Section 58 Tax Rules: How Digital Payments Can Lower Your Tax Rate

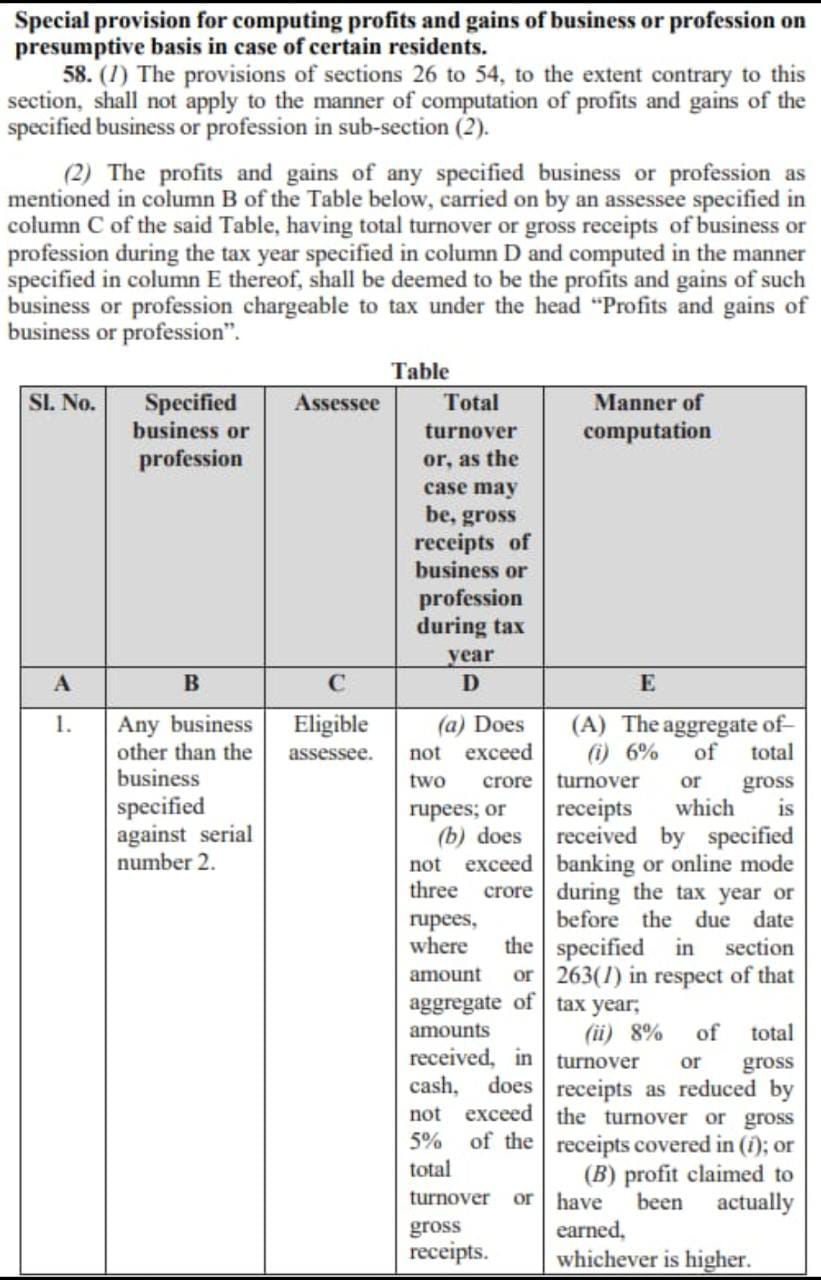

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

The government has relocated presumptive taxation provisions from the old Section 44AD to Section 58 in the new Income Tax Act, 2025. This affects how small businesses compute their taxable income.

Who Does This Affect?

Eligible Assessee: Any business (except those in serial number 2 of the table)

Turnover Limits:

- Up to ₹2 crore, OR

- Up to ₹3 crore (if cash receipts don't exceed 5% of total turnover)

How Tax is Computed

Under Section 58, businesses can choose the higher of:

Option A

- 6% of digital receipts (received via banking/online mode before due date), OR

- 8% of remaining turnover

Option B

- Actual profit earned

What This Means for You

- Simpler compliance - No need to maintain detailed books of accounts

- Lower tax burden - If you accept digital payments

- Quick calculation - Use presumptive rates instead of actual expense tracking

Action Required

Small business owners should:

- Review their turnover for eligibility

- Assess digital vs. cash transaction ratios

- Consult a tax professional to optimize under new provisions

- Update accounting systems to reflect Section 58

Important Note: Sections 26-54 don't apply to computation methods under this provision.

Stay compliant. Stay informed. Consult your tax advisor for personalized guidance.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles