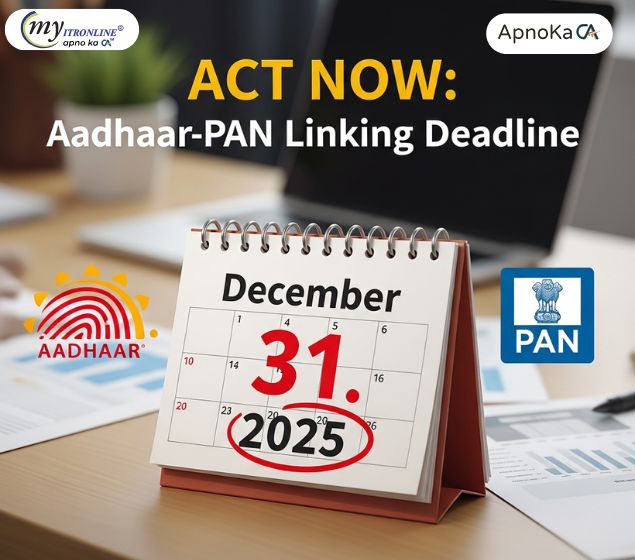

CBDT Mandate: Aadhaar-PAN Link for Specific Holders Due Dec 31, 2025

Link your PAN with Aadhaar by December 31, 2025. If you miss the date, PAN goes inoperative from January 1, 2026, stopping ITR filing and blocking refunds. Pay 1,000 on the e-Filing portal and link now. Some groups are exempt.

The Income Tax Department has set December 31, 2025 as the deadline to link your PAN with Aadhaar. If you miss it, your PAN will become inoperative from January 1, 2026, freezing many financial activities.

What happens if PAN becomes inoperative

- No ITR filing: You cannot file or verify your tax returns.

- Higher TDS/TCS: Taxes will be deducted at higher rates, reducing your income and returns.

- Refunds blocked: Pending tax refunds will not be processed.

- Financial limits: Issues with bank accounts, mutual funds, property deals, and KYC updates.

- Form rejection: Forms like 15G/15H for lower TDS will not be accepted.

How to link Aadhaar-PAN

- Pay fee: Pay ₹1,000 via the e-Pay Tax service.

- Link online: Use the “Link Aadhaar” option on the Income Tax e-Filing Portal.

If your PAN becomes inoperative, you can reactivate it by paying the fee and linking Aadhaar. Reactivation may take up to 30 days.

Who is exempt

- Citizens aged 80 years or above

- Non-Resident Indians (NRIs)

- Foreign nationals

- Residents of Assam, Meghalaya, and Jammu & Kashmir

Final reminder

Do not wait until the last minute. Complete the linking now to avoid a financial freeze and compliance issues in 2026.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)