# tax

12 posts in `tax` tag

CBI Court Jails Senior Tax Officials in 15 Lakh Bribery Case

A landmark judgment from Jodhpur’s CBI court has sentenced two senior Income Tax officials to four years in prison and a ₹1.1 lakh fine each for accepting a 15 lakh bribe in a 2015 corruption case.

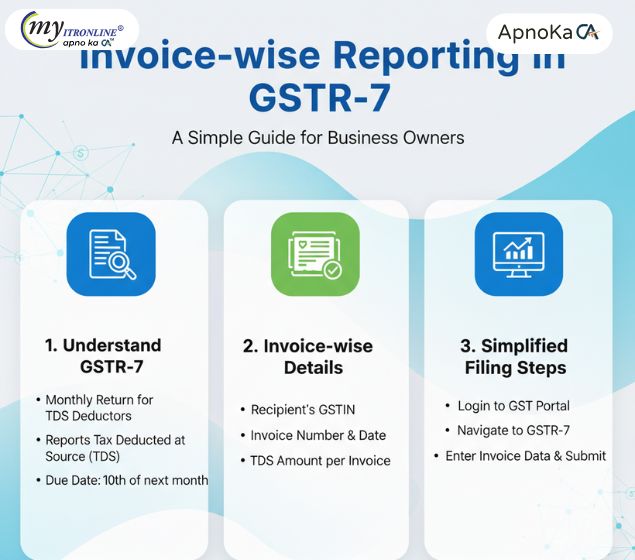

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

Income Tax AY 2024–25: Understanding Section 115BAC Rules

Section 115BAC introduces a simplified tax structure with reduced slab rates, but at the cost of foregoing key exemptions and deductions. Effective from AY 2024–25 as the default regime, this blog explains the revised tax slabs, outlines the benefits that are no longer available, and guides taxpayers on choosing between the new and old regimes based on their financial profile and investment habits.

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

Section 154 of Income Tax Act: What You Can and Can’t Correct

Section 154 of the Income Tax Act allows taxpayers to correct obvious errors in their tax assessments. This blog outlines common mistakes like TDS mismatches, incorrect tax calculations, and personal detail errors, and explains how to file a rectification request online. A must-read for salaried individuals, freelancers, and business owners.

Major IMS Enhancements on GST Portal: What Businesses Need to Know

Starting October 2025, the GSTN has rolled out major updates to the Invoice Management System (IMS) that simplify compliance, improve transparency, and give taxpayers more control over invoice handling. This blog breaks down the key changes and what they mean for businesses.

GST Compliance Update: CBIC Removes DIN Requirement for Portal-Based Notices

CBIC has released Circular No. 249/06/2025-GST, removing the mandatory use of DIN for communications issued via the GST portal. However, DIN remains compulsory for eOffice-based documents, as clarified in Circulars No. 23/2025 - Customs and 252/09/2025 - GST. This blog explains the changes and what taxpayers need to know.

Income Tax Department’s Section 87A Relief: What Taxpayers Must Know About STCG Rebate Claims

The Income Tax Department has issued relief for taxpayers who claimed Section 87A rebate on short-term capital gains (STCG). If demands are paid by December 31, 2025, interest will be waived. Learn what went wrong, what’s been clarified, and what you should do next.

Taxpayers Alert: Old Income Tax Records Removed from Portal

The Income Tax Department has removed all data for Assessment Year (AY) 2022-23 and prior years from its website. This blog explains the reason behind this change and provides actionable steps for taxpayers to secure their old records, emphasizing the importance of keeping personal backups.

GST 2.0: A Game Changer for India? Simplified Taxes & Economic Boost

This blog post provides a comprehensive overview of India's GST 2.0, implemented on September 22, 2025. It details the key features, including the reduction of tax slabs to 5% and 18% (with a new 40% for luxury/sin goods), lower taxes on essential goods, durables, and automobiles, and increased prices for luxury items. The article identifies beneficiaries like everyday households, the middle class, farmers, healthcare consumers, and MSMEs. It also addresses potential challenges such as revenue shortfall, price pass-through issues, and transition headaches for businesses. Finally, it outlines expected economic ripples and crucial factors to monitor for the reform's success, concluding that GST 2.0 is a bold step towards simplifying life for millions. An appendix with sample MRP comparisons is also included.