Which Tax Regime Works Best for You? Old vs New Compared

The Indian government provides two tax regimes – the Old Regime and the New Regime – each with its own benefits and drawbacks. The Old Regime offers multiple deductions and exemptions, while the New Regime provides lower tax rates with minimal exemptions. This blog explores the key differences, tax calculations, and real-life illustrations to help taxpayers make an informed choice. Find out which tax regime suits your financial situation best!

.jpg )

Old vs New: Which Tax Regime Saves You More?

Regime Change: What’s Best For You?

The Indian government offers two tax regimes – the Old Regime and the New Regime – each with its own benefits. Here’s a quick comparison to help you choose the one that suits you best:

Old Tax Regime: The Traditional Approach

Under the old tax regime, taxpayers can claim various exemptions, deductions, and rebates. Some key features include:

- Tax Deductions and Exemptions:

- 80C deductions for investments like Life Insurance Premium, PPF, EPF, and Tax Saving Fixed Deposits (up to Rs 1.5 lakh).

- HRA (House Rent Allowance) for those living in rented accommodation.

- Section 80D allows deductions on health insurance premiums.

- Section 24(b) allows deductions on home loan interest (up to Rs 2 lakh).

- Personalized Tax Planning: The old regime allows you to plan your taxes strategically based on eligible exemptions, deductions, and rebates that best suit your financial situation.

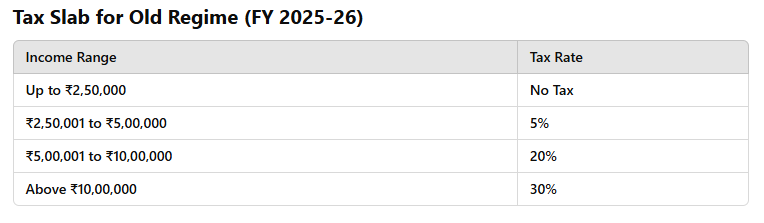

- Higher Tax Rates: While the old regime provides many deductions, the tax rates are relatively higher. For individuals below 60 years of age, the tax slabs are:

Illustration 1: Mr. Sharma's Tax Calculation

Mr. Sharma is employed with ABC Ltd. Here’s a breakdown of his salary and tax calculation under both regimes:

- Basic Salary: ₹10,00,000

- HRA: ₹3,40,000

- Bonus: ₹1,80,000

- LTA: ₹1,30,000

- Conveyance Allowance: ₹85,000

- Other Allowance: ₹4,50,000

- Rent Paid: ₹4,80,000

Deductions:

- Section 80C: ₹1,50,000

- Section 80D: ₹30,000

- Section 80CCD(2): ₹50,000

- Section 80TTA: ₹10,000

- Standard Deduction: ₹75,000

Tax Payable under Old Regime: ₹2,90,160 (including 4% Cess)

Tax Payable under New Regime: ₹1,49,760 (including 4% Cess)

Recommendation: Mr. Sharma should opt for the New Tax Regime to save ₹1,40,400 in taxes.

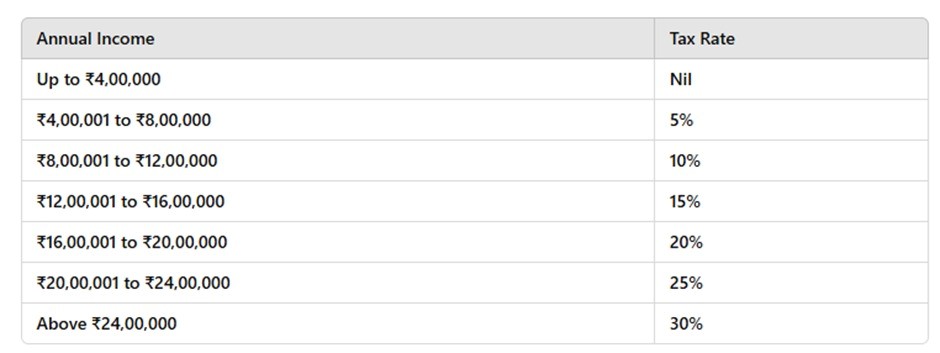

What is the New Tax Regime?

The new tax regime introduces simplified tax brackets for individual taxpayers, offering lower tax rates for various income ranges. These rates are progressive, meaning the tax percentage increases as income crosses certain thresholds. Unlike the old tax regime, the new regime does not allow exemptions like HRA, deductions under Section 80C, 80D, etc., except for a few specific ones like standard deduction and contributions to the NPS.

Benefits of the New Tax Regime:

- Lower Tax Rates

- No Need for Investment to Claim Deductions

- Simplicity

- No HRA or Other Exemption Claimed

- Standard Deduction

- Better for High Income Individuals

Who Benefits from the New Tax Regime?

- Salaried Individuals with No or Few Deductions

- Simpler Filing

- Higher Income Earners

Illustration 2: Mr. Paul's Tax Calculation

Mr. Paul has a professional income of ₹80 lakhs. Here’s a breakdown of his tax calculation under both regimes:

Old Tax Regime: ₹24,62,460

New Tax Regime: ₹22,68,552

Conclusion: Mr. Paul should opt for the new Tax Regime, as it results in a lower tax liability.

Illustration 3: Tax Calculation for FY 2025-26

For an individual with a basic salary of ₹4,50,000, the tax payable under both regimes is ₹62,400. In this case, both regimes result in the same tax liability.

Advice for Different Types of Taxpayers

- For Salaried Individuals with Few Deductions: Opt for the New Tax Regime.

- For Salaried Individuals with Significant Deductions: Choose the Old Tax Regime.

- For Business Owners and Self-Employed Individuals: Consider the Old Tax Regime.

- For Retirees and Pensioners: Opt for the New Tax Regime.

- For Individuals with Significant Capital Gains: Choose the Old Tax Regime.

- For Individuals with High Medical Expenses: Opt for the Old Tax Regime.

Frequently Asked Questions

1. Which tax regime should I choose – Old or New?

Answer: Choose the Old Tax Regime if you have significant deductions. Choose the New Tax Regime if you prefer simpler filing and lower tax rates.

2. Can I switch between the Old and New Tax Regime every year?

Answer: Yes, you can switch between the regimes every year, except if you have business income and opt for the New Regime.

3. What are the main differences between the Old and New Tax Regimes?

Answer: The Old Regime offers deductions/exemptions (like 80C, HRA), while the New Regime offers lower tax rates but no deductions or exemptions.

4. Does the New Tax Regime allow tax-saving investments?

Answer: No, the New Tax Regime does not allow deductions like 80C, 80D, or others, but it has a standard deduction of Rs. 75,000.

5. Can I claim the same exemptions under both regimes?

Answer: No, exemptions like HRA, LTA, and 80C are available only under the Old Tax Regime.

6. Which regime is better for high-income earners?

Answer: The Old Tax Regime is better for high-income earners with deductions/exemptions, while the New Regime may result in higher tax for those with significant deductions.

7. Is the New Tax Regime easier to understand?

Answer: Yes, the New Tax Regime is simpler, as it eliminates the need for tax-saving investments and deductions, resulting in straightforward tax calculations.

Written by Monika, Accountant

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles