MCA Grants Relief: DIR-3 KYC Filing Deadline Now October 31, 2025

The Ministry of Corporate Affairs (MCA) has extended the DIR-3 KYC deadline to October 31, 2025. This allows directors to file without incurring the ₹5,000 late fee and avoid DIN deactivation. Learn who needs to file, which form to use, and why early action is crucial.

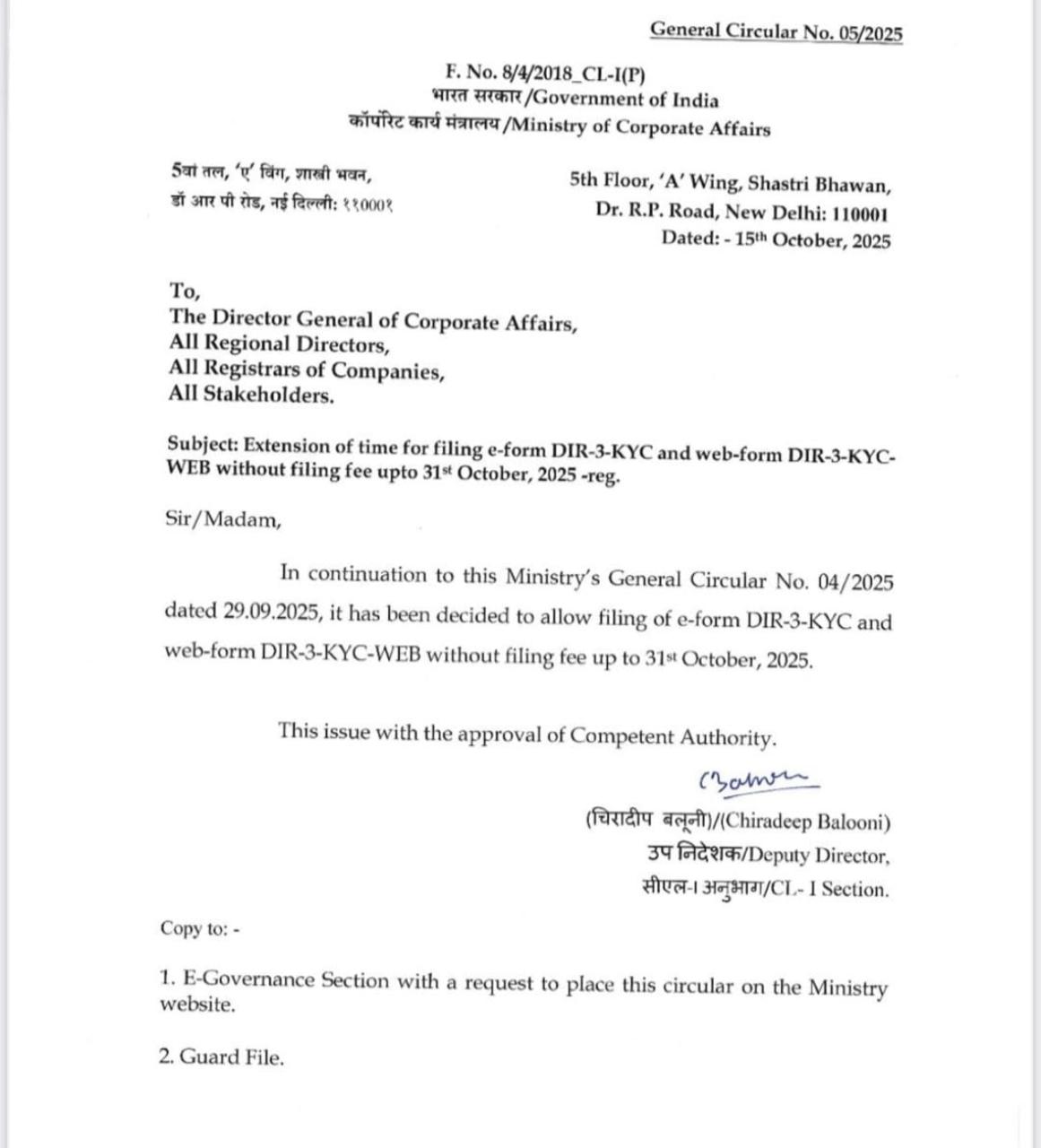

The Ministry of Corporate Affairs (MCA) has extended the deadline for filing DIR-3 KYC to October 31, 2025. Directors and designated partners can now file without paying the ₹5,000 late fee.

Who Needs to File?

- Individuals with a DIN allotted on or before March 31, 2025

- DIN status must be ‘Approved’

Filing Options

- e-Form DIR-3 KYC: For first-time filers or those with updated contact details. Requires DSC and professional attestation.

- Web-Form DIR-3-KYC-WEB: For repeat filers with no changes. Quick OTP-based verification via MCA portal.

Why This Extension Matters

- No Late Fees: File before October 31 to avoid the ₹5,000 penalty.

- Avoid DIN Deactivation: Non-filing leads to DIN being marked as ‘Deactivated due to non-filing of DIR-3 KYC’.

- Extra Time: Resolve technical issues or gather documents without pressure.

Recommended Action

- Verify your registered mobile and email

- Choose the correct form based on your filing history

- File early via the MCA V3 portal to avoid last-minute issues

Completing DIR-3 KYC is essential for maintaining your active DIN status and ensuring smooth corporate governance.

Disclaimer: This post is for informational purposes only. Please consult a qualified CA, CS, or CMA for professional advice.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles

.jpg

)

.jpg

)

.jpg

)

.jpg

)