Income Tax Return 2025-26: ITR-1 and ITR-4 Offline Utilities Released, File Easily!

The Income Tax Department has released offline utilities for ITR-1 and ITR-4 for Assessment Year 2025-26. This blog post explains what these utilities are, how to download and use them, and highlights the important changes in this year's ITR filing. Start your ITR filing preparation now! Contact MyITROnline for expert assistance.

The time to file Income Tax Returns (ITR) is steadily approaching, and this year kicks off with a significant announcement. The Income Tax Department has released the **Offline Utilities for ITR-1 (Sahaj) and ITR-4 (Sugam) for Assessment Year (AY) 2025-26.** This is welcome news for millions of taxpayers preparing to declare their income.

This blog post will cover all the essential information you need to know about this update, including what these utilities are, how you can use them, and the key changes introduced in this year's ITR filing process.

What are These Offline Utilities?

Offline Utilities are software tools provided by the Income Tax Department. They allow you to prepare your Income Tax Return directly on your computer without needing to be constantly online on the e-filing portal. You can download these utilities and input your income, deductions, and other details offline. Once you have filled in all the information and validated it, you generate a JSON file. This JSON file can then be uploaded to the Income Tax Department's e-filing portal.

These utilities are incredibly useful for taxpayers who may not always have a stable internet connection or prefer to fill out their information offline.

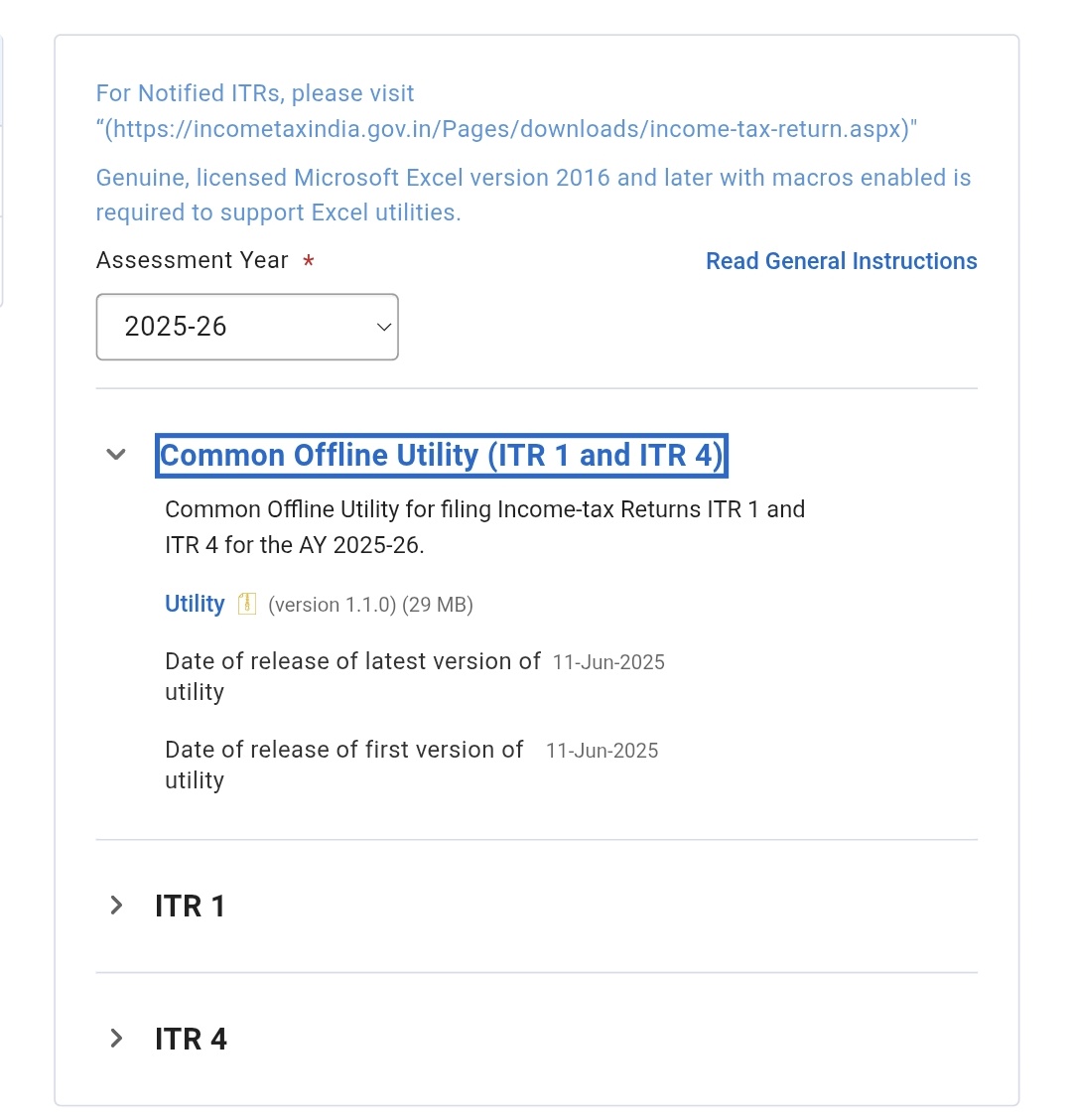

(Image: Showing the availability of Offline Utility on the Income Tax Department's portal)

Who Can File ITR-1 (Sahaj) and ITR-4 (Sugam)?

ITR-1 (Sahaj): This is the simplest ITR form and is for resident individuals (not Not Ordinarily Resident) whose total income is up to ₹50 lakh. It includes income from salary, one house property, other sources (like interest), and agricultural income up to ₹5,000. **New for this year:** Long-Term Capital Gains (LTCG) up to ₹1.25 lakh can now be reported in ITR-1, which previously required ITR-2.

ITR-4 (Sugam): This form is for resident individuals, HUFs, and firms (other than LLPs) whose total income is up to ₹50 lakh and whose income from business or profession is computed under the presumptive taxation scheme (under sections 44AD, 44ADA, or 44AE). It can also include income from one house property and other sources. Similar to ITR-1, LTCG up to ₹1.25 lakh can also be included here.

Important Note: If your income sources are more complex (e.g., foreign income, being a director in a company, or holding unlisted equity shares), you may need to use other forms like ITR-2 or ITR-3. Always ensure you select the correct ITR form based on your income and sources.

Why Do You Need These Utilities?

- Convenience: You can prepare your ITR at your convenience, even without an internet connection.

- Reduced Errors: These utilities have built-in validation that helps reduce errors while entering data.

- Data Security: Your financial data remains on your computer until you choose to upload it.

- Time-Saving: Once the online filing option is active, you can quickly upload your pre-prepared JSON file, avoiding last-minute rush.

How to Download and Use Offline Utilities?

- Visit the Income Tax Department Website: Go to incometax.gov.in.

- Navigate to 'Downloads' Section: Here you will find options for 'ITR Forms' or 'Common Offline Utility (ITR 1 to ITR 4)'.

- Select the Correct Assessment Year: Choose Assessment Year 2025-26 (Financial Year 2024-25).

- Download the Utility: Download the relevant utility for ITR-1 or ITR-4 (usually Excel or JSON-based).

- Install and Fill Data: Unzip the downloaded file and install the utility. Now you can fill in all your income, deductions, and tax payment details. You can also import your pre-filled data (like from Form 26AS or AIS/TIS) for ease of filling.

- Validate and Generate JSON: After filling the form, use the 'Validate' button provided in the utility to verify your entered information. If there are any errors, the utility will highlight them. Once everything is correct, you can generate the JSON file by clicking on the 'Generate JSON' option.

- File: This JSON file can later be uploaded to the Income Tax Department's e-filing portal to file your ITR (once online filing is activated).

Important Changes in This Year's ITR Filing:

The Income Tax Department has introduced some significant changes in ITR-1 and ITR-4 that taxpayers should be aware of:

- LTCG Reporting: As mentioned, certain Long-Term Capital Gains (under Section 112A) up to ₹1.25 lakh can now be reported in ITR-1 and ITR-4.

- Detailed Deduction Disclosure: For those opting for the old tax regime, more detailed information will be required for deductions under sections like 80C, 80D, 80E, etc. For example, details about the type of investment under 80C (PPF, ELSS, NSC) and payee details will be mandatory.

- Mandatory TDS Section Mention: It is now mandatory to mention the specific TDS section under which tax was deducted for various income sources (e.g., Section 192 for salary, Section 194A for interest income).

- Smarter Utility: The new utilities come with enhanced error detection and automated calculations, making the filing process smoother.

Please Note: The due date for filing ITR for Financial Year 2024-25 (Assessment Year 2025-26) has been extended to **September 15, 2025**. This extension is due to delays in ITR form notifications.

The availability of offline utilities is a positive step that will help taxpayers file their ITR accurately and on time. Start your preparation now and avoid last-minute hassles!

For any assistance with ITR filing, contact MyITROnline. Our expert team is ready to help you!

Visit for more information: www.myitronline.com

Or call us at: 9971055886

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles