Key Highlights of ITR Filing for AY 2025-26: India's Digital Tax Revolution

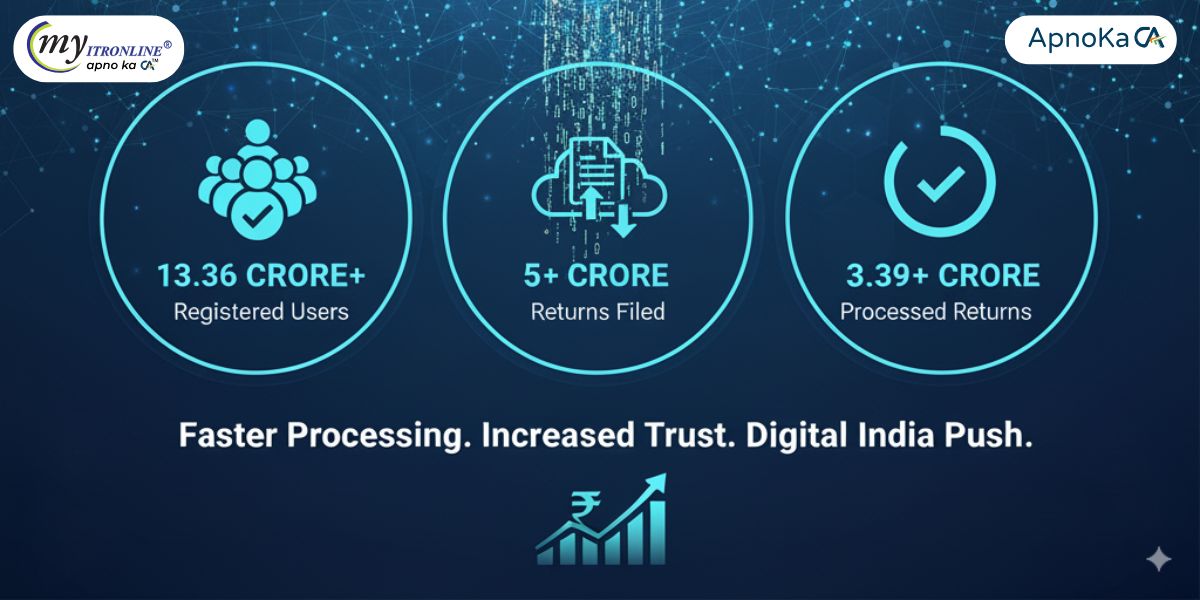

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

The Income Tax Department has been working steadily to make return filing easy and efficient for taxpayers across India. As the digital ecosystem grows, more people are using online filing platforms. The latest statistics, updated as of 8th September 2025, show a significant number of taxpayers participating in the ongoing filing season for Assessment Year (AY) 2025-26.

Let’s take a closer look at the numbers.

1. Over 13.36 Crore Registered Users

The e-filing portal has become the preferred platform for millions of taxpayers. With 13,36,26,282 registered users, the portal reaches a large majority of individual taxpayers, professionals, and businesses. This demonstrates the trust and growing digital adoption among taxpayers for income tax compliance.

2. More Than 5 Crore Returns Filed

So far, 5,00,09,951 returns have been filed for AY 2025-26. This indicates that taxpayers are becoming more proactive and meeting deadlines, which helps ensure smooth tax administration and avoids penalties.

3. Nearly 4.72 Crore Returns Verified

Filing is just the first step; verification is also crucial for processing returns. Out of the total filed returns, 4,72,36,099 have been successfully verified. This shows not only the efficiency of the verification system (through Aadhaar OTP, net banking, etc.) but also taxpayers’ awareness of its importance.

4. Over 3.39 Crore Returns Processed

Verification leads to the final step – processing returns. As of the latest update, 3,39,63,194 verified ITRs have already been processed. This results in faster refunds and quicker resolution of taxpayer compliance. The automation and AI-driven tools introduced by the Income Tax Department have noticeably reduced delays and improved transparency.

Why These Numbers Matter

- Increased Trust: The number of registered users indicates a growing confidence in the e-filing platform.

- Faster Processing: With over 3.39 crore returns processed, taxpayers are experiencing quicker outcomes.

- Digital India Push: These statistics reflect the success of India’s digital tax system, making compliance easier and more straightforward.

Looking Ahead

These statistics show that India’s tax administration is rapidly moving toward full digital transformation. With more users adopting online filing, quicker processing times, and better transparency, taxpayers can expect an even smoother experience in the coming years.

The Income Tax Department continues to support taxpayers through innovation, efficiency, and ease of compliance. They are truly “Success Enablers” in creating a strong and transparent tax system.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles