Benefits to Taxpayers of an Extension of the Income Tax Return Due Date

The deadline for filing income tax returns for the assessment year 2024–25 has been extended by the Central Board of Direct Taxes (CBDT) to October 7, 2024. This blog discusses the rationale for the extension, who stands to gain from it, and how taxpayers should use the additional time to make timely and proper filings in order to avoid fines. It is recommended that people and businesses take early action to prevent last-minute issues.

.png )

Extension of the Income Tax Return Due Date: Benefits for Taxpayers

The Central Board of Direct Taxes (CBDT) has released an important update about the extension of the Income Tax Return (ITR) filing deadline, taking into account the difficulties that stakeholders and taxpayers are facing. The goal of this extension is to lessen the load on people and companies that are finding it difficult to comply with the deadlines because of different administrative and technical difficulties.

Important Information on the Extension

The Ministry of Finance has extended the date for filing different audit reports under the Income Tax Act, 1961 for the assessment year 2024–25, with Circular No. 10/2024. The revised deadline, which was originally scheduled by September 30, 2024, has been moved to October 7, 2024 (circular-10-2024).

Justifications for the Extension

The following factors influenced the CBDT's decision:

- Technological Difficulties: Delays resulted from taxpayers and chartered accountants encountering issues with electronically filing audit reports.

- Administrative Delays: A large number of taxpayers requested deadline extensions because they were unable to obtain the required financial documentation in a timely manner.

- COVID-19 Residual Impact: Many businesses' regular operations have been disrupted by the pandemic's lingering impacts, making it difficult to comply with the initial timeframe.

Who Benefits from the Extension?

Main advantages of the deadline extension are:

- Companies Needing Audits: In accordance with Income Tax Act Section 139(1), companies and corporations that must file audited financial reports will now have until October 7, 2024, to comply.

- Individual Taxpayers with Complex Returns: You will have additional time to make sure that your files are proper if you have a lot of financial data, many sources of income, or investments that need to be thoroughly audited.

- Small and Medium Businesses (SMEs): This relief will help SMEs, who frequently struggle with managing cash flow and administrative responsibilities.

How Do Taxpayers Get Affected by This?

No Penalties for Late Filing: Under Section 234F of the Income Tax Act, taxpayers who file their returns by the extended deadline will not be assessed late fees or penalties.

Extra Time for Precise Submission: With the extension, people and companies may compile the required paperwork, double-check data, and make sure their filings are error-free.

Conformity with Audit Reports: Now that the original September deadline has passed, businesses may concentrate on finishing their audits and making sure they are in conformity with all Income Tax Act rules.

How to Submit Before the Upcoming Deadline

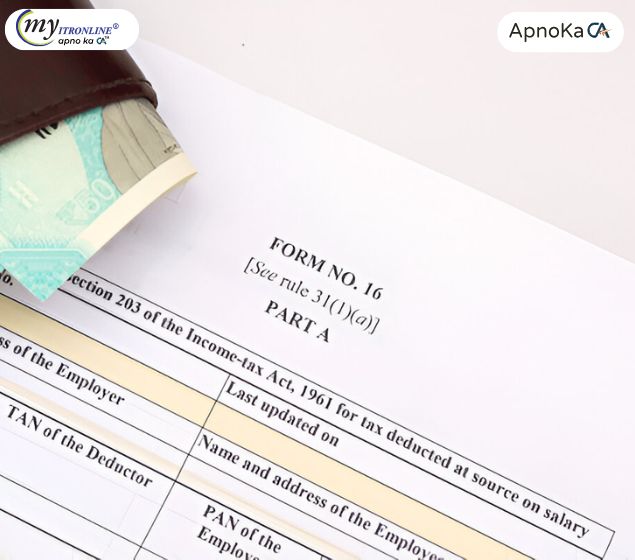

- Assemble the Documents: Make sure you have all the necessary paperwork, such as Form 26AS, Form 16, and any further evidence of investments, income, or deductions.

- See Your Certified Public Accountant: Make sure your CA finishes the audit well in advance of the new deadline if your returns need to be audited.

- Make Use of the e-Filing Portal: To electronically file your taxes, visit the official Income Tax e-filing system at www.incometax.gov.in. It is suggested to file early because the portal may see heavy usage closer to the deadline.

Resulting from Not Meeting the Extended Deadline

If your ITR is not filed by the extended deadline, you may be subject to:

- Penalties under Section 234F: Returns filed beyond the due date may be subject to a fine of up to ₹10,000.

- Interest on Unpaid Tax Debt: Interest under Sections 234A, 234B, and 234C for late payments will be assessed if you owe taxes.

- Forfeiture of Loss Carryovers: Taxpayers who do not file by the deadline forfeit the opportunity to carry over some of their losses for potential future tax offsets.

In Summary

The IRS has extended the deadline for filing returns until October 7, 2024, which is a welcome respite for those who were having trouble making the first deadline. It gives more time for precise filing, adhering to audit specifications, and avoiding fines. It is imperative that taxpayers make good use of this time and don't wait until the last minute to finish their filings. Taxpayers may guarantee efficient processing and steer clear of any last-minute technological difficulties on the e-filing system by filing early.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

Income tax filing deadline is right around the corner. If you haven’t filed yet, do it now for FREE on Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles