What Is the Difference Between Refund Issued and Refund Credited?

This guide clarifies the distinction between the two common income tax refund statuses, "Refund Issued" and "Refund Credited." Learn what each status means, the complete refund timeline, key differences, and how to check your refund status for a smoother tax experience

If you've filed your Income Tax Return (ITR) and are expecting a refund, you've probably checked the refund status multiple times on the income tax portal. Two common statuses that often confuse taxpayers are "Refund Issued" and "Refund Credited." While they sound similar, they represent different stages of the refund process.

Let's understand what each status means and what you should do at each stage.

Understanding the Refund Process

Before diving into the differences, let's understand the complete refund journey:

- ITR Filed → Return submitted

- ITR Verified → Return verified through Aadhaar OTP/EVC/ITR-V

- ITR Processed → Return processed by CPC (Centralized Processing Centre)

- Refund Determined → Refund amount calculated

- Refund Issued → Refund sent to your bank

- Refund Credited → Money deposited in your account

What Does "Refund Issued" Mean?

"Refund Issued" means the Income Tax Department has approved your refund and initiated the payment process to your bank account.

Key Points:

- IT Department's Responsibility Completed: The tax department has done its part

- Payment Initiated: The refund has been sent to RBI (Reserve Bank of India) for processing

- In Transit: Money is on its way but not yet in your account

- No Action Required: You just need to wait for the amount to reflect in your account

What Information You'll See:

- Refund amount

- Mode of payment (usually Direct Bank Transfer)

- Date when refund was issued

- Bank account details where it's sent

Typical Message:

What Does "Refund Credited" Mean?

"Refund Credited" means the refund amount has been successfully deposited into your bank account.

Key Points:

- Money in Your Account: The refund has reached your bank account

- Process Complete: The entire refund process is finished

- Available for Use: You can now use the refunded amount

- Confirmation Received: Bank has confirmed receipt of funds

What Information You'll See:

- Confirmation that refund has been credited

- Date of credit

- Bank account where credited

- Final refund amount received

Typical Message:

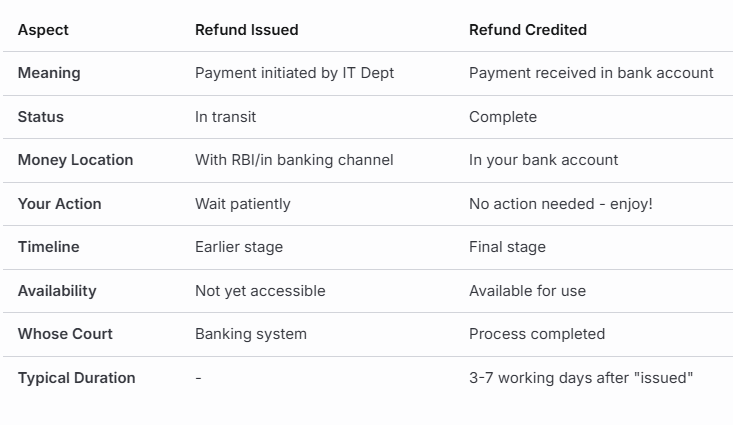

Key Differences: Refund Issued vs Refund Credited

Timeline: How Long Does It Take?

From "Refund Issued" to "Refund Credited"

Normal Timeline: 3-7 working days

However, the duration can vary based on:

- Bank Processing Time: Different banks have different processing speeds

- Weekends/Holidays: Banking holidays can delay the process

- Technical Issues: Sometimes banking systems face delays

- Account Status: Issues with your bank account can cause delays

- Verification Requirements: Some banks do additional verification for large amounts

Overall Refund Timeline (From Filing to Credit)

- ITR Filing: Day 0

- ITR Verification: Within 30 days of filing

- ITR Processing: 15-45 days after verification

- Refund Issued: Immediately after processing

- Refund Credited: 3-7 days after issued

Total Time: Typically 1-3 months from filing date (if everything goes smoothly)

How to Check Your Refund Status

Method 1: Income Tax e-Filing Portal

- Visit:

www.incometax.gov.in - Login with your credentials

- Go to "e-File" > "Income Tax Returns" > "View Filed Returns"

- Check the status of your ITR

Method 2: NSDL Website

- Visit:

https://tin.tin.nsdl.com/oltas/refundstatuslogin.html - Enter PAN, Assessment Year, and Captcha

- Click "Proceed" to view status

Method 3: Offline (Missed Call/SMS)

- Give a missed call to 1800 180 1961 from registered mobile number

- Send SMS:

ITREFUND PANto 57575

Method 4: Check Bank Account

- Look for credit from NSDL-TDS/Refund or Income Tax Refund

- Check your bank statement

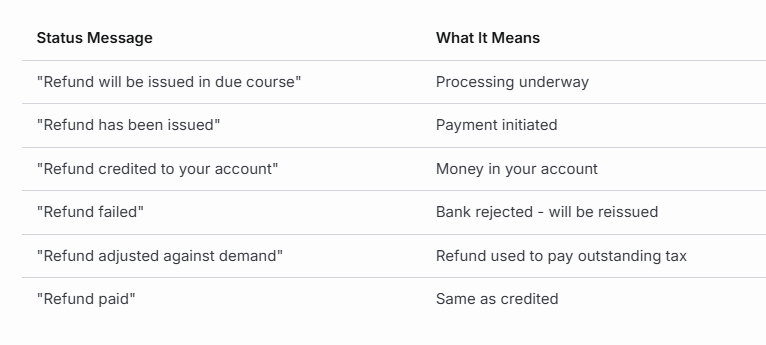

Understanding Your Refund Status Messages

Important Points to Remember

- Refund includes interest: You get interest @0.5% per month for delayed refunds

- Refund can be adjusted: Against any outstanding tax demand

- Status may skip: Sometimes you might see "Credited" directly without seeing "Issued"

- Bank name matters: Ensure bank details are exactly as per records

- Reissue is possible: If refund fails, it will be automatically reissued

- Check regularly: Portal updates may take 24-48 hours to reflect

Security Tips

- Beware of Fake Messages: IT department doesn't ask for bank details via SMS/email

- Official Channels Only: Check status only on official IT portal

- No Payment Required: You never pay to receive your refund

- Verify Communications: Cross-check any email with portal status

Frequently Asked Questions (FAQs)

Q1: How long after "Refund Issued" will I get the money?

A: Typically 3-7 working days. It can take up to 10 working days in some cases.

Q2: Can I track my refund after it's issued?

A: Yes, through the income tax portal or NSDL website. You can also check with your bank.

Q3: What if my refund status shows "Credited" but I haven't received the money?

A:

- Check your bank statement carefully

- Look for NSDL/Income Tax Refund entry

- Contact your bank

- It may take 1-2 days to reflect after status update

Q4: Will I get an SMS when refund is credited?

A: Yes, you should receive SMS from both IT department and your bank, provided your mobile number is registered.

Q5: What if I changed my bank account after filing ITR?

A: If status is still "Refund Issued," raise a grievance immediately to update bank details. The refund might fail and get reissued to the new account.

Q6: Is there a deadline to claim my refund?

A: No specific deadline, but it's advisable to resolve any issues promptly. Verify your ITR within 30 days of filing.

Q7: Why is my refund amount different from what I expected?

A: Check the intimation notice under Section 143(1). Reasons could be:

- Outstanding demands adjusted

- Calculation errors corrected by IT dept

- Interest added

- TDS mismatch

Q8: Can refund be issued by cheque?

A: Generally, refunds are issued via direct bank transfer. Cheques are rare and used only in exceptional cases.

Q9: What does "Refund Failed" mean?

A: It means the bank rejected the refund. Common reasons: inactive account, wrong details, or KYC issues. The IT department will reissue after you resolve the issue.

Q10: Do I need to pay tax on the refund received?

A: The refund itself is not taxable, but the interest received on refund (Section 244A) is taxable and should be shown as income in the next year's ITR.

Understanding the difference between "Refund Issued" and "Refund Credited" helps you track your tax refund journey better:

- "Refund Issued" = Payment initiated - Be patient

- "Refund Credited" = Payment received - Celebrate!

The gap between these two statuses is usually 3-7 working days. If it's taking longer, don't panic - follow the troubleshooting steps mentioned above.

Key Takeaway: "Refund Issued" means the IT department has done their job. Now it's just a matter of banking process completion before you see "Refund Credited" and the money in your account.

Disclaimer: This information is for educational purposes only and based on current income tax rules. For specific cases, please consult a Chartered Accountant or tax professional.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles