Your Complete Guide to Filing ITR-6 for AY 2025-26 with the New Excel Utility

This blog announces the release of the ITR-6 Excel Utility for the Assessment Year 2025-26 by the Income Tax Department. It details which companies are required to file this form, highlights key updates and changes for this year (such as LEI and capital gains reporting), provides a step-by-step guide on how to use the offline utility, and clarifies the important filing deadlines to help corporate filers ensure timely and accurate compliance.

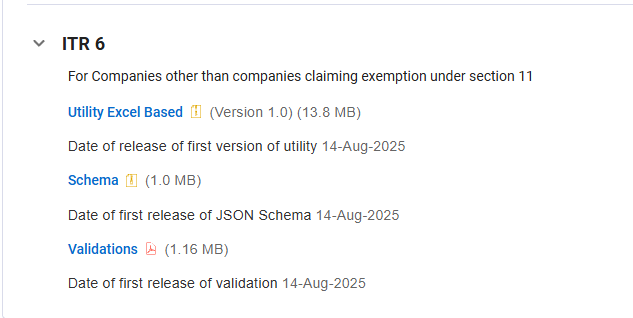

The Income Tax Department has released the Excel Utility for ITR-6 for the Assessment Year (AY) 2025-26. This signals the start of the income tax return filing season for companies. This important offline tool allows companies, except those claiming exemption under Section 11, to prepare and file their income tax returns for the financial year 2024-25.

Who Needs to File ITR-6?

The ITR-6 form is made for companies registered under the Companies Act, 2013, or any previous company law. This includes:

- Private limited companies

- Public limited companies

- One-person companies (OPCs)

- Domestic and foreign companies earning income in India

It is mandatory for every eligible company to file ITR-6, regardless of their income or if they have incurred a loss. Companies claiming exemption under Section 11, which usually applies to income from property held for charitable or religious purposes, must file ITR-7 instead.

Key Changes and Updates in ITR-6 for AY 2025-26

This year's ITR-6 form has several important changes aimed at improving transparency and following the amendments introduced in the Finance Act, 2024. Companies should note the following key updates:

- Detailed Capital Gains Reporting: The form now requires a breakdown of capital gains based on the date of transaction.

- Share Buyback Loss Treatment: Companies can now claim capital losses on share buybacks if the related dividend income is reported under 'Income from Other Sources'.

- New Presumptive Taxation Schemes: The form includes references to new presumptive taxation schemes, such as Section 44BBC for cruise shipping businesses.

- Enhanced Disclosures for Deductions: More detailed information is now needed for claiming certain deductions, including interest on housing loans under Section 24(b) and TDS, with the specific section code now required.

- Legal Entity Identifier (LEI): Companies must now provide their 20-character LEI, a global identifier for legal entities that participate in financial transactions.

How to Use the ITR-6 Excel Utility

The ITR-6 form must be filed electronically using a Digital Signature Certificate (DSC). The Excel utility makes this process easier by allowing companies to fill in the necessary details offline. Here’s a general guide to using the utility:

- Download the Utility: The Excel utility for ITR-6 can be downloaded from the official Income Tax e-filing portal under the 'Downloads' section.

- Fill in the Details: Open the downloaded Excel file and fill in all the required information across various schedules, including the balance sheet, profit and loss account, and computations of income and tax.

- Validate the Information: The utility includes a built-in validation feature to check for errors and ensure all mandatory fields are completed.

- Generate the JSON/XML File: Once the information is validated, you can generate a

JSONorXMLfile. - Upload to the Portal: Log into the e-filing portal. Under the e-file menu, upload the generated JSON/XML file to complete the filing process.

Important Filing Deadlines

While the utility is now available, it is important for companies to know the filing deadlines. The due date for filing ITRs for taxpayers whose accounts require auditing is usually October 31st of the assessment year. For companies that need to submit a report in Form No. 3CEB related to international transactions, the deadline is November 30th of the assessment year.

However, note that the due date for filing ITRs for certain taxpayers for AY 2025-26 was extended to September 15, 2025. Companies should check the specific deadline for their situation to avoid late filing fees or penalties. Missing the deadline can lead to a penalty of up to ₹ 5,000 and interest on the unpaid tax amount.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles