ICAI Offers Compliance Relief for Non-Corporate Entities & LLPs (FY 2024-25)

The Institute of Chartered Accountants of India (ICAI) has announced a significant, temporary compliance relaxation for non-corporate entities and Limited Liability Partnerships (LLPs) for the Financial Year 2024-25. This allows these entities to optionally adopt updated guidance notes on financial statements, aiming to reduce administrative burden while maintaining transparency and accuracy. This flexibility ensures that core accounting standards remain paramount, offering businesses a choice in their reporting approach for the upcoming fiscal year.

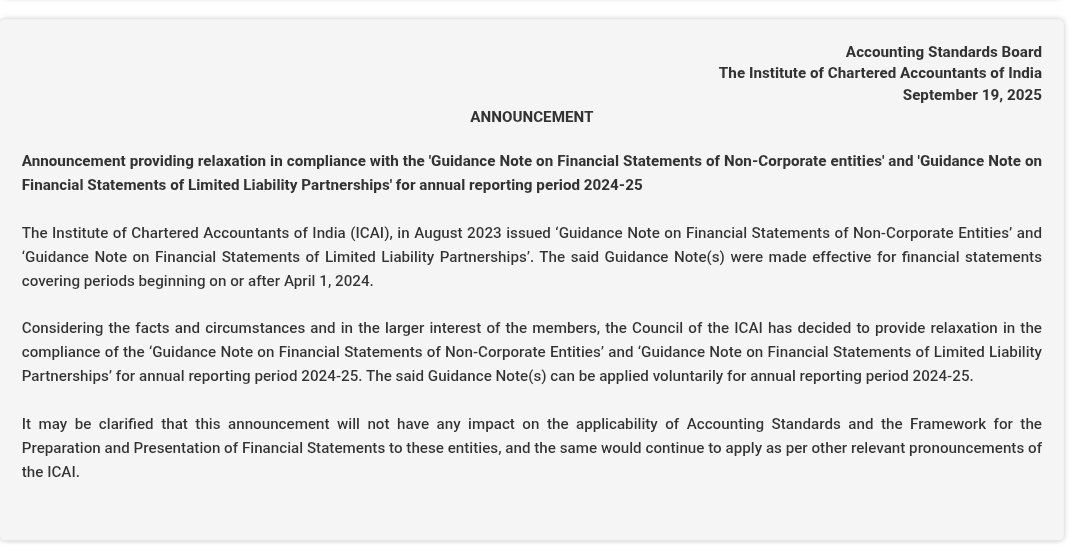

The Institute of Chartered Accountants of India (ICAI) is offering some breathing room for non-corporate businesses and LLPs when it comes to financial reporting for the 2024-25 financial year.

Basically, the ICAI's Accounting Standards Board (ASB) has announced a temporary break from mandatory compliance with their updated guidance notes for non-corporate entities and Limited Liability Partnerships (LLPs).

What Does This Mean?

If your business falls under these categories, you now have a choice: you can voluntarily follow the new guidance for your financial statements in FY 2024-25, or you can stick to the existing practices. This isn't a permanent change; it's just for this upcoming financial year. The main goal here is to make things a little easier on businesses without sacrificing accuracy and transparency in their financial reports.

Here's a visual summary of what this means for you:

Here's What You Need to Know:

- It's Your Call: This temporary relief is optional. You're not required to adopt the new guidance if you don't want to.

- Core Rules Still Apply: Don't forget, the fundamental Accounting Standards and the Framework for Financial Statements are still in full effect. These haven't changed.

- Who This Affects:

- Non-Corporate Entities: This covers any business that isn't an LLP.

- LLPs: There's a separate, specific guidance note for LLPs to address their unique reporting needs.

Why These Guidance Notes Matter:

- For Non-Corporate Entities: These notes help standardize financial statements, making them more consistent and easier to compare across different businesses.

- For LLPs: The LLP guidance is designed to fit their specific structure, making it simpler for them to meet the required standards.

What Should You Do Now?

- If you're a Non-Corporate Entity: Take a look at the updated guidance and decide if it makes sense for your financial reporting this year.

- If you're an LLP: Review your specific guidance note to ensure your statements are in line with the standards.

- If you're a Professional or Stakeholder: Stay informed about these changes to provide accurate advice and ensure compliance.

In short, the ICAI is giving businesses and professionals a bit more flexibility for FY 2024-25. This should help make the financial reporting process more manageable, all while keeping things clear and honest.

This initiative helps in managing compliance costs, perhaps saving entities X amount by streamlining processes, though individual savings will vary.

FILING YOUR INCOME TAX RETURN F.Y 2024-25 (A.Y. 2025-2026) WITH MYITRONLINE

The income tax filing deadline is right around the corner. If you haven’t filed yet, do it today with Myitronline! Avoid last minute rush and file your tax return today on MYITRONLINE in Just 5 mins.(www.myitronline.com)

If you are looking for eCA assistance to file your income tax return/ GST, you can opt for MYITRONLINE eCA assisted plan starting

Upload Salary Individual Form-16

If you have any questions with filing your tax return, please reply to this mail. info@myitronline.com OR call 9971055886,8130309886.

Note-All the aforementioned information in the article is taken from authentic resources and has been published after moderation. Any change in the information other than fact must be believed as a human error. For queries mail us at marketing@myitronline.com

Krishna Gopal Varshney

An editor at apnokacaKrishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

Leave a reply

Your email address will not be published. Required fields are marked *Share this article

Krishna Gopal Varshney, Founder & CEO of Myitronline Global Services Private Limited at Delhi. A dedicated and tireless Expert Service Provider for the clients seeking tax filing assistance and all other essential requirements associated with Business/Professional establishment. Connect to us and let us give the Best Support to make you a Success. Visit our website for latest Business News and IT Updates.

View articles