# tax

12 posts in `tax` tag

ITAT Ahmedabad: No Penalty for Late TDS Remittance under Section 271C

In a landmark ruling, ITAT Ahmedabad has held that penalty under Section 271C of the Income Tax Act is not applicable for delayed remittance of TDS, provided the tax was deducted and paid with interest. This decision, based on Supreme Court precedent, offers relief to taxpayers facing procedural delays.

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

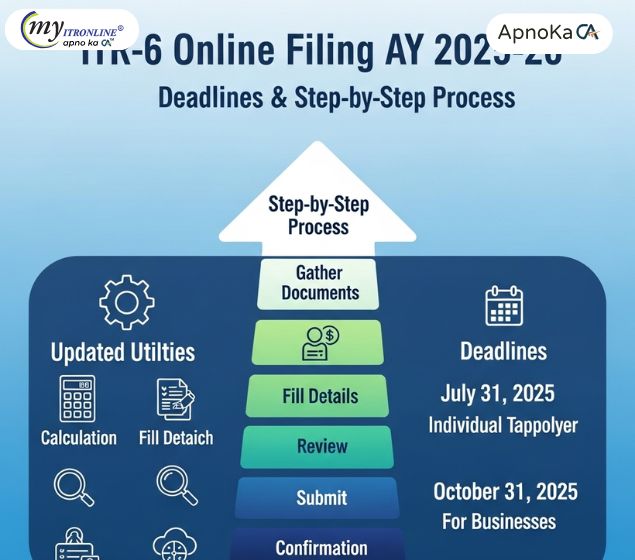

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

March 31, 2026: The TDS/TCS Correction Deadline You Cannot Miss

The Income Tax Act, 2025 has introduced a crucial change in TDS/TCS compliance: the timeline for filing correction statements has been reduced from 6 years to 2 years. Businesses must file all pending TDS/TCS corrections for FY 2018-19 Q4 through FY 2023-24 Q3 by March 31, 2026. Failure to meet this deadline will lead to automatic recovery proceedings, penalties, and compliance complications. Learn about the key changes, understand the implications for your organization, and discover the immediate steps you need to take to ensure full compliance before the deadline expires.

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

CBI Court Jails Senior Tax Officials in 15 Lakh Bribery Case

A landmark judgment from Jodhpur’s CBI court has sentenced two senior Income Tax officials to four years in prison and a ₹1.1 lakh fine each for accepting a 15 lakh bribe in a 2015 corruption case.

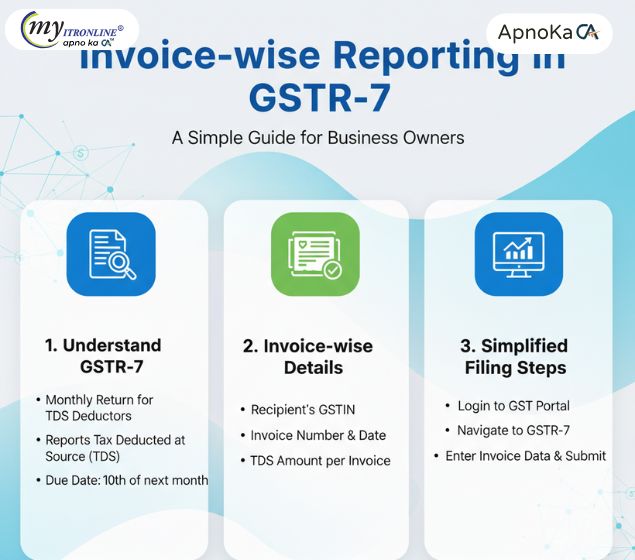

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

Income Tax AY 2024–25: Understanding Section 115BAC Rules

Section 115BAC introduces a simplified tax structure with reduced slab rates, but at the cost of foregoing key exemptions and deductions. Effective from AY 2024–25 as the default regime, this blog explains the revised tax slabs, outlines the benefits that are no longer available, and guides taxpayers on choosing between the new and old regimes based on their financial profile and investment habits.

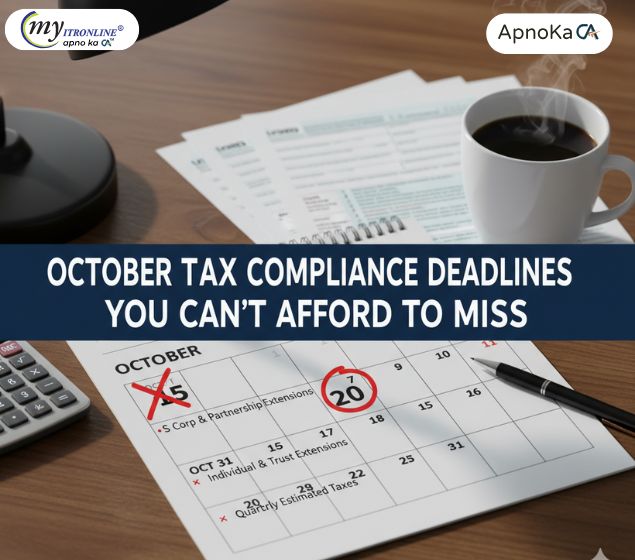

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

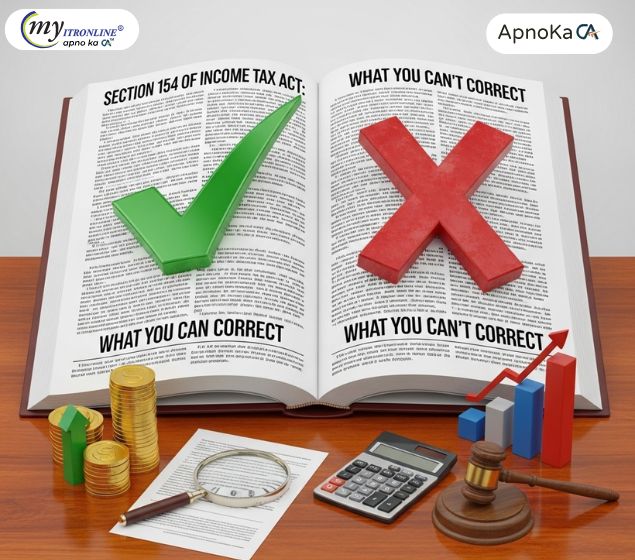

Section 154 of Income Tax Act: What You Can and Can’t Correct

Section 154 of the Income Tax Act allows taxpayers to correct obvious errors in their tax assessments. This blog outlines common mistakes like TDS mismatches, incorrect tax calculations, and personal detail errors, and explains how to file a rectification request online. A must-read for salaried individuals, freelancers, and business owners.