CRA-4 Filing Relaxation Announced by MCA Relief for Companies

The Ministry of Corporate Affairs (MCA) has extended the deadline for CRA-4 filing without extra fees till 31st December 2025. This move helps companies and cost auditors adjust to the new form rollout on the MCA V3 portal and avoid penalties.

The Ministry of Corporate Affairs (MCA) has given companies a helpful extension for filing the CRA-4 form (Cost Audit Report in XBRL format) for the financial year ending 31st March 2025.

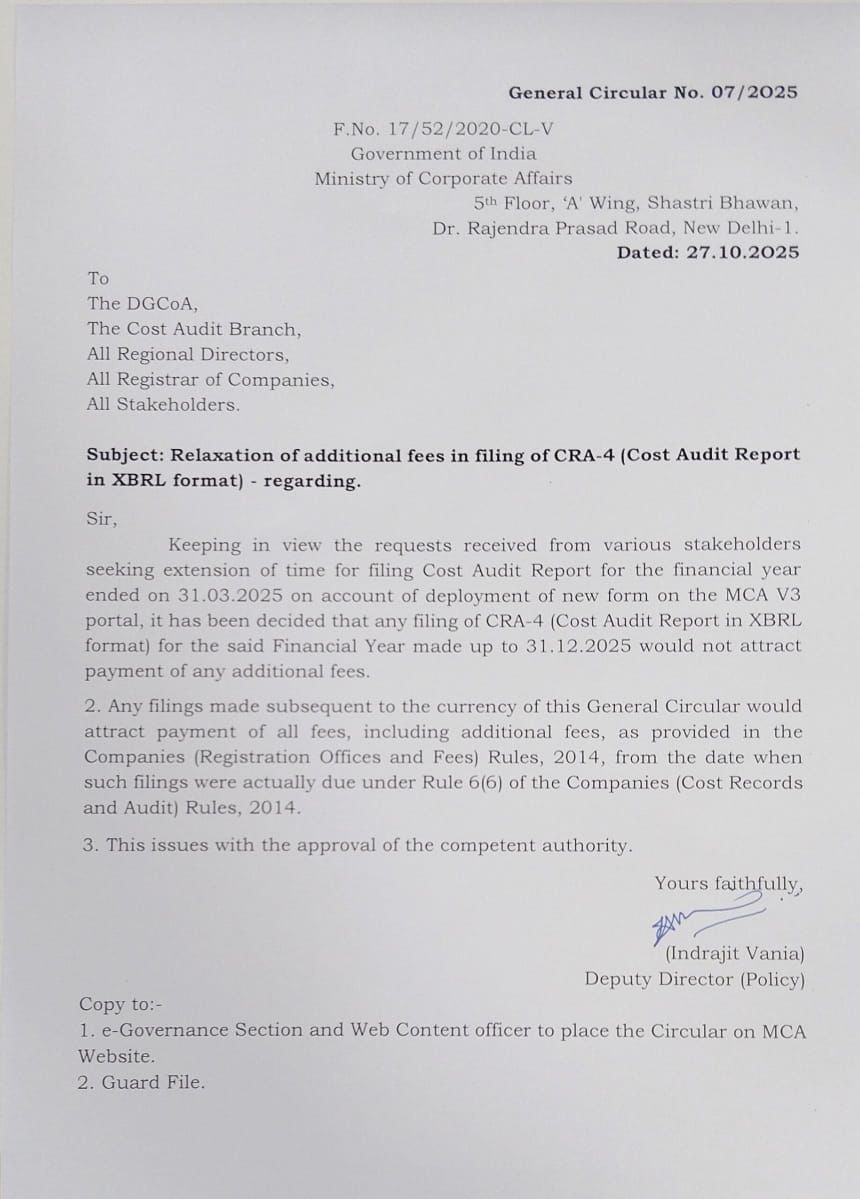

As per General Circular No. 07/2025, dated 27th October 2025, companies can now file CRA-4 without paying any extra fee if they do it by 31st December 2025.

What’s the Update?

- No Extra Fee Till 31st December 2025: Companies filing CRA-4 before this date won’t be charged any additional fee.

- Reason for Relaxation: MCA rolled out a new version of the CRA-4 form on its V3 portal. Many stakeholders requested more time to adjust.

- After Deadline: If companies file CRA-4 after 31st December 2025, they’ll have to pay regular and late fees as per the Companies (Registration Offices and Fees) Rules, 2014.

What Should Companies Do?

All companies and cost auditors should make sure to file CRA-4 within the extended timeline. Filing late may lead to penalties and extra charges.

Circular Reference: General Circular No. 07/2025, dated 27.10.2025 – Ministry of Corporate Affairs

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)

.jpg

)

.jpg

)