Understanding the Old and New Tax Regimes: Key Differences, Advantages, and Tax Calculations

Understand the key differences between the Old and New Tax Regimes in India. This blog provides a detailed comparison of tax slabs, exemptions, deductions, and practical examples to help you decide which regime is better for your income level.

.jpg )

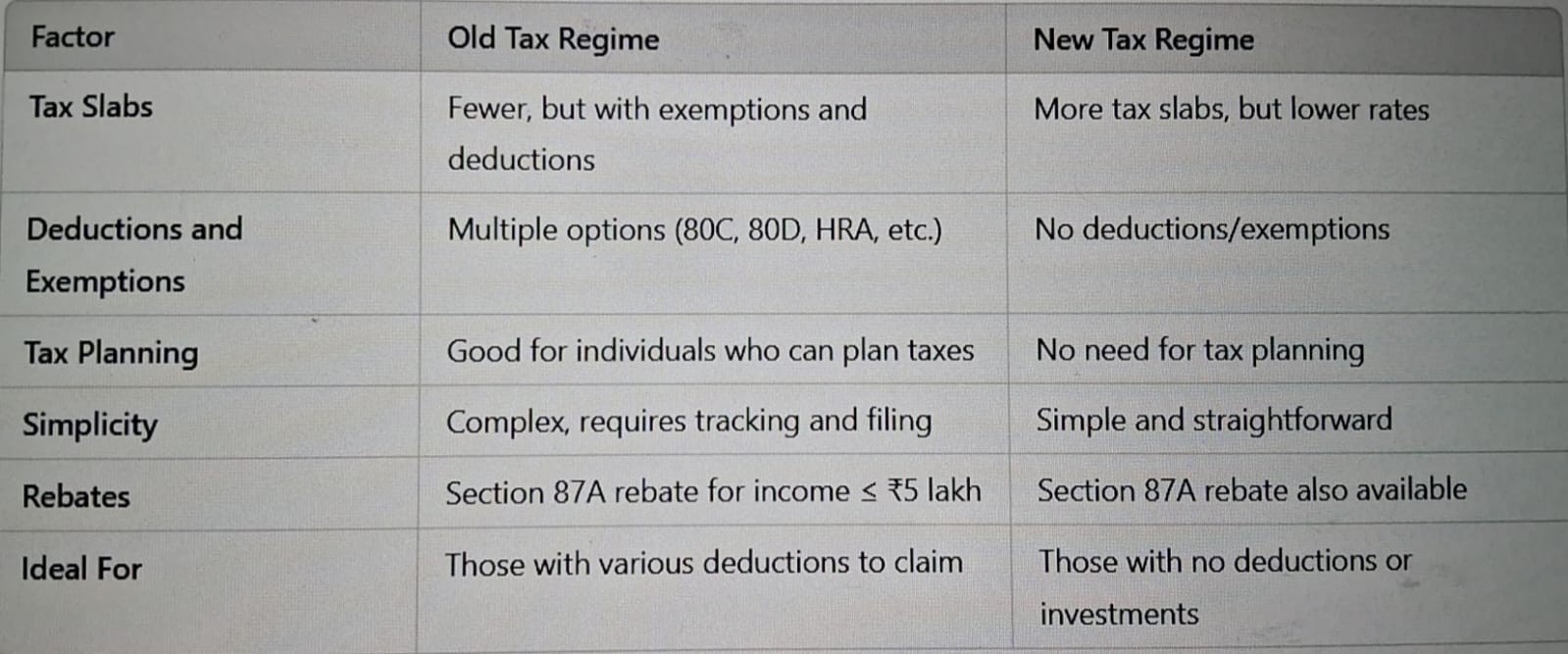

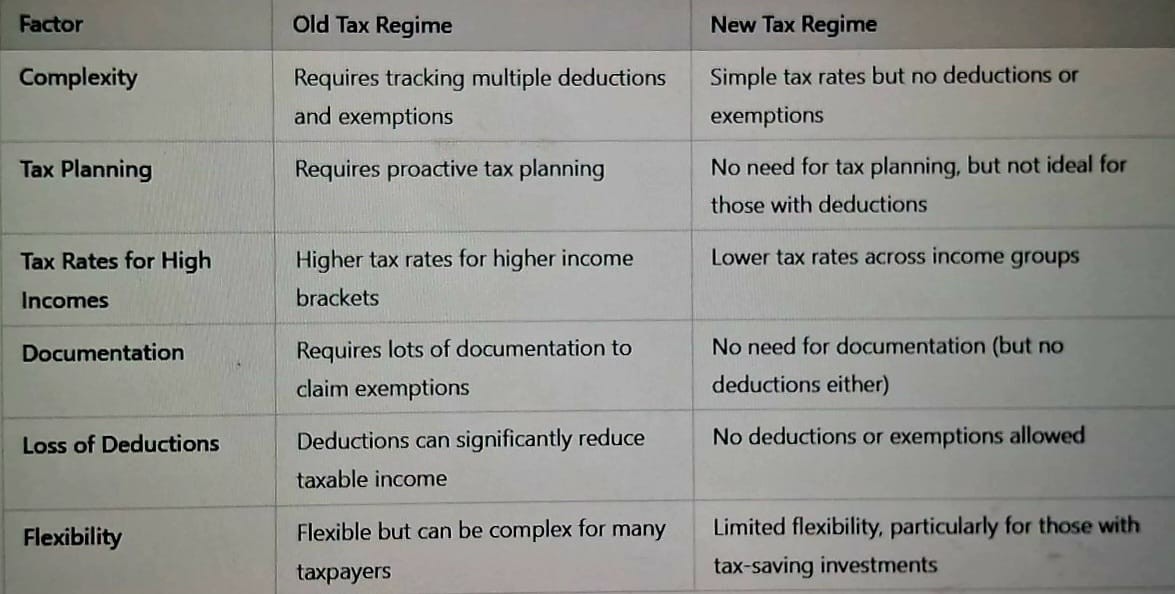

DIFFERENCE BETWEEN OLD AND NEW TAX REGIME

The Indian tax system offers two regimes for individuals and Hindu Undivided Families (HUFs) to choose from the old tax regime and the new tax regime. Both have distinct features, including different tax rates, exemptions, deductions, and rebates.

SUMMARY

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax Slabs | Offers a set of tax slabs, which apply to individuals based on their income. with deductions, exemptions, and rebates. | Offers lower tax rates but does not allow most exemptions, deductions, and rebates. |

| Tax Filing Complexity | Complex, requires proof of exemptions. | Simple, no paperwork for deductions. |

Old Tax Regime (Existing Tax Regime)

The old tax regime is the existing tax system in India, which has been in place for many years, individuals could reduce their taxable income by claiming various deductions, exemptions, and rebates.

TAX SLABS RATES: OLD TAX REGIME

- 0 - 250000: NIL

- 250000 - 500000: 5%

- 500000 - 1000000: 20%

- ABOVE 10 LAKH: 30%

Advantages:

- More Exemptions and Deductions: Taxpayers can claim various exemptions and deductions, which can significantly lower your taxable income

- Section 80C: Investments in PPF, ELSS, tax-saving fixed deposits etc.

- Section 80D: Premiums paid on health insurance.

- HRA (House Rent Allowance): If you live in a rented house

- Standard deduction: ₹50,000 for salaried

- LTA (Leave Travel Allowance): Reimbursement for travel expense

- Flexibility: you can choose it, and if not, you can opt for the new tax regime the following year.

- Potential to Reduce Taxable Income: If you’re able to leverage exemptions and deductions to their maximum, you can pay much less tax.

- Rebates (Section 87A): Under the Old Tax Regime, individuals with income up to ₹5 lakh can claim a rebate of ₹12,500 under Section 87A, effectively making their tax liability zero.

- Good for Tax Planning: The Old Tax Regime is better for individuals who have the time and inclination to actively manage their tax planning. By making tax-saving investments, paying premiums, or claiming exemptions, you can lower your overall tax burden.

Disadvantages:

- Complexity: Multiple exemptions and deductions can make tax filing complex.

- Tax Evasion: Opportunities for tax evasion through misclaiming exemptions and deductions.

- Dependence on Documentation: Many exemptions require you to provide substantial documentation (e.g., investment proofs, medical bills, insurance premiums, etc.). If you fail to keep track of these documents or forget to file them, you might miss out on tax-saving opportunities, resulting in a higher tax burden.

- Loss of Simplicity: it also makes the tax filing process more complicated. If you don’t take advantage of all the available deductions, you may end up paying more tax than you would under the New Tax Regime, which is simpler and more transparent.

- Higher Tax Rates for Higher Income Groups: In the Old Tax Regime, the tax rates are higher compared to the New Tax Regime for individuals in higher income brackets. For instance, individuals earning above ₹10 lakh face a tax rate of 30%, which is higher than the New Tax Regime rate of 25% for income between ₹12.5 lakh to ₹15 lakh.

NEW TAX REGIME

New Tax Regime: The new tax regime is an alternative tax system introduced by the government, aiming to simplify the tax structure.

New Tax Slabs Rates: NEW TAX REGIME

- 0 - 400000: NIL

- 400001 - 800000: 5%

- 800001 - 1200000: 10%

- 1200001 - 1600000: 15%

- 1600001 - 2000000: 20%

- 2000001 - 2400000: 25%

- Above 2400000: 30%

Advantages:

- Simplification: The reduced number of exemptions and deductions simplifies tax filing.

- Lower Tax Rates: For certain income brackets, the new tax regime offers lower tax rates, reducing tax liability.

- Increased Take-Home Pay: Due to lower tax rates, taxpayers may enjoy increased take-home pay.

- Rebates (Section 87A): Section 87A rebate also available

- Ideal for People Without Deductions: If you don’t have deductions to claim, the New Tax Regime will likely be more beneficial. It offers lower tax rates and a simpler approach to tax filing.

Disadvantages:

- Loss of Exemptions and Deductions: Taxpayers who previously claimed exemptions and deductions may lose these benefits.

- Section 80C (tax-saving investments),

- HRA (House Rent Allowance),

- LTA (Leave Travel Allowance),

- Standard Deduction for salaried individuals.

- Not Suitable for Taxpayers with Multiple Deductions: If you have various investments or exemptions to claim. the New Tax Regime can lead to higher tax payments because it doesn’t allow any deductions. For such individuals, the Old Tax Regime may be more beneficial.

- Limited Flexibility: The New Tax Regime has a one-size-fits-all approach, meaning it doesn’t take into account the individual’s spending patterns or savings behavior.

- Possibly Higher Tax for Some Taxpayers: For those who earn middle to high incomes and make use of various deductions, the New Tax Regime can lead to a higher tax liability compared to the Old Tax Regime.

- Potential for Confusion: Even though the New Tax Regime simplifies the tax structure, it can still be confusing for some people who are used to the old structure with its deductions and exemptions. Also, switching between regimes could cause uncertainty about which option to choose, as one might be more advantageous than the other depending on the individual’s circumstances.

SUMMARY OF THE KEY ADVANTAGES OF OLD TAX REGIME AND NEW TAX REGIME:

SUMMARY OF THE KEY ADVANTAGES OF OLD TAX REGIME AND NEW TAX REGIME:

EXAMPLE 1: OLD TAX REGIME

Let's say Rohan's annual income is ₹12,00,000. He has the following deductions:

- 80C deductions (e.g., PF, life insurance): ₹1,50,000

- HRA exemption: ₹2,40,000

- Standard deduction: ₹50,000

Tax Calculation

- Gross Income: ₹12,00,000

- Deductions: ₹1,50,000 (80C) + ₹2,40,000 (HRA) + ₹50,000 (Standard Deduction) = ₹4,40,000

- Taxable Income: ₹12,00,000 - ₹4,40,000 = ₹7,60,000

TOTAL TAX:

- 1-250000 = NIL

- 250001-500000 = 5% = 250000*5% = 12500

- 500001-760000 = 260000*20% = 52000

TOTAL TAX = 52000+12500 = 64500

Health and education cess is 4% of the tax payable

Cess = 4% of 64500 = 2580

Final Tax Payable:

Total tax payable = 64500 + 2580 = 67080.00

Rohan’s total income tax payable as per the OLD TAX REGIME is Rs 67080.00

EXAMPLE 2: NEW TAX REGIME

Let's say Rohan's annual income is ₹12,00,000. He has the following deductions:

- 80C deductions (e.g., PF, life insurance): ₹1,50,000

- HRA exemption: ₹2,40,000

- Standard deduction: ₹75,000

GROSS INCOME = ₹12,00,000

Standard deduction = ₹75000

Total taxable income = ₹1200000 - ₹75000 = ₹1125000

Tax payable = Nill (No tax payable as per new tax regime)

EXAMPLE 3: OLD TAX REGIME

If your taxable income is ₹15,00,000, and you avail of deductions such as ₹1,50,000 under 80C and ₹25,000 under 80D,

INTEREST FROM BANK = 11000

HRA = 120000

OLD TAX REGIME

Gross Income = Salary + Interest from Bank = ₹1511000

Deduction And Allowances = HRA + 80C + 80D + 80TTA + Standard Deduction = 120000 + 150000 + 25000 + 10000 + 50000 = ₹355000

Taxable Income = 1511000 – 355000 = ₹1156000

Total Tax

- 1-250000 = NIL

- 250001-500000 = 5% = 250000*5% = ₹12500

- 500001-1000000 = 20% = 500000*20% = ₹100000

- 1000001-1156000 = 30% = 156000*30% = ₹46800

Total tax = 12500 + 100000 + 46800 = ₹159300

Health and education cess is 4% of the tax payable

Cess = 4% of 159300 = 6372

Final tax Payable

Tax payable = 159300 + 6372 = ₹165672

Total income tax payable as per the OLD TAX REGIME is ₹165672

EXAMPLE 4: NEW TAX REGIME

If your taxable income is ₹15,00,000, and you avail of deductions such as ₹1,50,000 under 80C and ₹25,000 under 80D,

Interest From Bank = 11000

Hra = 120000

NEW TAX REGIME

Gross Income = Salary + Interest From Bank = ₹1500000 + 11000

Standard Deduction = ₹75000

Total Income = 1511000 – 75000 = ₹1436000

TOTAL TAX

- 1-400000 = NIL

- 400001-800000 = 5% = 400000*5% = ₹20000

- 800001-1200000 = 10% = 400000*10% = ₹40000

- 1200000-1436000 = 15% = 236000*15% = ₹35400

Total tax = 20000 + 40000 + 35400 = ₹95400

Health and education cess is 4% of the tax payable

Cess = 4% of 95400 = ₹3816

Final Tax Payable

Tax Payable = 95400 + 3816 = ₹99216

Total income tax payable as per the NEW TAX REGIME is ₹99216

CONCLUSION

- The Old Tax Regime is ideal for those who want to leverage deductions and exemptions for tax savings.

- The New Tax Regime is best suited for individuals who have minimal or no deductions, as it simplifies the entire process without the need for careful tax planning.

Written by Shiva Pandey, Accountant

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles