Linking PAN with Aadhaar Online - A Step-by-Step Process

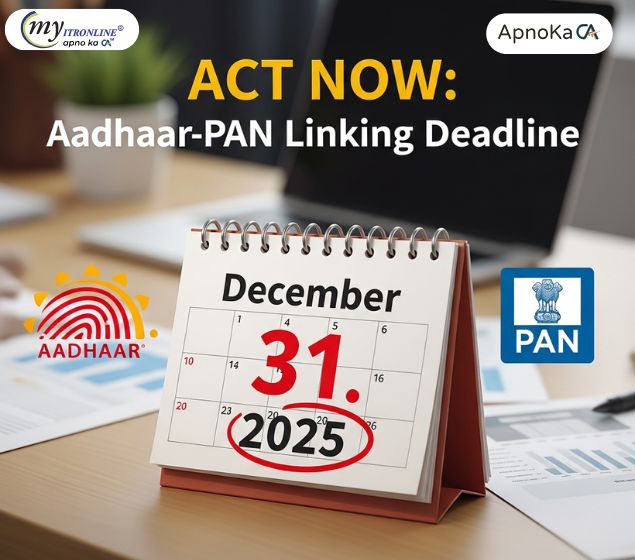

Linking your PAN with Aadhaar online is a crucial step in ensuring seamless financial transactions and tax compliance.

Linking PAN with Aadhaar Online - A Step-by-Step Process

Linking your PAN with Aadhaar online is a crucial step in ensuring seamless financial transactions and tax compliance. The process involves visiting the official Income Tax Department website, creating a user ID using your PAN and Aadhaar numbers, and completing the linking process through a secure login.

Additionally, we'll explore an alternative method via SMS for convenient PAN-Aadhaar linkage. This blog aims to provide a clear and concise overview of the online procedure, empowering individuals to align their PAN and Aadhaar details accurately.

1. Visit the official website of the Income Tax Department: [Income Tax Department](https://eportal.incometax.gov.in/iec/foservices/#/login).

2. Log in with your credentials.

3. Your PAN and Aadhaar numbers will be used to create a user ID.

4. After registration, log in with your user ID, password, and date of birth.

5. A notification about linking PAN with Aadhaar will be displayed.

6. If not, go to 'Quick Links' and select 'Link Aadhaar.'

7. Enter your Aadhaar number, PAN number, and name as per your PAN card. Optionally, select the checkbox if you only have the year of birth in your Aadhaar.

8. Enter the Captcha code for verification. Upon successful verification, a confirmation notification will be displayed.

How to Link PAN With Aadhaar Via SMS?

1. Type your message in UIDPAN format: (UID PAN <Aadhaar number> <PAN number>).

2. Send the SMS from your registered number to 567678 or 56161.

3. Receive a confirmation message about PAN and Aadhaar linking.

Benefits of Linking PAN With Aadhaar:

1. Easy ITR Filing: Simplifies the online income tax return filing process.

2. Preventing Tax Evasion: Averts tax evasion by ensuring individuals use a single PAN.

3. Facilitating KYC: Eases KYC processes for bank accounts, loans, and financial services.

4. Quick Processing of Refunds: Speeds up the processing of income tax refunds.

Note: Ensure accurate details during the linking process, as a spelling mismatch may hinder Aadhaar-PAN linkage.

How to Correct Spelling Mistakes in PAN Card?

1. Visit the NSDL e-filing website.

2. Select 'Changes or Correction in existing PAN data' and proceed.

3. After Aadhaar e-KYC, pay the necessary fee and submit the form online.

4. Once corrections are made, the revised PAN will be delivered to your address.

Alternatively,

1. Visit an Aadhaar Enrollment Center.

2. Fill out the Aadhaar Enrollment Form and submit it with the required documents.

3. Receive an acknowledgment slip with an update request number (URN).

4. Check the status using URN.

5. After corrections, proceed to link PAN with Aadhaar.

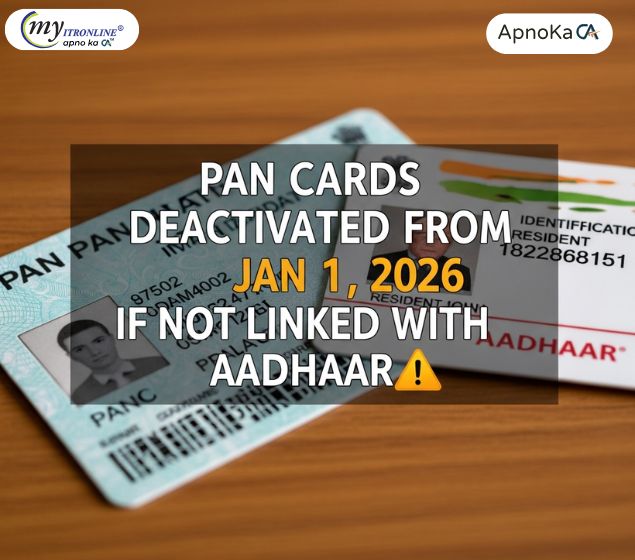

Also Read: Important Update for PAN Card Holders: Income Tax Department May Impose Rs 10,000 Fine Check Details

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)