Income Tax Department Offers Relief on Section 87A Tax Rebate Claims

The Income Tax Department has issued relief for taxpayers who claimed Section 87A rebate on short-term capital gains (STCG). If demands are paid by December 31, 2025, interest will be waived. Learn what went wrong, what’s been clarified, and what you should do next.

The Income Tax Department has recently issued a much-needed relief for taxpayers who claimed the Section 87A rebate on income taxed at special rates—particularly short-term capital gains (STCG) on equities. This move comes after a wave of tax demand notices and legal confusion that left many taxpayers in limbo.

What Is Section 87A?

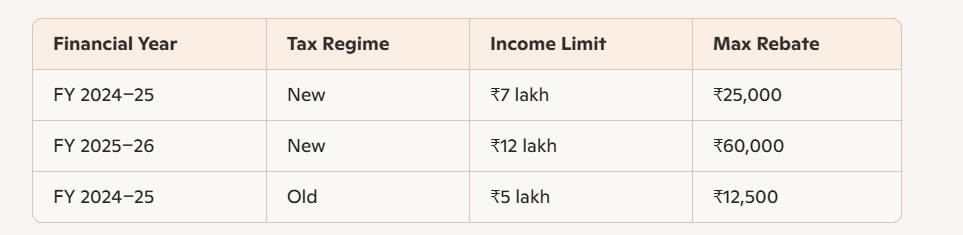

Section 87A of the Income Tax Act provides a rebate to resident individuals whose total income falls below a specified threshold. Here's how it works:

However, this rebate does not apply to income taxed at special rates—such as STCG under Section 111A or LTCG under Section 112A.

The Controversy: STCG and Rebate Claims

Many taxpayers filed returns claiming the Section 87A rebate on STCG income (taxed at 15%) before July 5, 2024. The Income Tax Utility Software initially allowed this, but a schema update later disallowed such claims. As a result, over 500 taxpayers received demand notices for the rebate amount they had claimed.

Relief from the Income Tax Department

In Circular 13/2025, the Central Board of Direct Taxes (CBDT) clarified that:

- Taxpayers who claimed Section 87A rebate on STCG income before July 5, 2024 will face rectification and tax demands.

- However, if these demands are paid on or before December 31, 2025, the interest under Section 220(2) will be waived.

This waiver is a significant relief, especially for those who acted in good faith based on earlier interpretations and software behavior.

Legal Debate: Is STCG Eligible for Rebate?

The issue remains legally contentious. While the Income Tax Department now disallows the rebate on STCG, several appellate authorities and tax experts argue that:

- Section 87A does not explicitly exclude STCG under Section 111A.

- The Finance Minister’s Budget Speech in 2023 stated that individuals with income up to ₹7 lakh under the new regime would pay no tax, without exceptions.

- Courts have ruled in favor of allowing the rebate in similar cases, making this a debatable issue.

Key Takeaways for Taxpayers

- If you claimed Section 87A rebate on STCG income before July 5, 2024, and received a tax demand, you can avoid interest charges by paying the demand before December 31, 2025.

- Going forward, do not claim Section 87A rebate on income taxed at special rates like STCG or LTCG.

- For FY 2025–26 and beyond, the rebate threshold has increased to ₹12 lakh under the new regime, but only for regular income.

Final Thoughts

This relief is a welcome gesture from the Income Tax Department, acknowledging the confusion caused by software changes and legal ambiguity. Taxpayers should stay informed and consult professionals when dealing with complex income types and rebate claims.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles