What You Should Know About the Latest Income Tax Changes in FY 2025–2026

India's income tax system has undergone a major shift for FY 2025–26, with the New Tax Regime now set as the default. This blog breaks down the differences between the New and Old Regimes, compares tax slabs, and helps taxpayers decide which option suits them best. Whether you're a young professional or a seasoned investor, understanding these changes is key to smarter tax planning.

As we navigate through the financial year 2025–26 (Assessment Year 2026–27), income tax rules in India have seen some big changes. While there's no brand-new "Income Tax Act, 2025," the government has updated the existing law through the annual Finance Act. The biggest change? The New Tax Regime is now the default for everyone.

The Big Change: New Tax Regime Becomes the Default

Earlier, the Old Tax Regime was the default, and you had to choose the New Regime if you wanted it. Now, it's the other way around. If you don't actively choose the Old Regime while filing your taxes, you'll automatically be taxed under the New Regime.

Quick Look: Old vs New Tax Regime

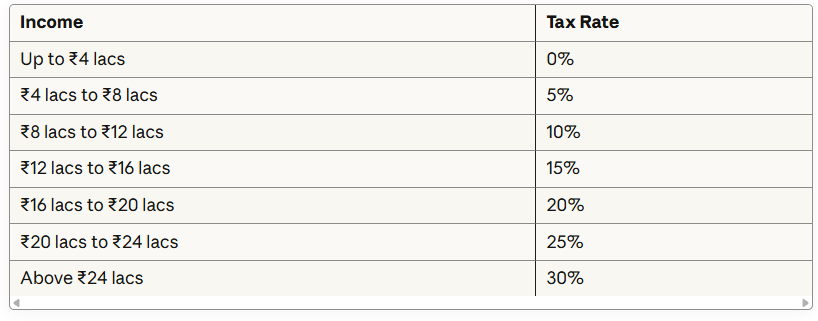

New Tax Regime (Default Option)

- Lower Tax Rates: You pay less tax on your income

- No Major Deductions: You can't claim benefits like Section 80C (investments), 80D (health insurance), HRA (house rent), etc.

- Standard Deduction: ₹75,000 for salaried people and pensioners

- Tax-Free Income: No tax if your income is up to ₹12 lakh for FY 2025–26, thanks to Section 87A rebate

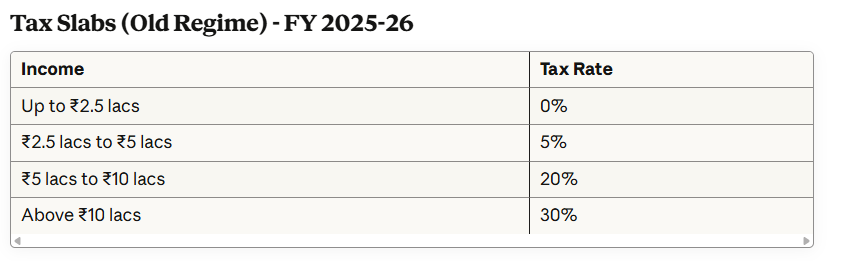

Old Tax Regime (Opt-In Option)

- Higher Tax Rates: Starts at 5% for income above ₹2.5 lakh

- Full Deductions Allowed: You can claim benefits under 80C, 80D, HRA, LTA, home loan interest, etc.

- Tax-Free Income: No tax if your income is up to ₹5 lakh

See the difference? The New Regime has more slabs with gradual increases, while the Old Regime jumps to higher rates faster. But remember, the Old Regime lets you reduce your taxable income through deductions!

When the New Regime Feels Like a Relief

- Young Professionals: If you're just starting out and don't invest much in tax-saving schemes, the New Regime is simpler and cheaper.

- Cash Over Savings: Prefer keeping money in hand instead of locking it in investments? This regime gives you that freedom.

- Easy Filing: No need to track multiple documents or deductions. Filing is quicker and less stressful.

When the New Regime Feels Like a Burden

- Salaried with Deductions: If you claim full 80C, HRA, and home loan interest, the Old Regime might save you more money.

- Disciplined Savers: Many people use tax-saving schemes to build long-term wealth. The New Regime removes that push.

- Home Loan Holders: You lose the benefit of claiming interest paid on your home loan under Section 24.

What You Should Do Before Filing

- List Your Deductions: Note down all the tax-saving investments and expenses you've made

- Use a Tax Calculator: Compare your tax under both regimes

- Make a Smart Choice: Decide which regime suits you best and opt for it while filing

Final Thoughts

The government wants to make taxes simpler with the New Regime. For some, it's a welcome change. For others, especially those who've built their finances around deductions, it might mean paying more.

The key is to not assume the default is best. Take a few minutes to compare both options. The choice is yours and it could save you a lot of money.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles