CBDT Extends AY 2023-24 ITR Processing: A Crucial Update for Taxpayers

The Central Board of Direct Taxes (CBDT) has issued an order extending the processing deadline for electronically filed Income Tax Returns (ITR) for Assessment Year (AY) 2023-24 to November 30, 2025. This relaxation applies to returns where the intimation under Section 143(1) had previously lapsed. The blog post explains who benefits, important exceptions (like scrutiny cases and assessee-attributable delays), and reiterates the necessity of PAN-Aadhaar linking for refund eligibility. It highlights this as a significant relief for taxpayers.

Important Announcement for Taxpayers: CBDT Extends Deadline for Processing AY 2023-24 Income Tax Returns

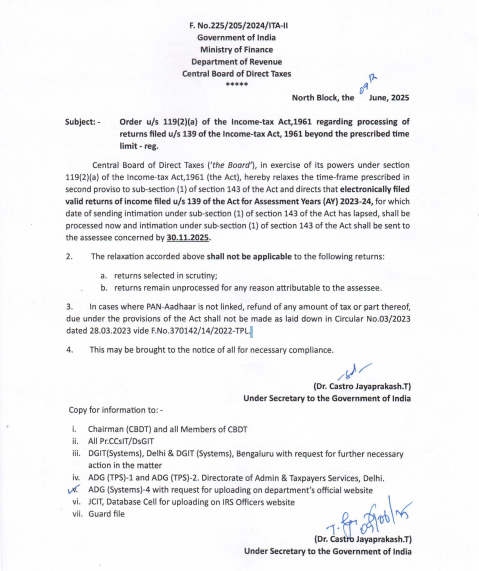

The Central Board of Direct Taxes (CBDT) has recently released a crucial directive (F. No.225/205/2024/ITA-II) offering significant relief for taxpayers. Dated June 2025, this directive concerns the processing of electronically submitted income tax returns for Assessment Year (AY) 2023-24 that were filed under Section 139 of the Income-tax Act, 1961, but for which the intimation under Section 143(1) has expired.

What Does This Relaxation Imply for You?

If you submitted your income tax return electronically for AY 2023-24 under Section 139, and have not yet received an intimation (such as an assessment order or refund notification) under Section 143(1), which is past the original deadline for sending it, there's good news! The CBDT has extended this timeline. Your return will now be processed, and the intimation under Section 143(1) will be sent to you by November 30, 2025.

This is a positive development from the CBDT, reflecting their dedication to processing all valid returns, even if there were delays in the intimation procedure.

Who Benefits from This Directive?

This order primarily assists taxpayers who:

- Electronically submitted their income tax returns under Section 139 of the Income-tax Act, 1961.

- The returns are intended for Assessment Year (AY) 2023-24.

- The initial deadline for issuing the intimation under sub-section (1) of Section 143 of the Act has already expired.

Key Exceptions to Consider:

Although this is a wide-ranging relaxation, there are a few important exceptions where this directive will not be applicable:

- Returns chosen for scrutiny: If your return has been selected for scrutiny (a more in-depth review by tax authorities), this relaxation will not apply to you.

- Returns unprocessed due to the taxpayer's fault: If your return remains unprocessed for any reasons attributed to you, the taxpayer, this relaxation does not apply. This may include incomplete submissions or issues that you need to address.

What About Refunds and PAN-Aadhaar Linking?

It is essential to note the ongoing rule regarding refunds: If your PAN (Permanent Account Number) and Aadhaar are not linked, no tax refund (or any part of it) due under the Income-tax Act provisions will be issued. This is in line with Circular No. 03/2023, dated March 28, 2023. Hence, despite this processing extension, it is crucial to ensure your PAN and Aadhaar are linked to avoid complications with potential refunds.

Why is This Significant?

This order delivers a well-needed sense of clarity and relief to taxpayers who may have been concerned about the status of their AY 2023-24 returns due to delayed intimations. It simplifies the process and guarantees that valid returns progress towards processing.

Taxpayers are encouraged to take note of this announcement and, if relevant, ensure their PAN and Aadhaar are linked to prevent any issues regarding possible refunds.

Disclaimer: This blog post is for informational purposes only and does not constitute professional tax advice. Tax laws can be complex and are subject to change. Please consult with a qualified tax professional for personalized advice regarding your specific situation.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles