Understanding Section 115BAC: Exemptions & Deductions Not Allowed Under the New Tax Regime

Section 115BAC introduces a simplified tax structure with reduced slab rates, but at the cost of foregoing key exemptions and deductions. Effective from AY 2024–25 as the default regime, this blog explains the revised tax slabs, outlines the benefits that are no longer available, and guides taxpayers on choosing between the new and old regimes based on their financial profile and investment habits.

The Optional Tax Regime under Section 115BAC offers lower tax rates but removes most exemptions and deductions. From AY 2024–25, it is the default regime. This blog explains the new tax slabs, exemptions not allowed, who should opt for it, and a comparison with the old regime.

Introduction

Taxes can feel complicated. To make things simpler, the Government introduced the Optional Tax Regime under Section 115BAC. This regime offers lower tax rates, but there’s a catch—you have to give up most of the popular exemptions and deductions.

From AY 2024–25, this new regime is the default option. But you can still choose the old regime if it saves you more tax.

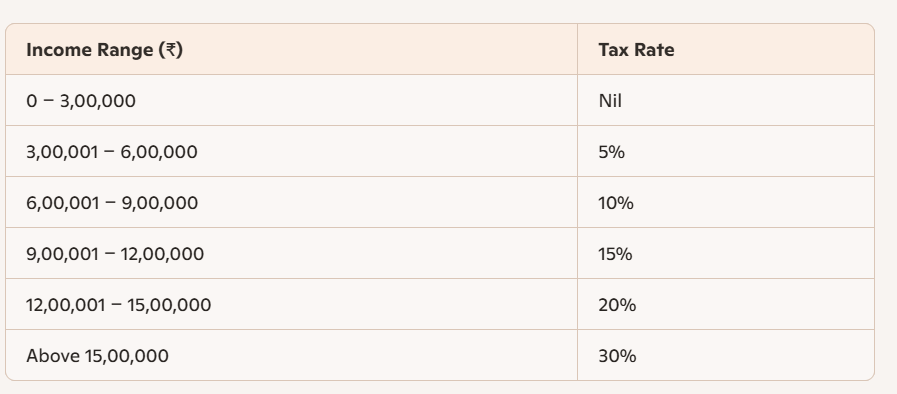

New Tax Slabs under Section 115BAC

Here’s how the new regime looks after Budget 2023:

Note: If your income is up to ₹7,00,000, you get a rebate u/s 87A, meaning zero tax under the new regime.

Exemptions & Deductions Not Allowed

Here’s what you cannot claim if you choose the new regime:

1. Salary-related benefits

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Children Education/Hostel Allowance

- Professional Tax deduction

2. Housing benefits

- Interest on home loan for self-occupied property (u/s 24(b))

- Extra deduction for affordable housing loan (u/s 80EEA)

3. Popular Chapter VI-A deductions

- Section 80C (LIC, PPF, ELSS, PF, tuition fees, etc.)

- Section 80D (Medical insurance premium)

- Section 80E (Education loan interest)

- Section 80G (Donations)

- Section 80TTA/80TTB (Savings/FD interest)

4. Other disallowed benefits

- Set-off of housing loan loss against other income

- Additional depreciation on plant & machinery

Still Allowed:

- Employer’s contribution to NPS (u/s 80CCD(2))

- Deduction for Agniveer Corpus Fund (u/s 80CCH(2))

- Deduction for new employees (u/s 80JJAA, for businesses)

- Standard Deduction of ₹50,000 (reintroduced from AY 2024–25)

Who Should Choose the New Regime?

The new regime is better for:

- Young professionals with fewer investments.

- Salaried individuals living in their own house (not claiming HRA or housing loan interest).

- People with income up to ₹7,00,000 (thanks to rebate).

But if you have housing loans, HRA, or big 80C/80D investments, the old regime may save you more tax.

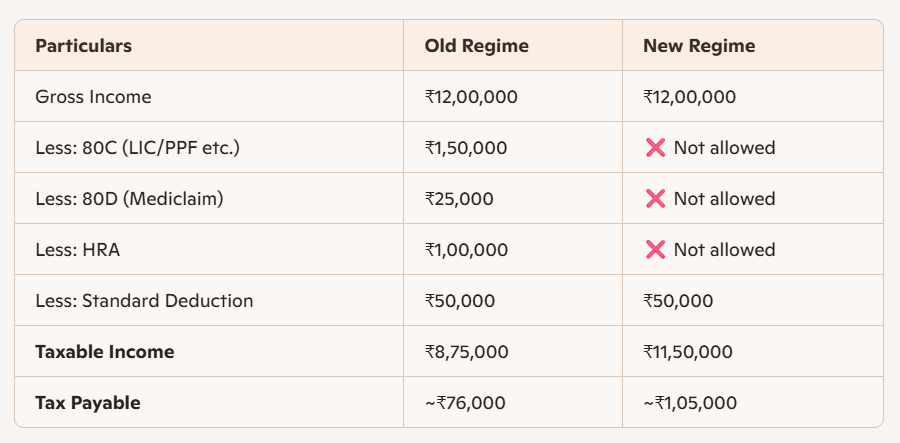

Example Comparison

Let’s say your annual salary = ₹12,00,000

In this case, the old regime is better. But if you had no deductions, the new regime wins.

Conclusion

Section 115BAC is all about simplicity vs. savings.

- If you don’t invest much in tax-saving instruments → the New Regime is easier and cheaper.

- If you actively use deductions like 80C, 80D, HRA, or home loan benefits → the Old Regime is smarter.

Pro Tip: Always compare both regimes before filing your ITR. A quick calculation can save you thousands.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles