Difference Between Original, Revised, and Updated ITR

This blog explains the differences between Original, Revised, and Updated Income Tax Returns (ITR) in India. It covers filing timelines, applicable sections, fees, and practical examples to help taxpayers choose the right return type and avoid penalties.

Filing income tax returns can be confusing, especially when you need to make corrections or updates. Understanding the difference between Original, Revised, and Updated ITR is crucial for taxpayers. Let's break down each type and understand when to use them.

What is an Original ITR?

Original ITR is the first Income Tax Return you file for a particular financial year.

- First-time filing for the assessment year

- Filed within the due date (usually July 31st for individuals)

- No previous return exists for that year

- Forms the base document for your tax assessment

When to File: When filing your return for the first time in an assessment year, before the deadline specified by the Income Tax Department.

What is a Revised ITR?

Revised ITR allows you to correct mistakes or omissions made in your original return.

- Can be filed if you discover errors in your original return

- Available under Section 139(5) of the Income Tax Act

- Can be filed until December 31st of the relevant assessment year

- Replaces the original return completely

- Can be filed multiple times (each revision replaces the previous one)

When to File Revised ITR:

- Incorrect income disclosure

- Wrong tax calculations

- Missing income sources

- Incorrect deductions claimed

- Wrong bank account details

- Incorrect personal information

Important Points: Free of charge, can be filed even after the original due date, ideal for genuine mistakes, cannot be filed if assessment proceedings are completed.

What is an Updated ITR?

Updated ITR is a new provision introduced from AY 2020-21, allowing taxpayers to file/update returns even after the revision deadline.

- Available under Section 139(8A)

- Can be filed within 24 months from the end of the relevant assessment year

- Requires payment of additional fees/taxes

- Can be filed even if you never filed an original return

- Can be filed only once for each assessment year

When to File Updated ITR:

- You missed the original and revised return deadlines

- You discovered unreported income after December 31st

- You want to declare previously undisclosed income

- You never filed a return initially

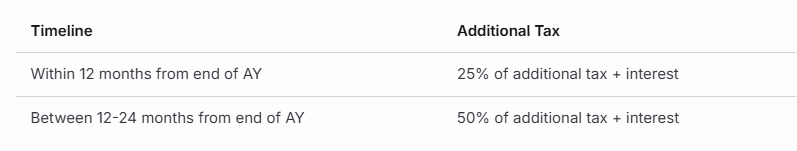

Fee Structure:

Restrictions - Updated ITR Cannot be Filed:

- If original return was filed under Section 139(1)

- For assessment year prior to 2020-21

- If income has already been assessed/reassessed

- If search/survey action has been initiated

- More than once for the same assessment year

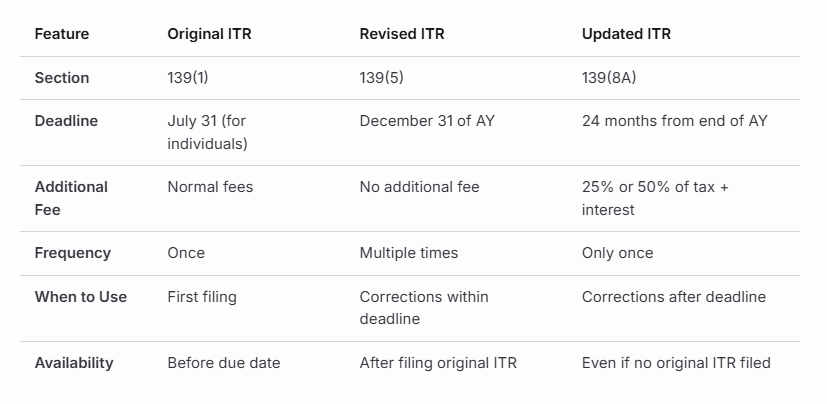

Quick Comparison Table

Practical Examples

Example 1: Revised ITR

Rahul filed his ITR for AY 2023-24 in July 2025. In October 2025, he realized he forgot to add interest income from a savings account. He can file a Revised ITR by December 31, 2025, at no extra cost.

Example 2: Updated ITR

Priya filed her ITR for AY 2024-25 but forgot to include rental income. She discovered this in February 2026 (after December 31 deadline). She can file an Updated ITR by March 31, 2026, by paying additional tax of 25% plus interest.

Example 3: Missed Filing

Amit completely forgot to file ITR for AY 2024-25. He can still file an Updated ITR by March 31, 2026, with applicable penalties.

Conclusion

Understanding the difference between Original, Revised, and Updated ITR empowers you to handle tax filing more effectively:

- Original ITR: Your first filing - do it right and on time

- Revised ITR: Your safety net for corrections - use it wisely

- Updated ITR: Your last resort - comes with penalties

Always aim to file an accurate original return by the due date. However, if you make mistakes, the tax department provides opportunities to correct them through revised and updated returns.

FAQs

Q1: Can I file a revised ITR multiple times?

Yes, you can revise your return multiple times before December 31 of the assessment year.

Q2: Is there a fee for filing a revised ITR?

No, filing a revised ITR is free of charge.

Q3: What happens if I file an updated ITR?

You'll need to pay 25% or 50% additional tax (depending on timing) plus interest on the additional tax liability.

Q4: Can I file an updated ITR if I've already filed a revised ITR?

Yes, if the time limit for revised ITR has expired and you're within the 24-month window.

Q5: What if I miss all deadlines?

You may face penalties and may not be able to claim refunds. You could also receive notices from the IT Department.

Disclaimer: This blog is for informational purposes only. Tax laws are subject to change. Please consult a qualified Chartered Accountant or tax professional for specific advice related to your situation.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles