# tax

12 posts in `tax` tag

Big Changes Coming to GST on October 1, 2025: What Your Business Needs to Know

The Indian government has announced significant GST updates, effective October 1, 2025, stemming from the Finance Act, 2025. These amendments will impact definitions, voucher taxation, Input Tax Credit (ITC) on plant & machinery (retrospectively from 2017), return filing procedures, appeal processes, and introduce a new 'track & trace' system with associated penalties. Businesses must prepare for these changes by reviewing operations, updating systems, and training staff to ensure compliance and manage potential cash flow implications.

Big News for Small Businesses: Say Goodbye to Annual GST Returns (GSTR-9) From FY 2024-25!

This blog post announces a significant and permanent change in GST compliance for small businesses in India. From Financial Year 2024-25, businesses with an annual aggregate turnover of up to 2 crore are exempt from filing the annual GST return (Form GSTR-9). The article details what changed, who benefits, and the tangible advantages like time and cost savings. It also highlights crucial reminders about continued monthly/quarterly filings, record-keeping, and turnover monitoring. The post emphasizes that this move will greatly enhance the "Ease of Doing Business" for millions of small enterprises.

Didn’t File ITR by September 16? Here’s What You Can Still Do

This blog post provides a comprehensive guide for individuals who have missed the September 16, 2025, deadline for filing their Income Tax Return (ITR) for FY 2024-25. It reassures readers that filing is still possible through a "belated return" by December 31, 2025, but outlines the associated penalties, including late filing fees (₹1,000 or ₹5,000) and interest on unpaid tax. The article also details other consequences of late filing, such as the inability to carry forward certain losses, delayed refunds, and potential loss of specific deductions. It touches on rare exceptions and what happens if even the belated deadline is missed. Finally, it offers practical advice to act promptly, gather documents, compute accurately, and seek professional help, promoting MyITROnline as a solution for simplified tax filing.

GST on Bricks: Understanding the Latest Rules

This blog post clarifies the latest GST rules for bricks in India, effective September 22, 2025. It details the two tax options for most brick types (6% without ITC under composition scheme or 12% with ITC under regular scheme) and introduces a special 5% GST rate with ITC for sand-lime bricks, which cannot opt for the composition scheme. The article also highlights the crucial annual turnover threshold of ₹20 lakh for GST registration. It explains the importance of these changes, who is affected, the pros and cons, and provides actionable advice for businesses, including checking turnover, correct brick classification, scheme selection, pricing adjustments, and record-keeping. Finally, it discusses the implications for buyers and builders and outlines potential issues such as classification disputes and transitional challenges.

Big News! GST Rate Changes Are Coming Soon

This blog post announces significant changes to Goods and Services Tax (GST) rates in India, set to become effective from September 22, 2025, as per Notification No. 09/2025 – Central Tax (Rate). It provides a clear, simplified table comparing old and new rates for categories like household essentials, packaged food, luxury goods, hospitality, travel, professional consultancy, and IT services. The post highlights the implications for businesses (updating systems for compliance) and consumers (potential price changes), emphasizing the government's aim for clarity and easier compliance. It concludes by advising consultation with tax professionals for specific sector-related queries.

Smart Property Moves: How Sections 54 and 54F Can Slash Your Tax Bill on Residential Property Sales (Latest Rules 2025)

Discover how Sections 54 and 54F of the Indian Income Tax Act provide crucial tax exemptions on Long-Term Capital Gains from property sales. This comprehensive guide covers the latest rules for 2025, including the new ₹10 Crore cap and the two-house option under Section 54, offering practical examples and a step-by-step plan for effective tax planning.

194J vs. 44AD: Tax Scrutiny on India's Content Creators & Consultants

This blog post addresses the increasing tax notices faced by Indian content creators, influencers, and consultants due to a common mismatch: clients deducting TDS under Section 194J while they file income tax returns under Section 44AD. It breaks down the key tax provisions (194J, 44AD, 44ADA), explaining what each means for freelancers and businesses. The article clarifies that a 194J deduction doesn't automatically mandate filing under 44ADA; the crucial factor is whether the profession is listed under Section 44AA. It details potential impacts on tax burden, cash flow, and the need for increased documentation, while also offering actionable steps for creators and consultants to ensure compliance, including clarifying work nature, maintaining records, client communication, cash flow monitoring, and seeking professional tax advice.

Due Date for Filing ITRs AY 2025-26 Extended Again

The Income Tax Department has granted a crucial one-day extension for filing Income Tax Returns for Assessment Year 2025-26, pushing the final deadline to September 16, 2025. This extension aims to assist taxpayers who encountered issues with the e-filing portal. This is a final opportunity to avoid penalties, so file your ITR promptly with myITRonline.

Is Your Tax Deadline Extended? Beware of Fake Circulars

A false circular claiming that the Income Tax Return (ITR) deadline has been extended past 15 September 2025 is being circulated. The post explains what the official record shows, how fake notices are spread, why they can be costly, and how to verify whether a circular is genuine.

Income Tax Alert: New Deadline for Correcting Mistakes in TDS/TCS

The Income Tax Department has given a final chance to correct mistakes in TDS/TCS returns for FY 2018–19 to FY 2023–24. The correction deadline is March 31, 2026. After this, only 2 years will be allowed for revisions, and unresolved errors may lead to tax notices.

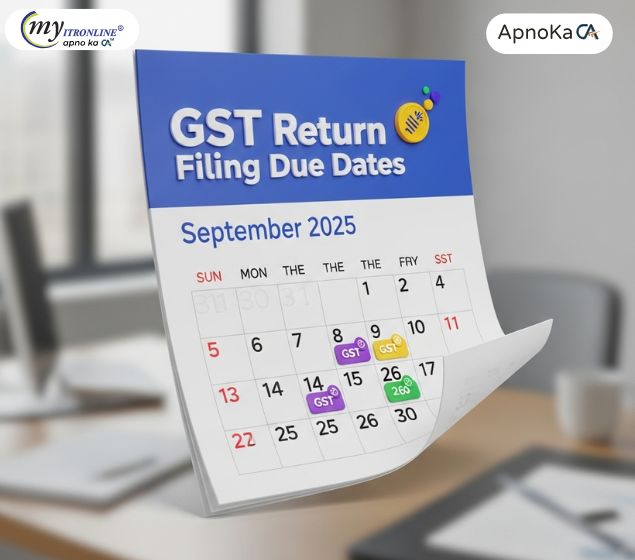

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."