Simple Tax Rules for Your Business and Profession: What You Need to Know for 2024-25

This comprehensive blog post provides a detailed overview of the presumptive taxation schemes under Sections 44AD and 44ADA of the Income Tax Act, 1961, for the Financial Year 2024-25 (Assessment Year 2025-26). It explains the eligibility criteria, benefits, and important considerations (like the 5-year rule) for small businesses and professionals. Additionally, it clarifies the requirements for maintaining books of accounts under Section 44AA and the applicability of tax audits under Section 44AB, including the enhanced turnover limits. The blog aims to simplify complex tax provisions, helping taxpayers make informed decisions for better compliance and tax planning.

The Indian Income Tax Act, 1961, aims to simplify tax compliance for small businesses and professionals through various provisions, especially those related to presumptive taxation. For Financial Year 2024-25 (Assessment Year 2025-26), understanding the applicability of Sections 44AA, 44AB, 44AD, and 44ADA is crucial for taxpayers. This understanding helps ensure compliance and manage their tax burden better. This blog will discuss each section, outlining their applicability, benefits, and key points to consider.

Understanding the Core Concepts: Why Presumptive Taxation?

Traditionally, businesses and professionals must maintain thorough books of accounts, record all transactions, and calculate their income based on actual profits and losses. This process can be complex and time-consuming, especially for smaller taxpayers. To help ease this burden, the Income Tax Act introduced presumptive taxation schemes.

Under presumptive taxation, a taxpayer can declare income at a specified rate, usually a percentage of their turnover or gross receipts. This approach eliminates the need to maintain detailed books or audit them in most cases. It makes compliance much easier.

Let's explore the individual sections:

Section 44AA: Maintenance of Books of Accounts

Section 44AA explains when someone running a business or profession must keep books of accounts. While presumptive taxation schemes aim to free some taxpayers from this requirement, it’s important to know the general rules.

Who needs to maintain books of accounts?

- Specified Professions (as per Section 44AA(1) and Rule 6F): This includes legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, film artists, and authorized representatives.

- Requirement: If gross receipts from the profession are over ₹1,50,000 in any of the three preceding years (or in the current year for new professions likely to exceed this limit), the prescribed books of accounts (cash book, journal, ledger, copies of bills issued, original bills for expenses) must be kept.

- Other Professions and Businesses:

- If total income exceeds ₹2,50,000 or gross receipts/sales/turnover exceed ₹25,00,000 in any of the three preceding years. (For individuals and HUFs, these limits rose from ₹1,20,000 and ₹10,00,000 respectively, effective from AY 2024-25).

- For newly established businesses/professions, if expected income or turnover is likely to exceed these limits.

- Opting Out of Presumptive Taxation: If someone eligible for presumptive taxation under Section 44AD or 44ADA (or 44AE) declares income lower than the prescribed rate while their total income exceeds the basic exemption limit, they must maintain books of accounts.

Key point for FY 2024-25: Even if you are usually covered by presumptive taxation (44AD/44ADA), declaring lower income than the presumptive rate requires you to keep books of accounts if your actual income is above the basic exemption limit.

Section 44AB: Tax Audit

Section 44AB requires certain businesses and professions to have their accounts audited by a Chartered Accountant. This is known as a "tax audit."

Who needs a tax audit for FY 2024-25 (AY 2025-26)?

- Businesses:

- If total sales, turnover, or gross receipts exceed ₹1 crore in the previous year.

- Increased Limit: This limit rises to ₹10 crore if:

- The total of all cash received during the previous year is less than 5% of the total gross receipts.

- The total of all cash payments made in the previous year is less than 5% of the total payments.

This higher threshold encourages digital transactions.

- If someone opts for the presumptive taxation scheme under Section 44AD but declares profits or gains lower than the prescribed rate while their income exceeds the basic exemption limit.

- If someone eligible for Section 44AD opts out and their total income exceeds the basic exemption limit in any five consecutive assessment years after opting out.

- Businesses reporting a loss where their turnover exceeds ₹1 crore (or ₹10 crore as applicable).

- Professions:

- If total gross receipts from the profession exceed ₹50 lakh in the previous year.

- If someone opts for the presumptive taxation scheme under Section 44ADA but claims profits or gains lower than 50% of the gross receipts while their income exceeds the basic exemption limit.

Important Note: The due date for filing the tax audit report for FY 2024-25 (AY 2025-26) is **September 30, 2025**.

Section 44AD: Presumptive Taxation for Businesses

Section 44AD offers a simplified presumptive taxation scheme for small businesses.

Who is eligible for Section 44AD for FY 2024-25 (AY 2025-26)?

- Eligible Assessee: Resident Individual, Resident Hindu Undivided Family (HUF), or Resident Partnership Firm (not including Limited Liability Partnership - LLP).

- Eligible Business: Any business, except for:

- Business of plying, hiring, or leasing goods carriages (covered under Section 44AE).

- Any agency business.

- Any person earning income in commission or brokerage.

- Any person practicing a specified profession as per Section 44AA(1).

- Turnover Limit:

- The total turnover or gross receipts from the business should not exceed ₹3 crore in the previous year, provided that cash received during the previous year does not exceed 5% of the total gross receipts.

- If cash receipts exceed 5% of total gross receipts, the limit stays at ₹2 crore.

How is income computed under Section 44AD?

- Deemed Income:

- 8% of total turnover or gross receipts for cash transactions.

- 6% of total turnover or gross receipts for transactions received through account payee cheque, bank draft, or electronic clearing system (or any other prescribed electronic mode). This lower rate encourages digital payments.

- The assessee can declare an income higher than 6% or 8% if their actual income is higher.

Benefits of opting for Section 44AD:

- No need to maintain books of accounts as per Section 44AA.

- No requirement for a tax audit under Section 44AB, unless income is declared lower than the prescribed rate and exceeds the basic exemption limit.

- No deductions allowed under Sections 30 to 38 (e.g., depreciation, business expenses) since the presumptive rate is assumed to cover all such expenses. However, salary/interest to partners in a partnership firm can be deducted within limits.

- Simplified Advance Tax: The entire advance tax can be paid in one installment by March 15 of the financial year.

Important Considerations ("5-Year Rule"):

- If someone opts for Section 44AD, they must continue for five consecutive assessment years.

- If someone opts out of Section 44AD in any of those five years, they cannot choose Section 44AD for the next five assessment years following the year they opted out. In that case, they must also maintain books of accounts and get a tax audit if their total income exceeds the basic exemption limit.

Section 44ADA: Presumptive Taxation for Professionals

Section 44ADA provides a similar presumptive taxation scheme for eligible professionals.

Who is eligible for Section 44ADA for FY 2024-25 (AY 2025-26)?

- Eligible Assessee: Resident Individual or Resident Partnership Firm (not including Limited Liability Partnership - LLP).

- Eligible Professions: Specified professions as per Section 44AA(1) (legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, film artists, and authorized representatives).

- Gross Receipts Limit:

- The total gross receipts from the profession should not exceed ₹75 lakh in the previous year, provided that cash received during the previous year does not exceed 5% of the total gross receipts.

- If cash receipts exceed 5% of total gross receipts, the limit remains ₹50 lakh.

How is income computed under Section 44ADA?

- Deemed Income: 50% of total gross receipts from the profession is considered taxable income.

- The assessee can declare an income higher than 50% if their actual income is higher.

Benefits of opting for Section 44ADA:

- No need to maintain books of accounts as per Section 44AA, unless income is declared lower than 50% and exceeds the basic exemption limit.

- No requirement for a tax audit under Section 44AB, unless income is declared lower than 50% and exceeds the basic exemption limit.

- No deductions allowed for business expenses (Sections 30-38) as the 50% rate is seen as covering all such expenses. However, deductions under Chapter VI-A (e.g., 80C, 80D) can still be claimed.

- Simplified Advance Tax: The entire advance tax can be paid in one installment by March 15 of the financial year.

Important Considerations:

- Unlike Section 44AD, Section 44ADA does not have a strict "5-year rule" for continuous opting in. Professionals can choose to join or leave the scheme each year. However, if a professional declares income lower than 50% and their total income exceeds the basic exemption limit, they will need to maintain books of accounts and get an audit.

- Partnership firms choosing 44ADA cannot claim deductions for payments made to partners, including remuneration or interest.

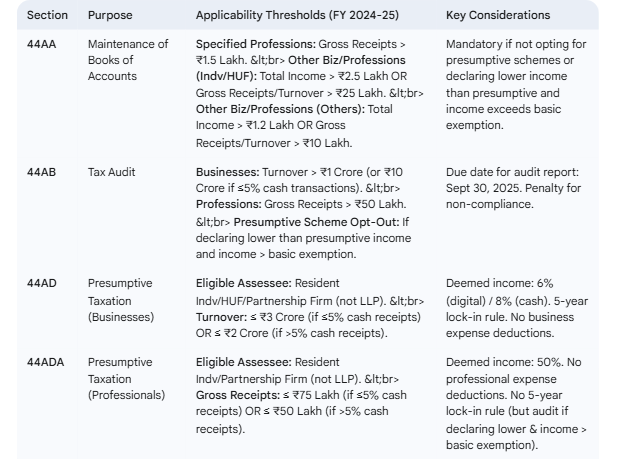

Summary of Applicability for FY 2024-25 & AY 2025-26

Choosing the Right Scheme: What to Consider

Deciding whether to choose a presumptive taxation scheme involves several factors:

- Actual Profitability: If your actual net profit is much lower than the presumptive rate (for example, less than 6%/8% for businesses or 50% for professionals), opting for presumptive taxation could mean a higher tax bill than regular computation. In such cases, maintaining books of accounts and declaring actual income may be better, even if it leads to an audit.

- Compliance Burden: Presumptive taxation simplifies compliance by removing the need for detailed bookkeeping and audits. This can be a major advantage for small taxpayers.

- Future Plans: Businesses should think about the 5-year lock-in rule under Section 44AD. If you expect your business to grow quickly or your profits to change drastically soon, the lock-in might be limiting.

- Deductions and Losses: Under presumptive schemes, you cannot claim deductions for individual business expenses or carry forward losses. If you have a lot of expenses or losses, regular taxation might be better.

- Advance Tax Payment: The simplified single advance tax payment under presumptive schemes can be convenient.

Conclusion

Sections 44AA, 44AB, 44AD, and 44ADA of the Income Tax Act, 1961, aim to streamline tax compliance for small businesses and professionals in India. For FY 2024-25 (AY 2025-26), taxpayers must carefully assess their turnover/gross receipts, the nature of their business or profession, and their actual profitability to choose the best and most compliant approach. While presumptive taxation simplifies compliance, a clear understanding of the conditions and implications of each section is vital to avoid penalties and ensure proper tax planning. Consulting with a tax professional for personalized advice based on your specific situation is always a good idea.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles