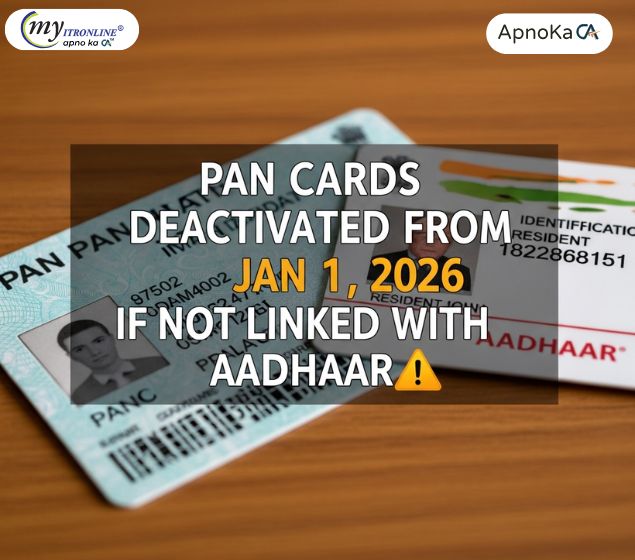

Deadline Relief: PAN-Aadhaar Linkage Extended for TDS/TCS Deductors Until May 31st, 2024

Good news for TDS/TCS deductors! The deadline for linking PAN with Aadhaar has been extended until May 31st, 2024. This extension provides relief and ensures compliance with tax regulations. Stay informed and avoid penalties by understanding the implications of this extended deadline

.jpg )

Relief for Tax Deductions! PAN-Aadhaar Linkage Deadline Extended till May 31st, 2024

Attention all taxpayers and TDS/TCS deductors!

There's some good news on the tax front. The government has announced an extension for linking your PAN with Aadhaar. This is a welcome relief for those who might not have been able to meet the earlier deadline.

What's the Update?

The deadline for linking your PAN with Aadhaar has been officially extended to May 31st, 2024. This applies specifically to TDS/TCS deductors.

Here's a quick explanation of these terms:

- TDS (Tax Deducted at Source): This is when a tax is deducted on certain payments you receive, like your salary or interest income. The deductor (usually your employer or bank) then deposits this tax to the government on your behalf.

- TCS (Tax Collected at Source): This is similar to TDS, but it applies to specific transactions like buying property or selling shares. The collector (typically the seller or broker) deducts the tax at source and deposits it to the government.

What This Means for You

Taxpayers: If you haven't linked your PAN with Aadhaar yet, you now have more time to get it done. This will avoid any complications while filing your tax returns or claiming refunds in the future.

TDS/TCS Deductors: This extension provides some breathing room to ensure PAN-Aadhaar linkage for the taxpayers you deduct/collect tax from. This helps you avoid potential penalties for non-compliance due to unlinked PANs.

Why Link Your PAN with Aadhaar?

While the deadline has been extended, it's still important to get your PAN linked with Aadhaar eventually. Here's why:

- Smooth Tax Filing: A linked PAN-Aadhaar helps streamline the tax filing process and reduces the chances of errors.

- Faster Refunds: Processing of tax refunds becomes quicker when your PAN is Aadhaar-linked.

- Reduced Paperwork: Aadhaar verification eliminates the need for submitting physical documents in many cases.

How to Link Your PAN with Aadhaar?

The Income Tax Department website provides resources and instructions for PAN-Aadhaar linkage. Here are the general steps:

- Visit the Income Tax Department's official website (https://www.incometax.gov.in/iec/foportal/).

- Go to the "Quick Links" section and click on "PAN - Aadhaar Linking."

- Enter your PAN details and Aadhaar number.

- Verify the details and submit the request.

Remember, this extension is a great opportunity to get things in order. Take advantage of the extra time and link your PAN with Aadhaar for a smoother tax experience!

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)