TDS vs. Advance Tax: Everything You Need to Know to Stay Tax-Compliant

This blog discusses the fundamental distinctions between TDS (Tax Deducted at Source) and Advance Tax, as well as their application, payment schedules, and penalties for late payments. It also offers specific advice for taxpayers to stay compliant and avoid fines. Whether you're a salaried employee, freelancer, business owner, or investor, this guide will help you understand which taxes apply to you and how to handle your tax payments efficiently.

.jpg )

Overview

A key component of financial planning is tax compliance, and knowing the distinction between advance tax and tax deduction at source (TDS) may help taxpayers avoid fines and make sure their tax payments go smoothly. Although they both aim to ensure timely tax collection, TDS and Advance Tax have different regulations, payment dates, and areas of application.

To assist you stay in compliance and prevent fines, this blog discusses the main distinctions between TDS and advance tax, as well as associated penalties and tax planning advice.

TDS: What is it?

Meaning

Tax is withheld at the time of payment to a recipient using a system known as TDS (Tax Deducted at Source). The deductor ensures tax collection at the source of revenue generating by depositing the money with the government.

Relevance of TDS

TDS is applied to a number of payments, including:

- Employer-paid salaries;

- Rent payments exceeding ₹50,000 per month;

- Interest received from recurring and fixed deposits;

- Commission and professional fees;

- Dividend income;

- Buying real estate for more than ₹50 lakh;

- Transactions involving cryptocurrency and digital assets.

Who Takes TDS Away?

TDS must be withheld by employers, banks, businesses, or people who make certain payments beyond the threshold limitations.

The beneficiary receives the deducted TDS when it has been deposited with the Income Tax Department. Form 16/16A

The beneficiary receives Form 16/16A as evidence of the deduction when the deducted TDS is submitted with the Income Tax Department.

TDS Payment Schedule

The deductor deposits TDS monthly after deducting it at the time of payment.

Depending on the form of payment, either Form 26Q or Form 24Q must be used for quarterly TDS returns.

During the filing of an Income Tax Return (ITR), TDS is deducted from the ultimate tax liability.

Late TDS Payment Penalties

- 1.5% monthly interest is charged for late deposits of TDS that has been withheld.

- Late TDS return submission carries a penalty of ₹200 per day.

- Prosecution for deliberate default, which carries penalties including fines and jail time.

Advance tax: what is it?

Meaning

Advance Tax is a tax payment scheme in which taxpayers pay tax in installments throughout the fiscal year rather than in one flat sum at year-end. This occurs if the overall tax liability exceeds ₹10,000 in a fiscal year.

Who Needs to Pay Advance Taxes?

- Self-employed professionals and freelancers;

- Business owners (proprietors, partnership firms, LLPs);

- Salaried workers (with extra income from rent, capital gains, or business revenue);

- Investors and traders (stock market, cryptocurrency, mutual funds, real estate, etc.).

Advanced Tax Payment Schedule (FY 2024-25)

| Due Date | % of tax payable |

|---|---|

| 15th June 2024 | 15% of projected tax obligation. |

| 15th September 2024 | 45% of projected tax obligation. |

| 15th December 2024 | 75% of the projected tax obligation. |

| 15th March 2025 | 100% of the projected tax obligation. |

How Do I Calculate Advance Tax?

- Estimate the total yearly revenue from all sources.

- Deduct any relevant exclusions and deductions (under provisions such as 80C, 80D, etc.).

- Calculate your total tax due using the income tax slab.

- If the ultimate tax amount exceeds ₹10,000, pay it in installments.

Penalties for late advance tax payments.

- Late or nonpayment incurs a monthly interest rate of 1% (under Sections 234B and 234C).

- If Advance Tax is not paid on time, the tax burden at the end of the year will increase.

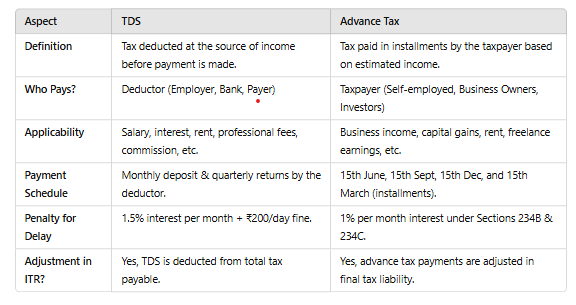

Key Differences Between TDS and Advance Tax:

TDS vs. Advance Tax: Which One Applies to You?

For Salaried Individuals

- TDS applies automatically, deducted by the employer.

- If you have additional income (rent, capital gains, business), Advance Tax is required.

For Business Owners & Freelancers

- No TDS is deducted on business/freelance income.

- Must calculate and pay Advance Tax quarterly to avoid penalties.

For Investors & Traders

- TDS is levied on fixed deposit interest, dividends, and property transactions.

- Advance tax is levied on capital gains from stock market, cryptocurrency, mutual fund, and property transactions.

For High Net-Worth Individuals (HNIs)

- TDS is deducted on several sources of income.

- If a person's ultimate tax due exceeds ₹10,000, they must pay advance tax.

How do you ensure compliance?

- Check Forms 26AS and AIS on a regular basis to keep track of TDS deductions.

- Pay the Advance Tax on time to avoid fines.

- To claim TDS refunds or amend tax liability, ensure that you file your ITR appropriately.

- Use the Income Tax e-filing system for quick payments and tracking.

- Consult a tax professional to optimize deductions and tax planning.

Conclusion

TDS and Advance Tax are critical components of India's tax system, facilitating efficient tax collection and avoiding evasion. While TDS is deducted at the source of income, taxpayers pay Advance Tax based on their expected profits.

Understanding which taxes apply to you and paying your dues on time may help you avoid interest, penalties, and the tax burden at the end of the year. If you need help with tax filing, myITRonline offers expert advice to help you stay compliant and maximize tax savings.

Use myITRonline to easily file your ITR and meet tax deadlines!

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles