New ITR Forms Coming for AY 2026–27: What Taxpayers Should Know

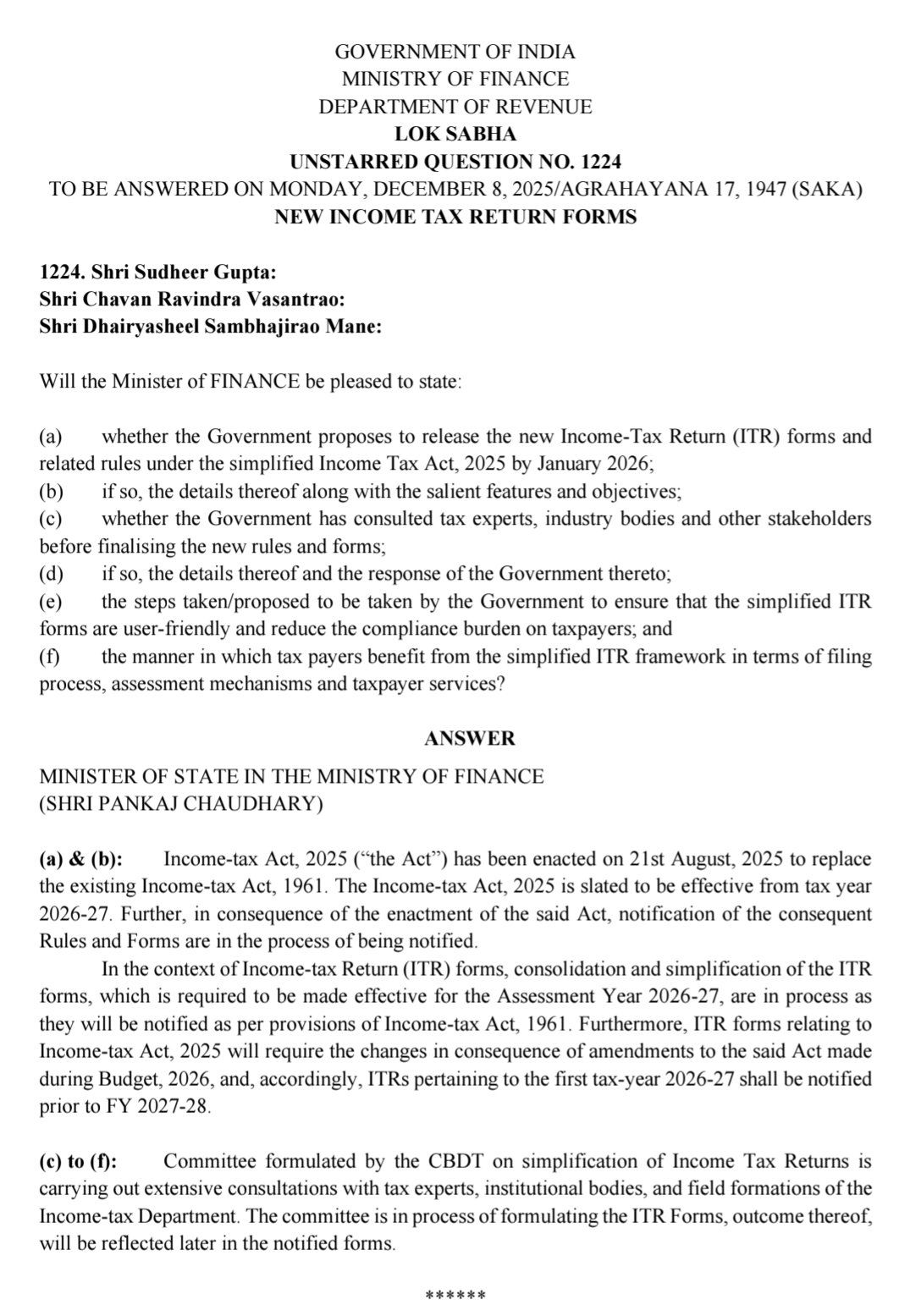

The Government will soon release simplified ITR forms for AY 2026–27, aligned with the new Income-tax Act, 2025. These updated forms aim to make filing easier, reduce compliance burden, and reflect changes expected in Budget 2026. Here’s a quick, clear overview for taxpayers.

The Government will introduce simplified Income Tax Return (ITR) forms for Assessment Year 2026–27 that align with the Income-tax Act, 2025 and Budget 2026 changes. Here’s a short, easy summary for taxpayers.

Why are new ITR forms needed?

The Income-tax Act, 2025 becomes effective from FY 2026–27. To match the new law and any Budget 2026 updates, ITR forms must be revised so taxpayers file under the correct rules.

When will they be released?

The Government has stated the ITR forms for FY 2026–27 will be notified before FY 2027–28 begins. Work to consolidate and simplify the forms is already underway.

Who is preparing the forms?

A committee formed by the Central Board of Direct Taxes (CBDT) is:

- Consulting tax experts and industry groups

- Working with Income Tax Department teams

- Designing forms to reduce filing difficulty

The final notified forms will reflect these consultations.

What taxpayers can expect

- Simpler and clearer filing process

- Consolidated forms with fewer sections

- Instructions aligned with the new tax law

The goal is to reduce compliance burden and make filing smoother from FY 2026–27 onward.

Note: If you need help preparing for the new forms or understanding how Budget 2026 changes affect you,Myitronline can assist with step-by-step filing support.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles