How to Save Tax on Capital Gains by Reinvesting in Property

Selling a big asset like property, stocks, or gold can lead to huge capital gains and a big tax bill. But if you reinvest smartly, you can claim full exemption under Section 54 or 54F, up to ₹10 Crore. This blog explains how to do it, the deadlines, and the rules to follow.

How to Save Tax on Capital Gains by Reinvesting in Property

Selling a major asset like a house, commercial property, stocks, or gold—can give you a big profit. But it also brings a big tax bill. Long-Term Capital Gains (LTCG) are taxed at 20% (with indexation), which can be a shock.

The good news? You can avoid paying tax if you reinvest the gains smartly. The Income Tax Act allows individuals and Hindu Undivided Families (HUFs) to claim full exemption by reinvesting in a new residential property.

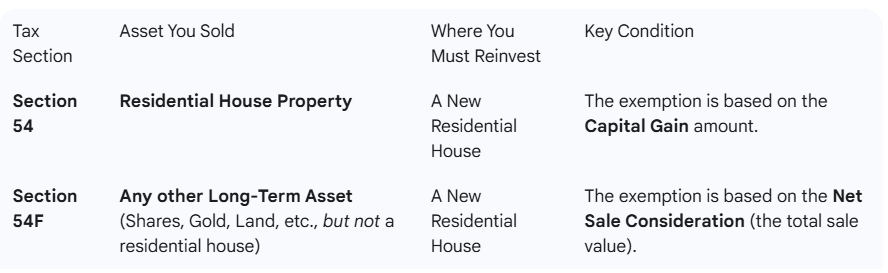

Section 54 vs Section 54F: Two Ways to Save Tax

The ₹10 Crore Cap: What Changed

Earlier, there was no limit on how much exemption you could claim. But from April 1, 2023 (Assessment Year 2024-25 onwards), the maximum exemption allowed under Section 54 or 54F is ₹10 Crore.

Example: If you reinvest ₹12 Crore in a new house, only ₹10 Crore will be exempt from tax.

Reinvestment Deadlines: Don’t Miss Them

- Purchase: Buy the new house within 1 year before or 2 years after selling the original asset.

- Construction: Finish building the new house within 3 years from the sale date.

Capital Gains Account Scheme (CGAS)

If you haven’t found the right house before filing your Income Tax Return (ITR), you can still save tax. Just deposit the capital gain amount into a Capital Gains Account Scheme (CGAS) before the ITR due date. You must use this money within the original 2 or 3-year limit.

Important Rules to Keep Your Exemption

- Don’t Sell the New House Too Soon: You must hold the new house for at least 3 years. If you sell it earlier, the exempted gain becomes taxable again.

- Section 54F Is Stricter: You must not own more than one house on the date of selling your original asset. Also, you must reinvest the full sale amount not just the gain to get full exemption.

Another Option: Invest in Startups (Section 54GB)

If you sold a residential house or plot and want to support startups, you can invest the sale proceeds into equity shares of an eligible startup. This also gives you LTCG exemption, but the rules are more complex and need expert advice.

Final Tip: Always consult a tax professional before making big reinvestment decisions to ensure you meet all conditions and deadlines.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles