Warning Alert: Tax Department Knows About Your Foreign Assets

The Income Tax Department is sending alerts to people who may have foreign bank accounts, investments or property that are not shown in their Income Tax Return. If you get this message, you must check and revise your ITR before 31 December 2025 to avoid big tax and penalties under the Black Money Act.

If you have any bank accounts, investments, or property outside India, this message is for you. The Income Tax Department has started sending fresh alerts to people who may have missed or not fully reported their foreign assets in their Income Tax Returns (ITR).

This is a chance to correct your return before heavy tax and big penalties apply.

What is the "Nudge" message from the tax department?

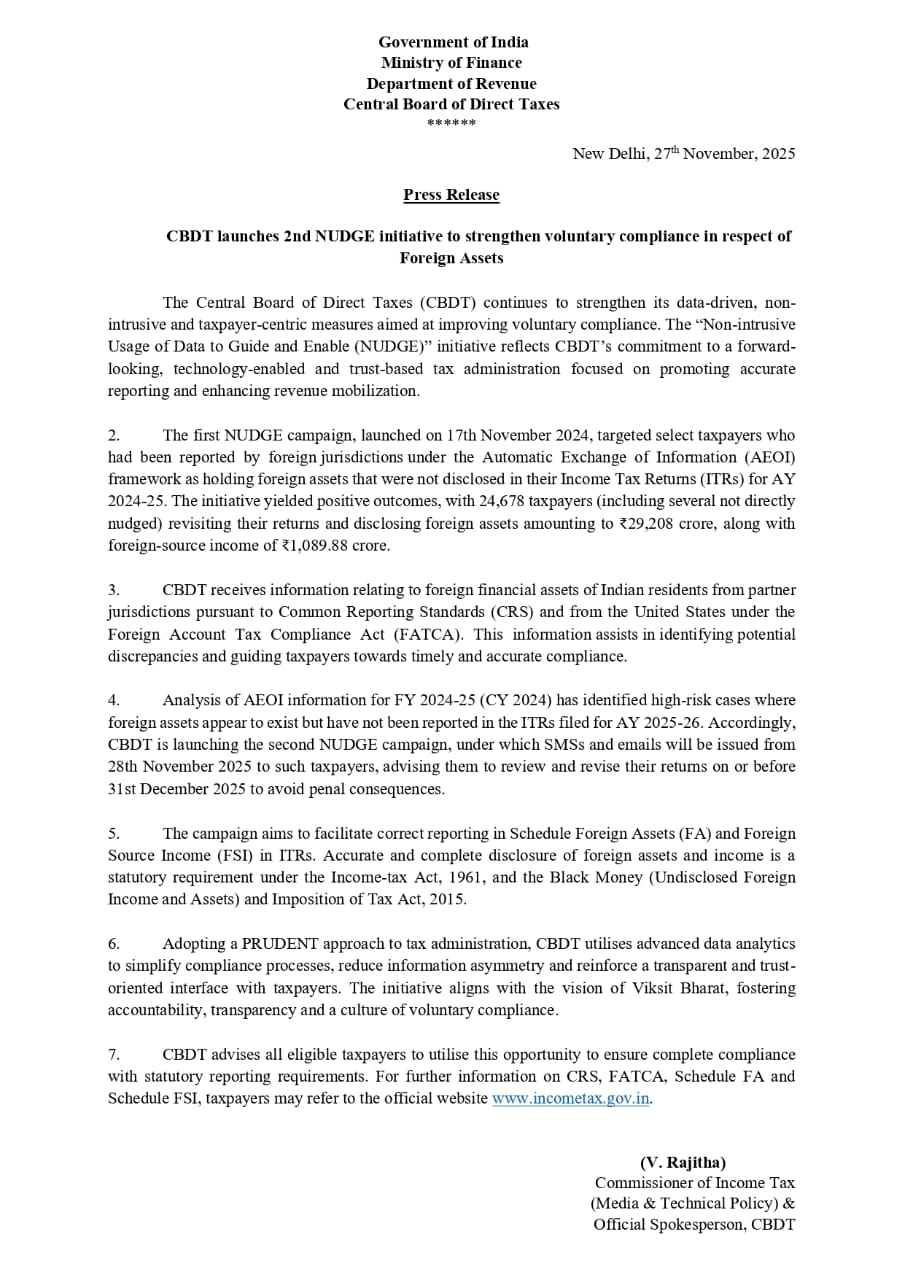

The tax department (CBDT) has launched the second phase of its "Nudge" campaign. Under this, the department sends a friendly reminder by SMS or email to people whom it believes have foreign assets but have not shown them correctly in their ITR.

How does the department know about your foreign assets?

India now receives data from many other countries about bank accounts and investments held by Indian residents. This is through an information system called Automatic Exchange of Information (AEOI).

The department compares this AEOI data with the details in your ITR. If there is a mismatch, you may get a Nudge alert.

Who can get this alert?

In the first round of this second phase, around 25,000 taxpayers marked as "high risk" have been chosen to receive these alerts.

You may get an alert if:

- You have a foreign bank account but did not show it in your ITR.

- You hold shares, mutual funds or any investment outside India and did not report them.

- You own property in another country and did not mention it in your tax return.

- You had income from foreign assets but did not show it or showed it partly.

Important Deadline: 31 December 2025

If you receive this alert, you must act fast.

Step 1: Review your ITR

Check your Income Tax Return for the financial year 2024–25 (Assessment Year 2025–26). See whether:

- All foreign bank accounts are reported.

- All foreign investments are shown.

- All foreign property details are given.

- All income from these assets is included.

Step 2: Revise your ITR, if needed

If you find that you missed any foreign asset or foreign income, you should file a revised ITR as soon as possible. Do not wait till the last day.

Step 3: Remember the last date

The last date to correct your return under this Nudge campaign is 31 December 2025.

If you delay and the department starts action under the Black Money Act, the cost will be much higher.

What happens if you ignore the alert?

Ignoring this warning can lead to very serious action under the Black Money Act.

- Big penalty: A penalty of ₹10 lakh may be charged for not disclosing a foreign asset.

- Heavy tax: Tax at 30% on the undisclosed amount, plus a penalty that can be up to 300% of the tax payable.

This means that if you hide foreign assets or foreign income, you may end up paying much more than the income itself in tax and penalties.

The tax department has clearly said that it is using AEOI data very actively and is closely checking high-risk cases.

What should you do if you have foreign assets?

- Collect all details of your foreign bank accounts, investments and property.

- Check whether these assets and the income from them are shown in your ITR.

- If not, speak to your tax advisor or a trusted tax expert quickly.

- File a revised ITR before 31 December 2025, if required.

It is always better to be honest and correct with your tax return. Taking action now can save you from stress, notices, and very high penalties later.

Final reminder

If you have any foreign bank account, investment or property, do not ignore this issue. Check your ITR, fix any mistake, and stay safe and compliant with the law.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

comming Soon

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles