account is pre-validated and marked as the Refund Destination Account.

- Double-Check IFSC and Account Number: Even a small mistake can cause the refund to bounce back.

- Check for Failed Transactions: If the bank couldn’t credit the refund, they may have returned it to the ITD. Look at your bank statement or ask your bank if they rejected any incoming ECS/NEFT credit.

3. Track Refund Reissue Status

- Look for a Failure Message: You may get an SMS or email from the ITD saying the refund failed.

- How to Request a Reissue:

- Log in to the e-Filing portal

- Go to ‘Services’ > ‘Refund Reissue Request’

- Select the correct Assessment Year and Communication Reference Number

- Update your bank details if needed (make sure it’s pre-validated)

- Choose the correct account and submit the request

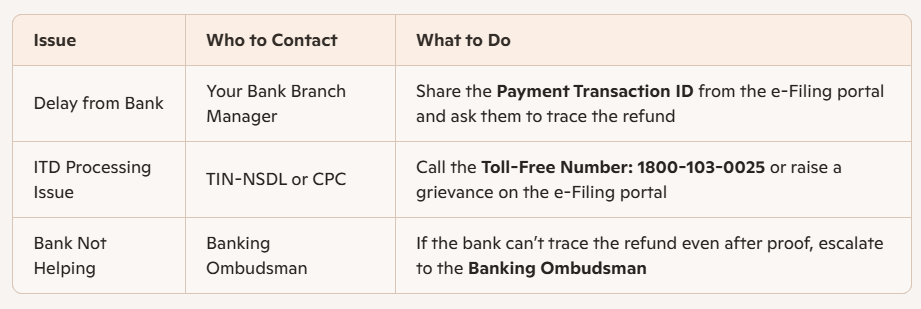

4. Contact the Right Authorities

If it’s been more than 7 working days and there’s no update, here’s who to contact:

Quick Tips to Avoid This in the Future

- Always Pre-Validate Your Bank Account: Do this on the e-Filing portal before filing your ITR.

- Select the Right Account for Refund: While filing your return, choose the correct pre-validated account as the refund destination.

Final Word

If your refund status says “Credited” but the money isn’t in your account, don’t panic. Start by checking the processing time, then verify your bank details. If needed, raise a refund reissue request or contact the right authority.

Stay calm, follow the steps, and your refund should reach you soon.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles