Important Update for PAN Card Holders: Income Tax Department May Impose Rs 10,000 Fine Check Details

If someone holds two PAN cards, s/he may have to pay a fine for this, and the income tax department has the right to cancel the individual’s PAN as per the law.

Important Update for PAN Card Holders: Income Tax Department May Impose Rs 10,000 Fine – Check Details

Attention PAN Card Holders: Ensure You Have Only One PAN Card. Individuals must possess only one PAN card, as having two PAN cards is not permissible. PAN (Permanent Account Number) is vital for various financial transactions. While it is essential for numerous activities, carrying it comes with certain risks, such as the possibility of loss or misuse if it falls into the wrong hands.

The PAN card plays a crucial role in enabling the Income Tax authority to monitor financial transactions, aiding in assessing tax liabilities for individuals and companies. This, in turn, helps minimize the potential for tax evasion.

Despite its importance, individuals need to exercise caution. A minor oversight in adhering to PAN card regulations may result in a fine of Rs 10,000.

What if someone holds two PAN cards?

If someone holds two PAN cards, s/he may have to pay a fine for this, and the income tax department has the right to cancel the individual’s PAN as per the law. Moreover, the individual also may face some punishment or penalty if levied.

However, if there is any false information found in your PAN, then your bank account can be frozen by the authorities. If you furnish incorrect details of your PAN then the penalty of Rs. 10,000 can be levied on you. Therefore, we advise you that if you possess two PANs, return it to the department as soon as possible.

How to File a PAN Card Return and Check Aadhaar Linking Status?

To file a PAN card return or make corrections, follow these simple steps:

1. Go to the official website of the incometaxindia.gov.in.

2. Click on either 'Request for new PAN card/change' or 'Correction PAN data.'

3. Download the form, fill it out, and submit it at any National Securities Depository Limited (NSDL) office.

To check if your Aadhaar is linked to your PAN card, follow these steps:

1. Visit the Income Tax e-filing portal and click on 'Link Aadhaar Status' under the quick links on the homepage.

2. Enter your PAN and Aadhaar number, then click 'View Link Aadhaar Status.'

In case you PAN is not linked with your Aadhaar, a pop will be displayed showing Your PAN is not linked with Aadhaar. Follow the provided steps to link them seamlessly. Stay informed and ensure your details are up to date.

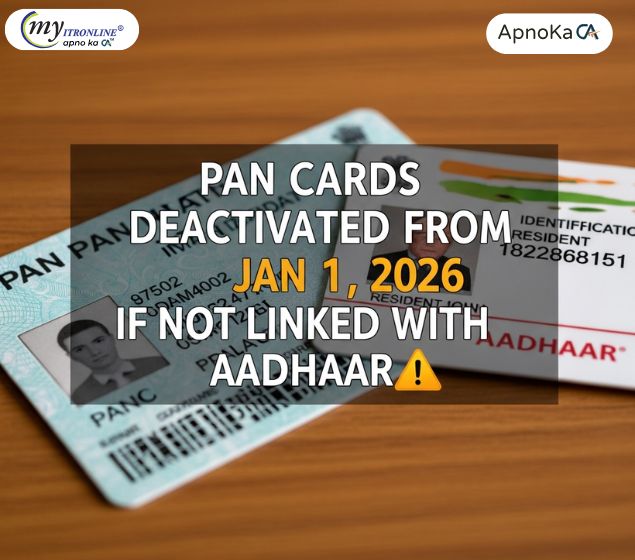

What can be the outcome of not linking PAN with Aadhaar?

Failure to link PAN with Aadhaar by the specified deadline renders the PAN card inoperative, leading to several consequences:

1. Taxpayers cannot file or claim Income Tax Returns (ITR) with an inoperative PAN.

2. Pending returns will not be processed, and refunds will not be issued for inoperative PANs.

3. TCS/TDS may be applicable at a higher rate.

4. TCS/TDS credits won't appear in Form 26AS, and related certificates will be unavailable.

5. Submission of 15G/15H declarations for nil TDS becomes impossible.

Inoperative PANs restrict various transactions, including:

1. Opening a bank account.

2. Issuing debit/credit cards.

3. Purchasing mutual funds units.

4. Depositing cash exceeding Rs.50,000 in a bank or post office per day.

5. Purchasing a bank draft or pay order in cash exceeding Rs.50,000 in a day.

6. Making time deposits exceeding Rs.50,000 or aggregating over Rs.2,50,000 in a financial year.

7. Making payments for prepaid payment instruments exceeding Rs.50,000 in a financial year.

8. Engaging in the sale or purchase of goods or services exceeding Rs.2,00,000 per transaction.

9. Conducting bank transactions exceeding Rs.10,000.

However, individuals can make their PAN operative again within 30 days by providing their Aadhaar number to the prescribed authority after paying a fee of Rs.1,000.

Also Read: Security Flaw in MCA Portal Exposed Aadhaar-Based KYC Information of India’s Leading Industrialists

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)