Slab Rates for Income Tax in FY 2024–2025 and AY 2025–2026

The blog discusses the changes in income tax slab rates for FY 2024-25 and AY 2025-26, including the increase in the basic exemption limit, revision of slab rates, and increase in the standard deduction. The implications of these changes, including tax savings, simplified tax structure, and increased disposable income, are also discussed.

Overview

The income tax slab rates for the fiscal year 2024–2025 and the assessment year 2025–2026 have undergone substantial modifications as a result of the Union Budget 2024. The goals of these adjustments are to simplify the tax code and offer relief to taxpayers. We will talk about the ramifications of the slab rate changes as well as how they will impact individual taxpayers in this blog.

Variations in Slab Prices

The slab rates for FY 2024–25 and AY 2025–26 have changed significantly under the new tax framework that was unveiled in Budget 2020. The following are the updated slab rates:

FY 2023–2024 Tax Slab

| Tax Slab | Tax Rate |

|---|---|

| Upto ₹ 3 lakh | Nil |

| ₹ 3 lakh - ₹ 6 lakh | 5% |

| ₹ 6 lakh - ₹ 9 lakh | 10% |

| ₹ 9 lakh - ₹ 12 lakh | 15% |

| ₹ 12 lakh - ₹ 15 lakh | 20% |

| More than ₹ 15 lakh | 30% |

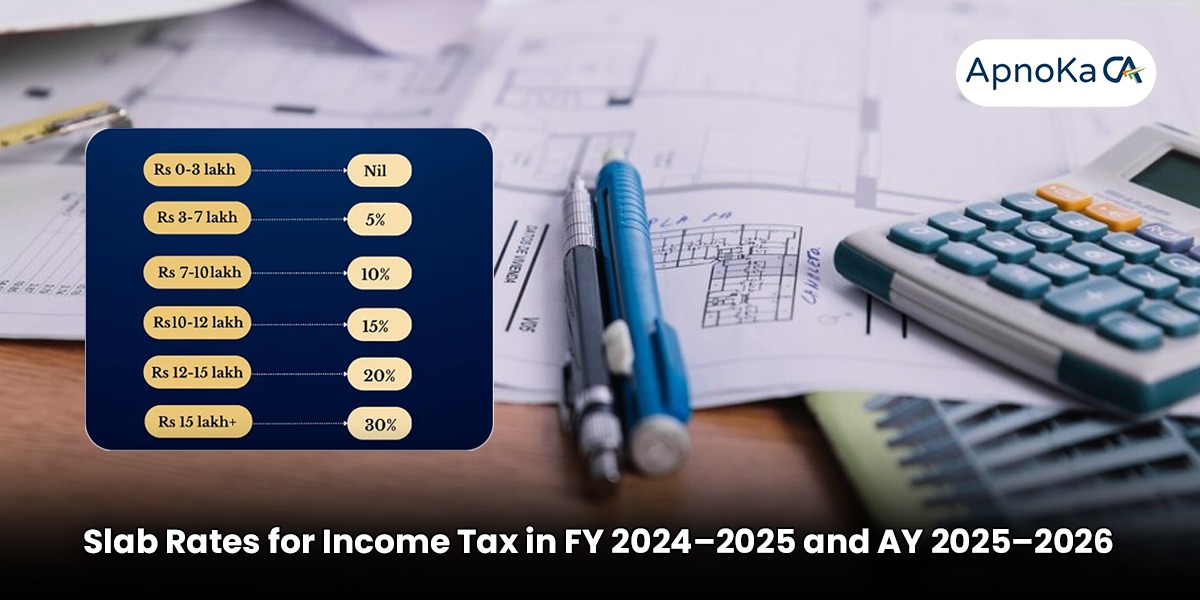

Tax Slab for FY 2024-25

| Tax Slab | Tax Rate |

|---|---|

| Upto ₹ 3 lakh | Nil |

| ₹ 3 lakh - ₹ 7 lakh | 5% |

| ₹ 7 lakh - ₹ 10 lakh | 10% |

| ₹ 10 lakh - ₹ 12 lakh | 15% |

| ₹ 12 lakh - ₹ 15 lakh | 20% |

| More than ₹ 15 lakh | 30% |

Important Modifications

These are the main modifications to the slab rates:

- Raising the basic exemption threshold: A ₹ 3 lakh threshold now replaces the previous ₹ 2.5 lakh threshold.

- Modification of slab rates: In order to give taxpayers more assistance, the slab rates have been modified. For income between ₹ 3 lakh and ₹ 7 lakh, the tax rate has been lowered from 10% to 5%.

- Raising the standard deduction: A ₹ 75,000 increase has been made to the standard deduction, which was formerly ₹ 50,000.

- Family pension deduction: A ₹ 25,000 increase was made to the ₹ 15,000 family pension deduction.

Consequences of the Adjustments

The following effects of the slab rate modifications will be felt:

- Tax savings: The higher standard deduction and lower tax rates will help taxpayers, which will save them money on taxes.

- Simplified tax structure: Both the tax structure and the complexity of tax calculations will be made simpler by the updated slab rates.

- Enhanced disposable income: The tax savings will lead to a rise in disposable income, which will stimulate demand and economic expansion.

In Summary

For taxpayers, the modifications to the slab rates for FY 2024–25 and AY 2025–26 are a good development. Taxpayers will receive relief from the reduced slab rates, which will also simplify the tax code and raise discretionary income. It is imperative that individuals comprehend the modifications and adjust their tax strategies properly.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles