Common Sense Relief for Taxpayers: Why Section 139(1) Due Dates Need an Extension

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

As the deadline for filing income tax returns looms, many professionals, small businesses, and chartered accountants are facing a familiar frustration: the tools aren’t ready, the portal isn’t stable, and compliance feels more like a race against time than a fair process.

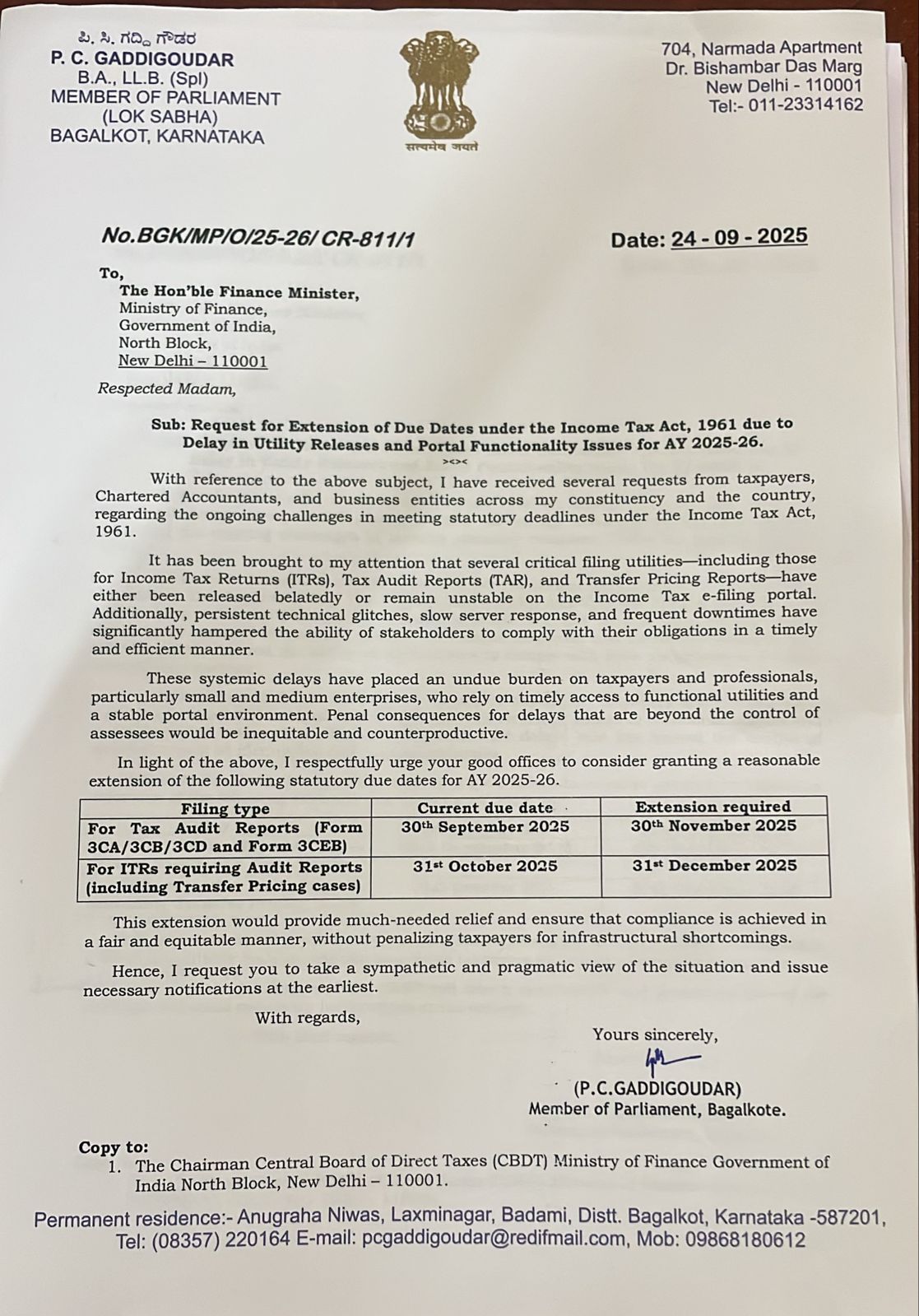

On 24th September 2025, Member of Parliament P.C. Gaddigoudar stepped in on behalf of taxpayers and wrote to the Hon’ble Finance Minister, requesting a much-needed extension of due dates under the Income Tax Act, 1961 for Assessment Year 2025–26. His letter is more than a formality—it’s a reflection of the ground realities many of us are dealing with.

What’s the Issue?

Despite best efforts, the Income Tax portal continues to face technical glitches. Utility forms for filing returns and audit reports have been released late, leaving professionals scrambling to meet deadlines. The result? Stress, errors, and a growing sense that compliance is being compromised—not by taxpayers, but by the system itself.

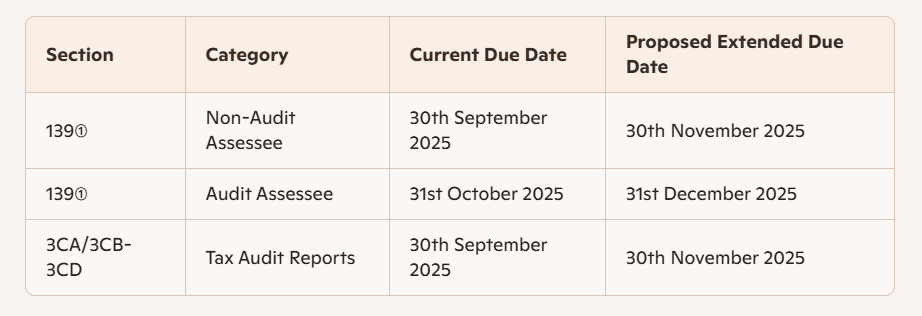

What’s Being Requested?

The MP’s letter proposes a practical extension of key due dates to give taxpayers breathing room and ensure fair compliance. Here's a snapshot of the current vs proposed deadlines:

Why It Matters

For many taxpayers, especially those in Tier 2 and Tier 3 cities, digital infrastructure isn’t always reliable. Add to that the late release of filing utilities and portal errors, and you have a recipe for rushed filings and potential penalties.

Extending the due dates isn’t just a technical adjustment—it’s a gesture of trust and fairness. It acknowledges that compliance should be collaborative, not punitive.

Final Thoughts

Tax compliance is a shared responsibility between citizens and the government. But when the tools to comply aren’t ready, it’s only fair to extend the timeline. The request made by MP P.C. Gaddigoudar is a timely reminder that policy must reflect reality.

Let’s hope the Finance Ministry listens not just to the letter, but to the voices behind it.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles