Choose the Right Tax Regime Based on Your Financial Situation

The Old Tax Regime and the New Tax Regime are the two tax regimes that India offers to people. This document highlights the benefits, drawbacks, and tax computations for FY 2025–2026 of both regimes. Find out which regime is most appropriate for your financial status and income.

.jpg )

Old vs. New Tax Regime: Which is Right for You? (FY 2025-26)

Choose the Right Tax Regime Based on Your Financial Situation

Summary

India offers two tax regimes for individuals: the Old Tax Regime and the New Tax Regime. Both come with their own set of benefits and drawbacks. The right choice depends on your income, investments, and expenses. This article will help you navigate through the options and make an informed decision.

Introduction

Choosing the right tax regime for the financial year 2025-26 is essential for minimizing your tax liabilities. It's important to understand your finances before picking a regime. This guide will help you analyze both options so you can select the most beneficial tax regime based on your personal financial situation.

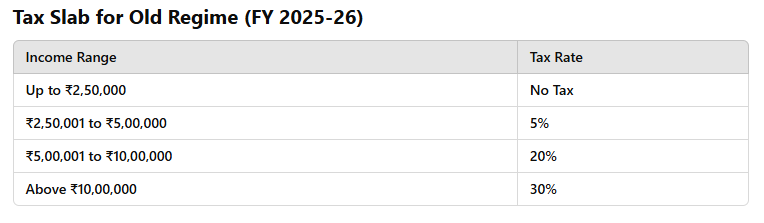

Old Tax Regime: Advantages and Disadvantages

Advantages

- Deductions & Exemptions: The Old Tax Regime allows a variety of deductions, such as 80C (investments up to ₹1.5 lakh), 80D (health insurance), HRA (house rent allowance), and more. These deductions help reduce your taxable income.

- Suited for Investors: If you make substantial investments in tax-saving instruments like PPF, ELSS, NPS, or pay significant health insurance premiums, the Old Tax Regime may work better for you.

Disadvantages

- Higher Tax Slabs: The tax rates under the Old Tax Regime are higher compared to the New Tax Regime.

- Complex Calculation: Calculating your tax liability can be more complicated due to the number of deductions and exemptions that need to be claimed.

Additional Cess (Applicable to Old Regime): Health and Education Cess: 4% on the total tax payable.

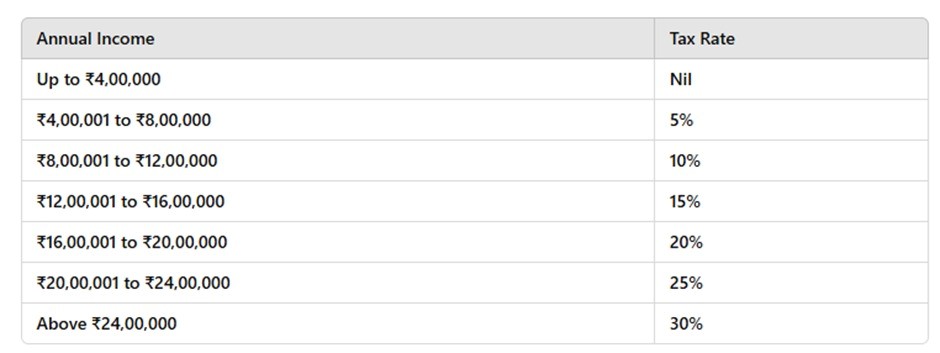

New Tax Regime: Advantages and Disadvantages

Advantages

- Lower Tax Slabs: The New Tax Regime offers lower tax rates, which can be beneficial if you do not have significant deductions or exemptions.

- Simplicity: It simplifies the tax calculation process, as there are fewer deductions and exemptions to manage.

Disadvantages

- No Deductions: The biggest drawback is that no deductions, such as 80C, 80D, HRA, etc., can be claimed under the New Tax Regime.

- Less Beneficial for High Earners with Investments: If you're in a higher tax bracket and have significant investments, the lack of deductions may result in higher overall taxes despite the lower tax slabs.

Additional Cess (Applicable to New Regime): Health and Education Cess: 4% on the total tax payable.

Which Tax Regime is Right for You? A Simple Guide

Here’s a straightforward way to decide which regime is right for you:

- Do you make significant investments? If you regularly invest in PPF, ELSS, or pay substantial home loan interest, the Old Tax Regime will likely benefit you more.

- Do you prefer simplicity? If you have minimal investments and don’t fully utilize 80C deductions, the New Tax Regime may be better, as it simplifies tax calculations.

- Still Unsure? Calculate both options. Use a tax calculator or consult a professional to see which tax regime results in a lower payable tax.

Illustrations to Help You Decide

Illustration 1: Old Tax Regime Calculation

- Income Details:

- Total Income: ₹3,500,000

- Interest from Savings Bank: ₹10,000

- Dividend Income: ₹20,000

- Total Income (including other sources): ₹3,530,000

- Exempt Allowances:

- House Rent Allowance (HRA): ₹800,000

- Other Allowance: ₹1,100,000

- Total Exempt Allowances: ₹1,900,000

- Total Income (after exempt allowances): ₹3,530,000 - ₹1,900,000 = ₹1,630,000

- Deductions under Section 80:

- 80C: ₹150,000

- 80TTA: ₹10,000

- 80D: ₹25,000

- 80CCD(2): ₹50,000

- 80G: ₹50,000

- Total Deductions: ₹285,000

- Standard Deduction: ₹50,000

- Total Deductions (including Standard Deduction): ₹335,000

- Taxable Income: ₹3,530,000 - ₹1,900,000 - ₹335,000 = ₹1,295,000

- Tax Payable:

- ₹201,000

- Health and Education Cess (4%): ₹8,040

- Total Tax Payable: ₹209,040

Illustration 2: New Tax Regime Calculation

- Income Details:

- Total Income: ₹3,500,000

- Interest from Savings Bank: ₹10,000

- Dividend Income: ₹20,000

- Total Income (including other sources): ₹3,530,000

- Exempt Allowances: Under the New Tax Regime, no allowances or exemptions are permitted. Exempt Allowances: ₹0

- Deductions under Section 80: 80CCD(2): ₹50,000

- Standard Deduction: ₹75,000

- Total Deductions (including Standard Deduction): ₹125,000

- Taxable Income: ₹3,530,000 - ₹125,000 = ₹3,405,000

- Tax Payable:

- ₹6,01,500

- Health and Education Cess (4%): ₹24,060

- Total Tax Payable: ₹6,25,560

Conclusion

In short, the Old Tax Regime results in a significantly lower tax payable (₹209,040) compared to the New Tax Regime (₹6,25,560). Therefore, the client should opt for the Old Tax Regime for a lower tax liability, unless they prefer the simplicity of the new regime and don't need to claim deductions.

Conclusion: Choosing the Right Tax Regime Based on Your Income

Choosing between the Old Tax Regime and the New Tax Regime is a critical decision that depends on your income level and financial circumstances.

- If you are a salaried individual earning up to ₹12.75 lakh per annum, or a businessperson earning up to ₹12 lakh, the New Tax Regime may be a better option. The New Regime simplifies tax filing and may result in zero tax payable due to the lower tax rates and no deductions.

- If your income exceeds ₹12.75 lakh as a salaried person, or ₹12 lakh as a businessperson, the Old Tax Regime is likely more advantageous. The Old Regime allows you to claim various deductions (such as HRA, 80C, 80D, etc.) that significantly reduce your taxable income and overall tax liability.

In short:

- For lower income (up to ₹12.75 lakh as a salaried person or ₹12 lakh as a businessperson), the New Tax Regime offers simplicity and low tax rates.

- For higher income, the Old Tax Regime provides greater tax savings through deductions and exemptions.

Before making a decision, analyze your income and investments to choose the tax regime that minimizes your tax liability.

Written by: Nikhil Kumar, Accountant

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles