BREAKING: ITR-1 & ITR-4 Excel Utilities for AY 2025-26 Ready for Submission!

Big news for individual taxpayers and small businesses! The Income Tax Department has released the Excel Utilities for ITR-1 (Sahaj) and ITR-4 (Sugam) for Assessment Year 2025-26. This means you can now begin filing your income tax returns offline. This blog covers who can use these forms, the benefits of early filing, and how MYITRONLINE can provide seamless assistance.

Introduction: The Tax Season Begins Early!

The Income Tax Department has just announced exciting news for millions of taxpayers throughout India! The Excel Utilities for filing Income Tax Returns (ITR) for Assessment Year 2025-26 (Financial Year 2024-25) for ITR-1 (Sahaj) and ITR-4 (Sugam) are now accessible for download. This event marks the official start of the tax filing season for a large number of individual taxpayers and small businesses.

This early release gives taxpayers a fantastic opportunity to complete their filings ahead of time, eliminating last-minute stress and the risk of penalties. Let’s explore what this means for you and how you can benefit from this development.

What This Means for You: An Overview of ITR-1 and ITR-4

The release of these Excel Utilities is essential as they serve a substantial number of taxpayers. Here’s a brief overview of who generally utilizes these forms:

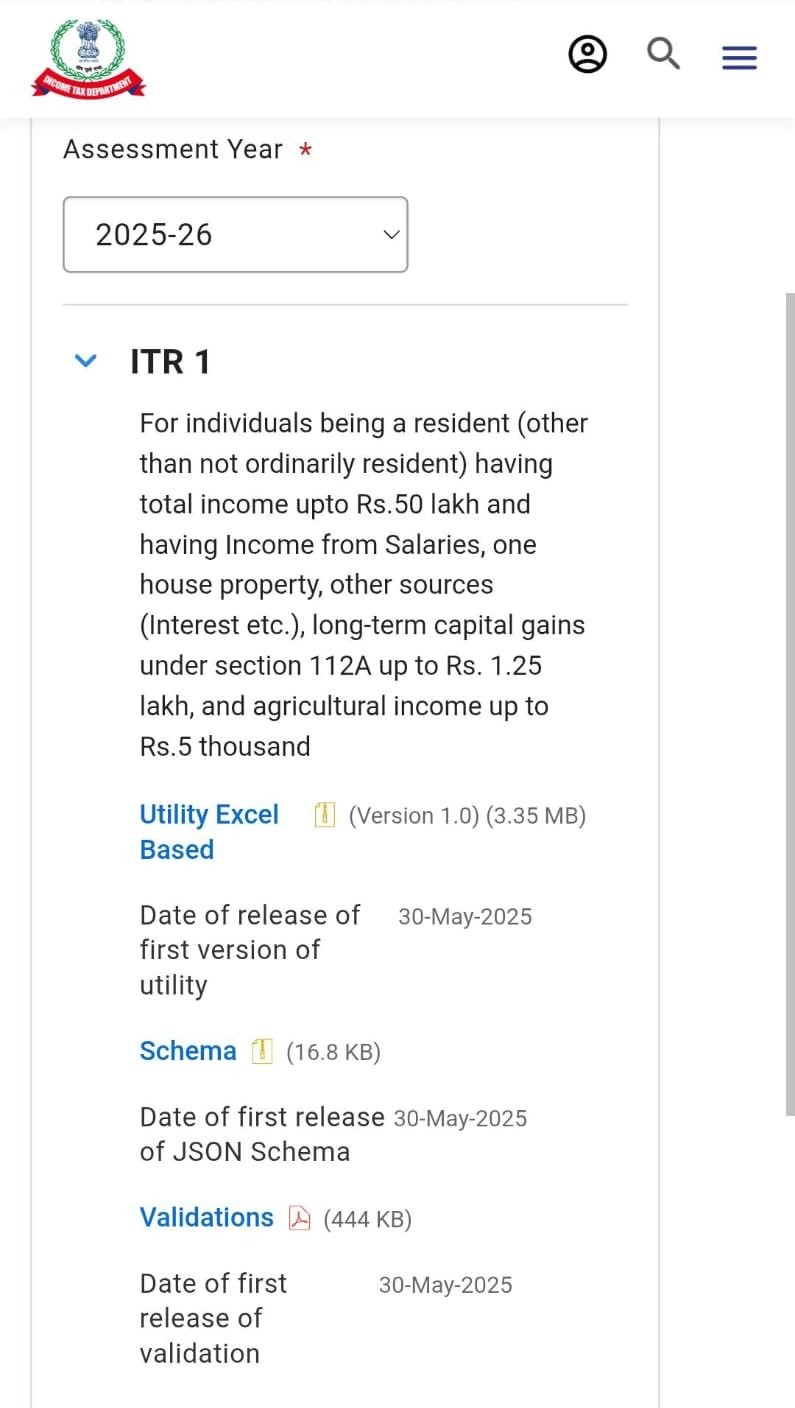

- ITR-1 (Sahaj): This simplified form is intended for resident individuals with total income not exceeding ₹50 Lakh. Common income sources include salary, one house property, other sources (like interest income), and agricultural income up to ₹5,000.

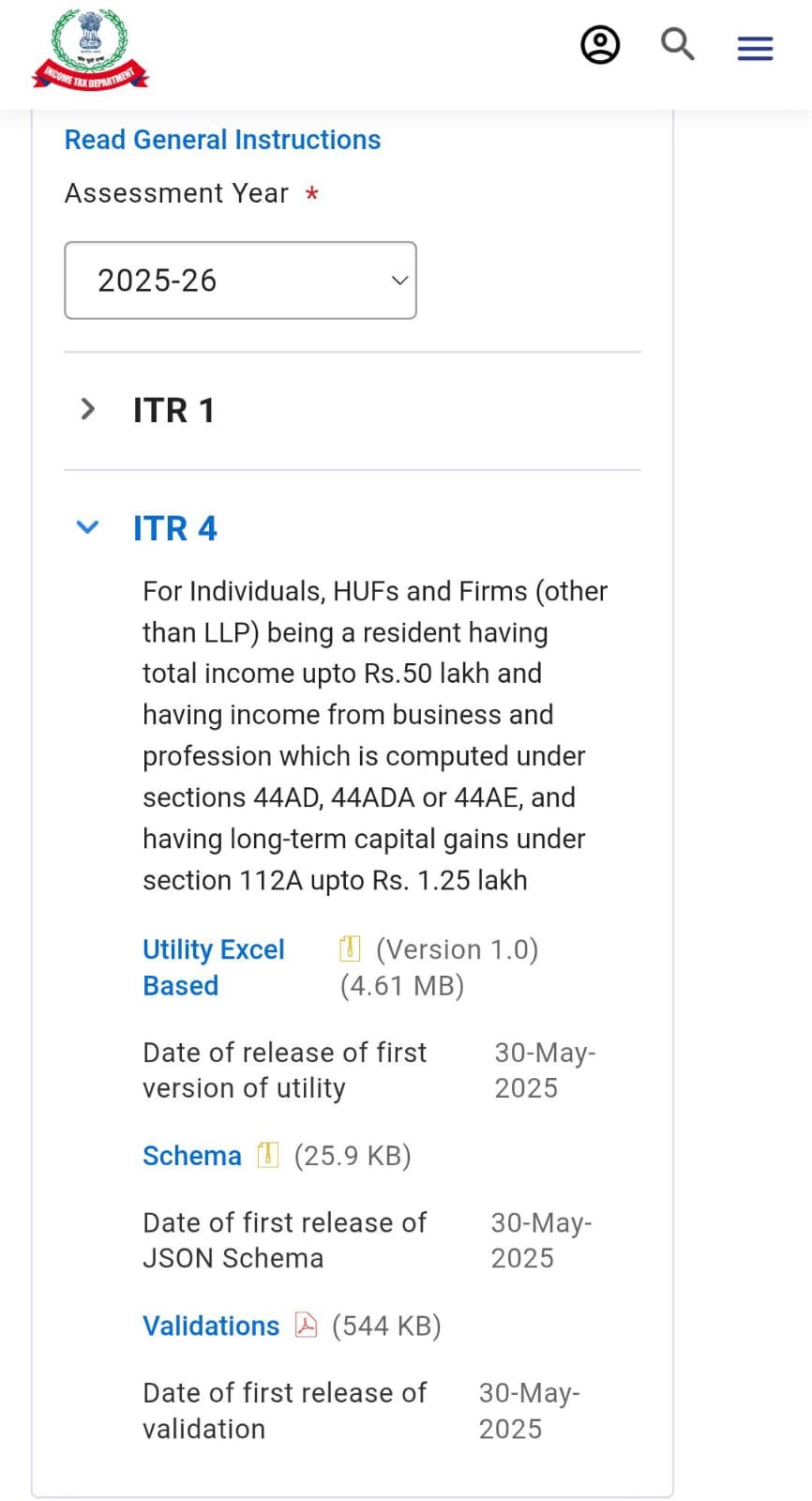

- ITR-4 (Sugam): This form is designated for resident individuals, HUFs, and firms (excluding LLPs) whose total income is up to ₹50 Lakh and who have income from presumptive taxation under Section 44AD, 44ADA, or 44AE.

The provision of Excel Utilities allows you to download the form, complete your information offline, and generate an XML file for upload to the Income Tax e-filing portal. This delivers flexibility and convenience for many users.

Why File Your ITR Early? (The Clear Advantages)

- Avoid Last-Minute Rush: The final submission period often leads to heavy traffic on the Income Tax portal, causing slower performance. Early filing guarantees a smoother experience.

- Timely Refunds: If you qualify for a tax refund, early filing ensures that you receive your refund credited to your bank account more quickly.

- Rectify Errors: Early submission grants you sufficient time to identify and correct any mistakes or omissions without the pressure of an approaching deadline.

- Peace of Mind: Finalizing your tax obligations sooner allows you to free up your time and lessen financial anxiety.

- Financial Planning: Early filing provides a clearer understanding of your financial situation, facilitating improved financial planning for the remainder of the year.

Steps to File Using the Excel Utility:

- Download the Utility: Head to the official Income Tax e-filing website and obtain the newest Excel Utility for ITR-1 or ITR-4 for the Assessment Year 2025-26.

- Enter Details: Launch the downloaded Excel file and diligently fill in your income, deductions, taxes paid (TDS, TCS, Advance Tax), and personal information.

- Validate & Calculate: Click the "Validate" button in the utility to identify any errors, then select "Calculate Tax" to determine your tax liability or refund.

- Generate XML: After validation, create the XML file, which includes all your ITR information.

- Upload to Portal: Sign in to the Income Tax e-filing portal, choose the appropriate ITR form and Assessment Year, and upload the XML file you generated.

- Verify Your Return: The last important step is to validate your return (for example, via Aadhaar OTP, Net Banking, or mailing ITR-V to the CPC). If not verified, your return will not be regarded as valid.

Key Things to Remember for AY 2025-26:

- New Tax Regime vs. Old Tax Regime: The new tax regime serves as the default for AY 2025-26. However, taxpayers can opt for the old tax regime if it offers more advantages after accounting for all deductions and exemptions. Make an informed decision!

- Staying Updated: Always check the latest guidelines and notifications from the Income Tax Department, as there may be minor alterations to rules and forms.

- Required Documents: Keep all essential documents ready, such as Form 16/Form 16A, bank statements, proof of investments, Aadhaar, PAN, etc.

Common Mistakes to Avoid During ITR Filing:

- Choosing the Wrong ITR Form: Confirm that you have selected the correct ITR form (ITR-1 or ITR-4) based on your income sources and eligibility criteria.

- Incorrect Personal Details: Carefully verify your PAN, Aadhaar number, bank account information (particularly the IFSC code), and contact details.

- Mismatch in Income/TDS: Cross-reference your income information with Form 26AS/AIS/TIS to ensure there are no discrepancies in reported income or TDS credits.

- Not Declaring All Income: Make certain that all income sources, including interest from savings accounts and fixed deposits, are reported.

Conclusion: File Your ITR Smoothly with MYITRONLINE

The early availability of ITR-1 and ITR-4 Excel Utilities for AY 2025-26 is a great advancement, providing taxpayers with sufficient time to meet their tax responsibilities. Do not procrastinate until the deadline!

Need assistance with ITR filing, comprehending the new/old tax regimes, or other tax-related concerns? At MYITRONLINE, we offer a complete solution for everything from ITR filing to GST compliance, ensuring your business stays protected from compliance issues. Contact us today at 9971055886 for expert support!

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles