Income Tax Rectification Under Section 154: What You Need to Know

Section 154 of the Income Tax Act allows taxpayers to correct obvious errors in their tax assessments. This blog outlines common mistakes like TDS mismatches, incorrect tax calculations, and personal detail errors, and explains how to file a rectification request online. A must-read for salaried individuals, freelancers, and business owners.

Ever filed your income tax return and later spotted a mistake? Maybe a wrong PAN, a missed deduction, or a mismatch in TDS? Don’t worry you’re not alone. The good news is that the Income Tax Department gives you a second chance to fix certain errors through Section 154 of the Income Tax Act, known as the Rectification of Mistake provision.

Let’s break it down in plain English.

What is Section 154?

Section 154 allows taxpayers or the Income Tax Department to correct “mistakes apparent from the record” in an order passed under the Income Tax Act. These are not complex disputes, but obvious errors that can be spotted without deep investigation.

Think of it as a quick fix for genuine goof-ups.

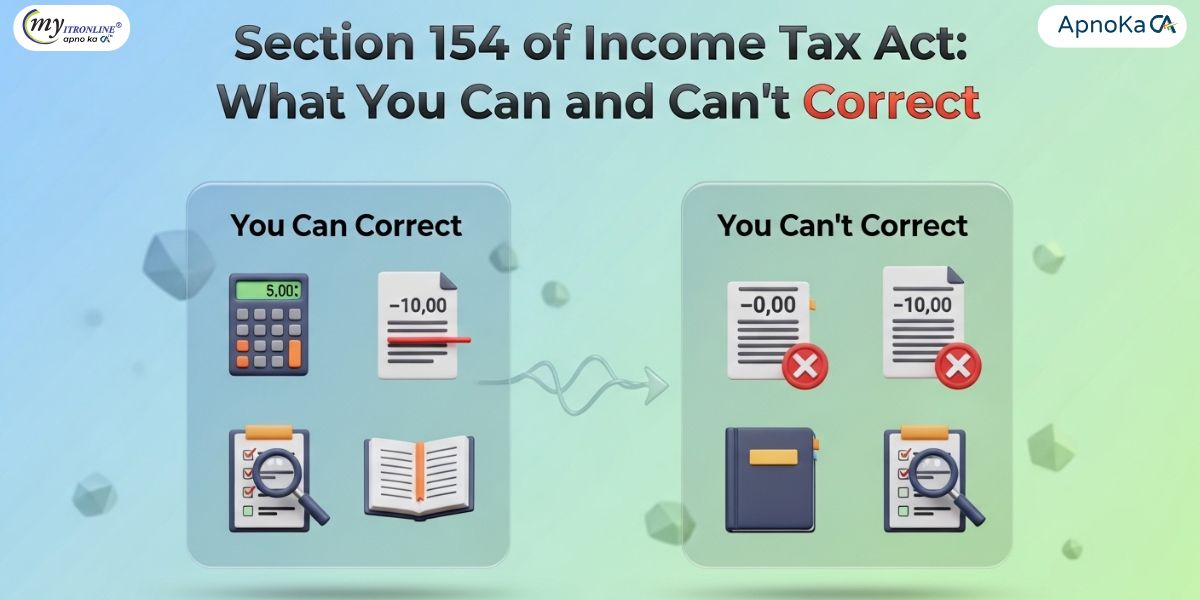

Common Errors You Can Rectify Under Section 154

Here are some typical mistakes that can be corrected through a rectification request:

1. TDS Mismatch

If your Form 26AS shows more TDS than what’s considered in your assessment, you can file a rectification to claim the correct credit.

Example: Your employer deducted ₹50,000 TDS, but the CPC considered only ₹30,000. You can request rectification to claim the full ₹50,000.

2. Incorrect Tax Computation

Sometimes, the system miscalculates tax due to wrong inputs or missed deductions.

Example: You claimed ₹1.5 lakh under Section 80C, but the system ignored it. Rectification can fix this.

3. Wrong Personal Details

Errors in PAN, name, address, or bank details can be corrected.

Example: Your refund got delayed because of a wrong bank account number. Rectify it and get your money faster.

4. Arithmetical Mistakes

Simple calculation errors in tax, interest, or penalty amounts.

Example: Interest under Section 234B was wrongly calculated. You can file for correction.

5. Disallowance of Deduction Already Allowed

If a deduction was allowed in the original order but later disallowed due to a system error, you can rectify it.

Example: HRA deduction was accepted initially but removed in the final intimation. Rectification can restore it.

6. Double Taxation

Income taxed twice due to duplication or system glitch.

Example: Same salary income considered under two employers. You can request correction.

How to File a Rectification Request

You can file it online through the Income Tax e-filing portal:

- Log in to your account.

- Go to “Services” → “Rectification.”

- Select the relevant assessment year.

- Choose the type of rectification (e.g., Tax Credit Mismatch, Return Data Correction).

- Submit supporting documents if needed.

Time Limit: You must file the rectification within 4 years from the end of the financial year in which the order was passed.

What You Can’t Rectify

Section 154 is not for disputes or fresh claims. You can’t use it to:

- Claim new deductions not mentioned in the original return.

- Challenge legal interpretations.

- File revised returns (use Section 139(5) for that).

Final Thoughts

Mistakes happen—even in tax filings. But Section 154 gives you a fair shot to fix them without legal battles or lengthy procedures. Whether you're a salaried employee, freelancer, or business owner, knowing your rights under this section can save you time, stress, and money.

If you’ve received an intimation under Section 143(1) and something looks off don’t panic. Just check the details and file a rectification if needed.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles